Which Of These Is Not A Valid Fico Credit Score

Ever feel like your credit score is a bit of a mystery? Like it's this secret code only the banks understand? Well, get ready for some fun, because we're diving into the wacky world of FICO scores! It’s not just about numbers; it’s about your financial reputation, and trust me, it can be surprisingly entertaining.

Think of your FICO score as your financial report card. It tells lenders how likely you are to pay back money you borrow. A good score means you're a star student, and a not-so-good score means you might need to do some extra credit work. It's a big deal, but it doesn't have to be scary!

Now, imagine a game show where the prize is a great interest rate. The contestants? Your credit habits! We’re going to play a little game of "Which of These Is NOT a Valid FICO Credit Score?" This isn't your average quiz; it's designed to be super engaging and a little bit silly. You’ll learn without even realizing it!

The FICO score is named after the company that developed it, Fair Isaac Corporation. They're the wizards behind this magic number. It’s been around for ages, helping people get loans for homes, cars, and even that fancy new gadget you’ve been eyeing. It’s a pretty important piece of the financial puzzle.

So, what makes a FICO score valid? It’s all about ranges and specific factors. We’re talking about numbers that fall within certain brackets. These brackets are the sacred zones of creditworthiness. Outside of these zones? Well, that’s where the fun begins for our quiz!

Let’s get our game faces on! Our quiz involves looking at different numbers and deciding if they could actually be a real FICO score. It’s like spotting an imposter in a line-up. Some numbers might look plausible, but they’re secretly a big no-no.

What’s so special about this? It’s the relatability! We all interact with credit, whether we realize it or not. Understanding your FICO score is like unlocking a superpower for your wallet. And doing it in a lighthearted way makes all the difference. No boring lectures here!

Think about it: a number that influences whether you can drive a new car or own your dream home. It’s a big deal, but the journey to understanding it can be a joyride. We’re aiming to spark curiosity, not induce anxiety. Let’s make learning about your finances feel less like homework and more like a discovery.

Our quiz question is designed to be super simple. We'll present you with a few options, and you have to pick out the one that just doesn't belong. It's about recognizing patterns and knowing the "rules of the game." And don't worry, we won't judge if you guess! It's all part of the learning process.

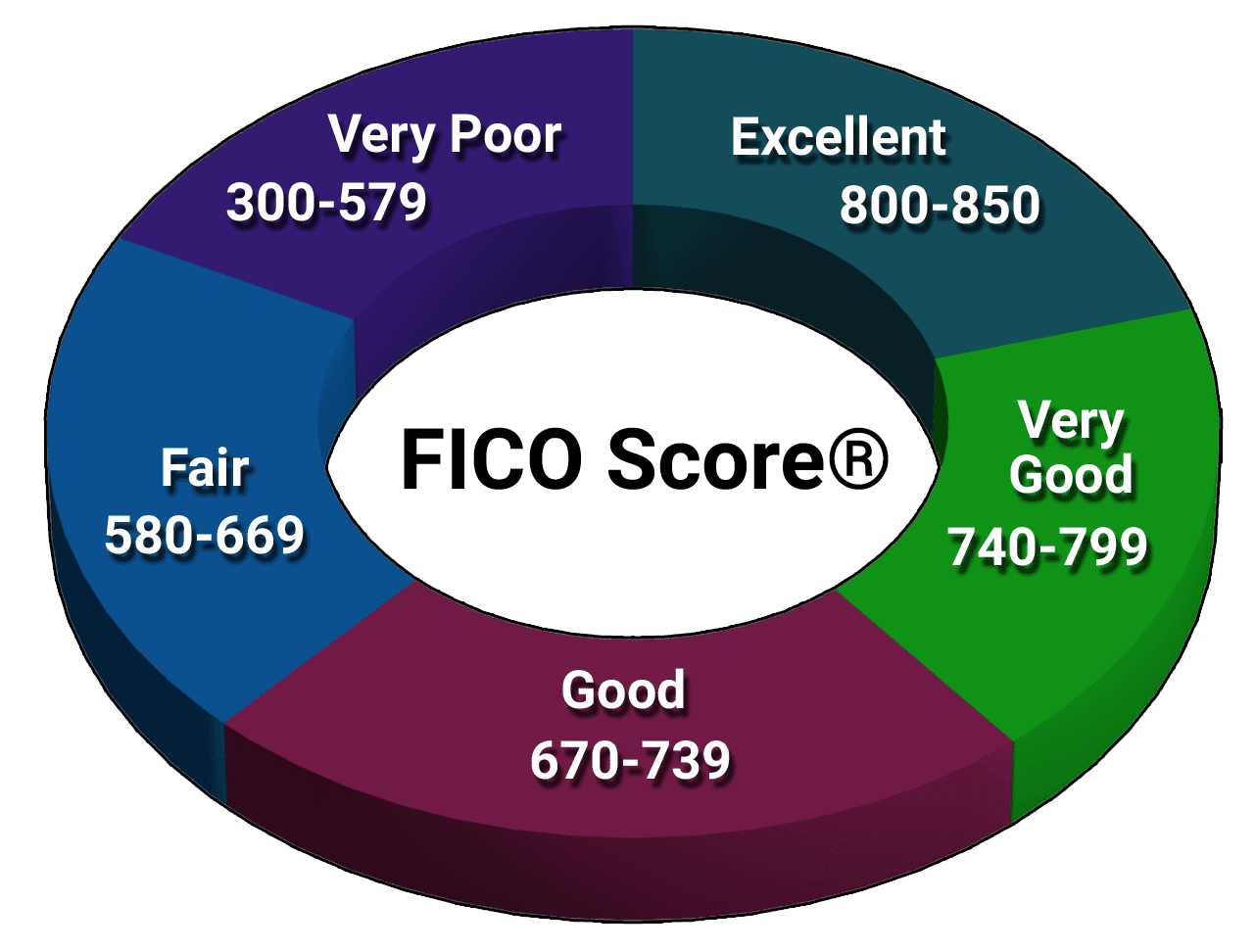

The standard FICO score range is generally between 300 and 850. This is the golden zone, the playground where your credit score lives. Any number outside this range is immediately suspect. It’s like seeing a giraffe wearing roller skates – unusual, to say the least!

So, imagine you see a number like 250. Could that be a FICO score? Nope! It's too low, outside the valid range. Or what about 900? That's also a no-go. It’s beyond the highest possible score. These are your easy outs, the obvious incorrect answers.

But here’s where it gets more interesting. Sometimes, the "invalid" score might look almost right. It might be a number that's technically within the 300-850 range, but for some subtle reason, it’s not a real FICO score. This is where our engaging quiz truly shines!

What makes it so entertaining? It’s the element of surprise! You think you know the answer, then BAM! There’s a twist. It’s the satisfaction of figuring out the puzzle. Plus, who doesn’t love a little friendly competition, even if it’s just with yourself?

The magic of this approach is that it demystifies credit. Instead of dry statistics, you’re getting a fun challenge. It’s about making you feel smart and empowered. You’ll walk away with a newfound understanding, and maybe even a chuckle.

Let’s talk about the components that do make up a FICO score. These are the ingredients in the secret sauce. They include your payment history (do you pay bills on time?), your amounts owed (how much debt do you have?), the length of your credit history (how long have you been borrowing and repaying?), credit mix (do you have different types of credit?), and new credit (how often do you open new accounts?).

Each of these factors plays a crucial role. They’re like the different players on a sports team. They all have their position and contribute to the overall score. Missing a player or having one play poorly can affect the final score.

Now, imagine a score that is calculated using, say, your favorite color or the number of pets you own. Could that be a FICO score? Absolutely not! While our quiz might present numbers that look like scores, the invalid ones are often based on logic that has nothing to do with credit scoring principles.

The real fun is in spotting the imposter. It’s about understanding that a FICO score isn't just a random number; it’s a carefully calculated figure based on your financial behavior. It’s a reflection of your financial habits, and that’s what makes it so special.

Let’s consider an example for our quiz. Suppose you see these options: * A) 720 * B) 550 * C) 910 * D) 400 Which one is NOT a valid FICO credit score? You probably already guessed it! C) 910 is outside the standard 300-850 range. Easy, right? That’s the introductory level of fun.

But what if the options were a bit trickier? What if they were all within the range, but one was derived from a completely nonsensical formula? For instance, a score that was calculated by dividing your age by the number of times you’ve blinked today. That would be hilarious and definitely not a FICO score!

The beauty of our engaging quiz is that it encourages you to think critically. It prompts you to ask: "Does this make sense in the world of credit?" It's not about memorizing complex formulas, but about grasping the general concept. It's about developing an intuition for what's real and what's just pretend.

Why is this so special? Because it makes you feel smart. You’re not just consuming information; you’re actively participating. You’re solving a puzzle, and that’s inherently rewarding. It taps into our natural desire to learn and succeed.

And the best part? This knowledge is power. Understanding the FICO score, even through a fun quiz, can inspire you to check your actual score. Websites like MyFICO.com or your bank often offer ways to see your score for free. It's like getting a backstage pass to your financial life!

Imagine the thrill of checking your own FICO score. It’s no longer a scary, abstract concept. It’s a number you understand, a score you can influence. And this quiz is your fun, quirky introduction to that empowering journey.

So, are you ready to play? Are you curious to see if you can spot the imposter FICO score? It’s a simple game, but the insights it offers are anything but. It’s a lighthearted way to dip your toes into the world of credit and come out feeling a little bit wiser and a lot more entertained. Dive in, have fun, and let the financial fiesta begin!