Which Of These Factors Would An Insurer Consider

Ever wondered what goes on behind the scenes when you get a quote for, say, car insurance or maybe even home insurance? It’s not like they’re just picking numbers out of a hat, right? There's a whole system at play, a bit like a detective figuring out how likely something is to happen. Insurers look at all sorts of things to figure out how much of a risk you are, and honestly, some of it is pretty fascinating. It’s all about probabilities, like trying to guess how many jellybeans are in a jar, but way more important for your wallet!

So, what exactly are they peeking at? Let’s dive into some of the key factors that an insurer might consider. Think of it as a peek behind the curtain of the insurance world, and maybe you’ll get a better understanding of why your premium is what it is. It’s like they’re trying to build a profile, a financial fingerprint, if you will, to understand your unique situation.

Your Driving Habits (For Car Insurance, Obviously!)

This one’s a no-brainer for car insurance, right? If you’re a speed demon who loves to weave through traffic, you’re probably going to cost an insurer more than someone who cruises at 50 mph with their grandma in the passenger seat. They’re looking at things like:

Your Driving Record

Have you had a few fender-benders? Are there tickets cluttering up your history? Insurers see this as a sign that you might be more prone to accidents. It’s like seeing someone with a history of tripping; you might be a bit more cautious around them. A clean driving record? That’s golden! It signals you’re a responsible driver, a low-risk individual, and that’s music to an insurer’s ears.

How Much You Drive

Do you commute 50 miles each way to work? Or do you mostly drive to the local shop for milk? The more time your car is on the road, the more opportunities there are for something to go wrong. It’s simple math, really. Someone who drives thousands of miles a year is going to have a statistically higher chance of encountering an issue than someone who only drives a few hundred. Think of it like a lottery ticket – the more tickets you buy, the more chances you have of winning (or, in this case, having an accident).

Where You Live

This might seem a bit unfair, but location matters. If you live in an area with high rates of car theft or a lot of busy, accident-prone intersections, your premiums might be higher. It’s not about you personally being a risk, but about the environment your car is in. Imagine living in a neighbourhood where everyone’s bike gets stolen versus a quiet cul-de-sac. Your bike’s safety is inherently different in those two places, and it’s the same for cars.

Your Car Itself

Some cars are just more expensive to fix or more attractive to thieves. A flashy sports car might cost more to insure than a sensible sedan. And if your car has a reputation for being unreliable, that might also factor in. Insurers look at the cost of repairing your vehicle and its general appeal to sticky-fingered individuals. A classic vintage car might be a joy to own, but its repair parts can be astronomical, and that’s something they’ll consider.

Your Lifestyle and Habits (Beyond the Wheel!)

It’s not just about what you do with your car. Insurers also want to understand your general lifestyle, especially for things like life insurance or health insurance.

Your Age and Health

This is a big one. Generally, younger drivers are considered higher risk, and as people get older, certain health risks increase. For life insurance, your age and your current health status are paramount. Are you a smoker? Do you have any pre-existing conditions? These are all factors that help insurers gauge potential future claims. It's like asking a doctor to assess your health before a big surgery; they need the full picture.

Your Occupation

Believe it or not, your job can play a role. A high-risk profession, like a construction worker who rappels down buildings, might have different insurance needs and considerations than an accountant who spends their days at a desk. It’s all about the inherent dangers (or lack thereof) associated with your daily work. Some jobs are just inherently more physically demanding or exposed to hazardous environments.

Your Hobbies

Are you an adrenaline junkie who loves skydiving, rock climbing, or base jumping? While these hobbies might be incredibly exciting, they also come with a higher risk of injury. Insurers will definitely take this into account, especially for life or disability insurance. It’s like choosing to go bungee jumping – you know the risks involved and are prepared for them, and so is the insurer.

Your Financial History (Sometimes!)

This one can be a bit more sensitive, but in some cases, your financial history might be considered. For example, a history of bankruptcy or frequent claims on other insurance policies might signal a higher risk. It’s not about judging your financial situation, but about understanding patterns that might indicate a greater likelihood of future claims. Think of it as insurers looking for stability and predictability in your life.

Your Property (For Home or Renters Insurance)

If you're insuring your home or your belongings, the insurer will definitely be interested in the property itself.

The Age and Condition of Your Home

An older home with outdated plumbing and electrical systems might be more prone to issues like leaks or fires than a newer, well-maintained property. The materials used in construction also matter. A wooden fence might be more susceptible to damage in a storm than a brick one. It’s like buying a house; you want to know how well it’s been looked after.

Your Location (Again!)

This isn’t just about crime rates for your car. For home insurance, it’s about natural disaster risk. Are you in an area prone to floods, earthquakes, hurricanes, or wildfires? These are huge factors that can significantly impact your premiums. Living on a beautiful coastal cliff sounds idyllic, but it might come with a higher risk of storm damage than a home in the middle of a city.

Security Measures

Do you have a robust alarm system? Deadbolt locks? Security cameras? The more steps you take to protect your property from theft or damage, the lower your risk is perceived to be. It’s like putting extra locks on your doors; it’s a visible deterrent.

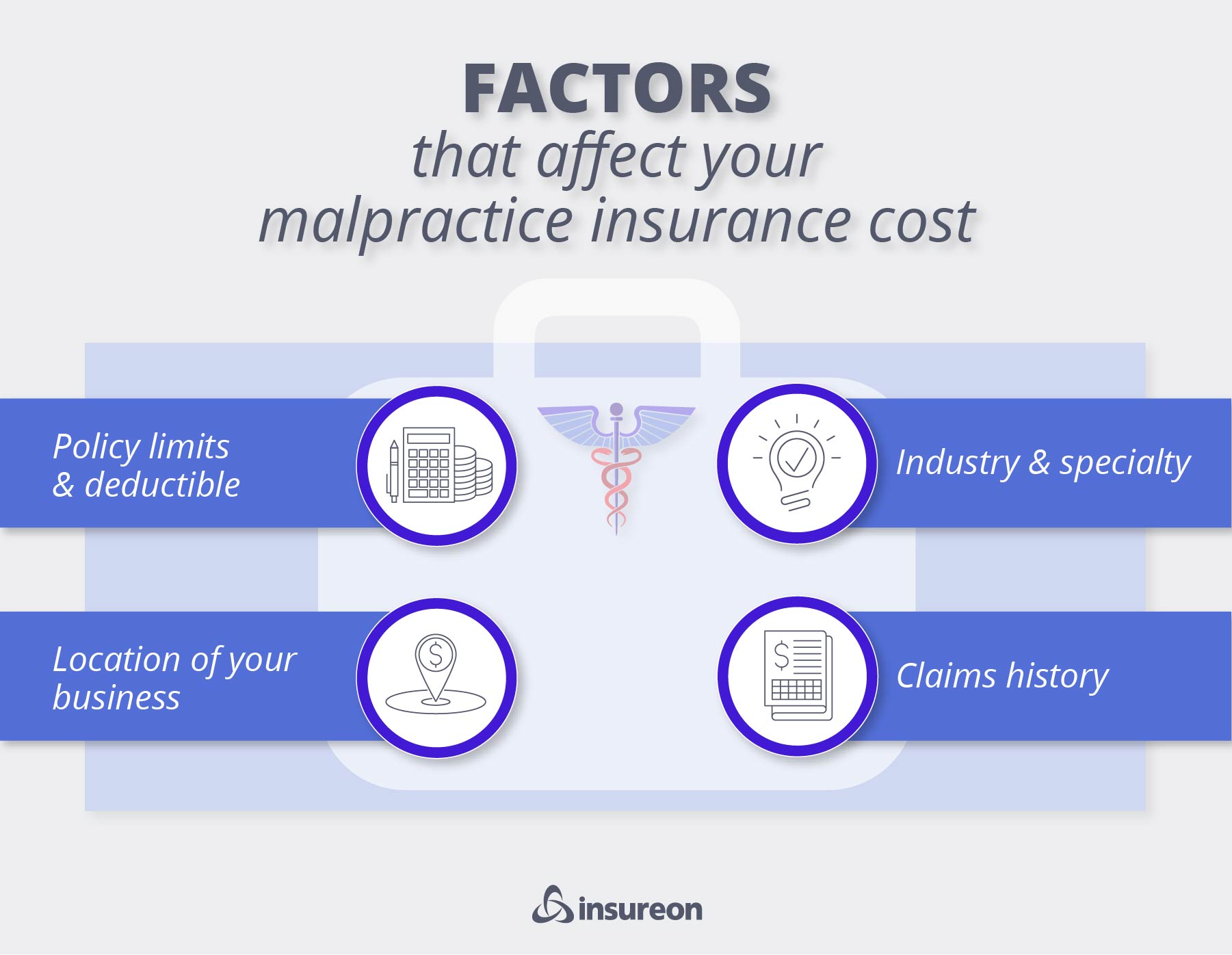

Your Claims History

Have you filed many claims in the past? Even if they weren’t your fault, a history of frequent claims might indicate that your property is in a higher-risk area or that there are ongoing issues. It’s like a restaurant’s health inspection report; a history of problems might make you think twice.

Ultimately, insurers are trying to balance risk and reward. They need to collect enough premiums to cover potential claims, but they also want to attract and retain customers. Understanding these factors can not only demystify the insurance process but also help you make informed decisions about your coverage and even how you can potentially lower your premiums. It’s a bit like playing a game of chance, but with a little knowledge, you can definitely improve your odds!