Which Of The Following Describes Accrued Revenue

Hey there, finance fan! Ever heard the term "accrued revenue" and immediately pictured a grumpy accountant surrounded by stacks of dusty ledgers? Yeah, me too. But guess what? It's actually way more interesting and, dare I say, fun than it sounds. Think of it like this: it's the business equivalent of that feeling when you know you've earned something, even if it hasn't landed in your pocket yet. Pretty neat, right?

So, the big question is: which of the following describes accrued revenue? Let's dive in and have a little peek behind the curtain of how businesses count their chickens. And trust me, there are some surprisingly quirky bits to uncover!

The "Almost Famous" Money

Imagine you've mowed your neighbor's lawn. You did the job. The grass is shorter. They're happy. You're owed, say, $20. But they're on vacation and won't be back for a week. Did you earn that $20? Absolutely. That's accrued revenue in a nutshell, my friend. It's money you've earned, but you haven't received it yet.

It's like when you bake a killer batch of cookies for a bake sale. You put in the effort, you used your ingredients, and you know you've got deliciousness ready to go. Even if no one has handed you cash for them yet, you've basically sold them in spirit. That's the spirit of accrued revenue!

It's All About the "Earned" Part

The key word here is earned. It's not just about someone owing you money. It's about you having done the work or provided the service that entitles you to that money. It’s like hitting a home run in a baseball game. You made contact, the ball is flying, and the run is practically inevitable. That run is your accrued revenue!

Think about a subscription service. Let's say you're paying $10 a month for your favorite streaming platform. On the first day of the month, they've technically earned a portion of that $10 for the service you'll receive throughout the month. Even though you paid for the whole month upfront, and they haven't "unearned" any of it yet, they've accrued a bit of revenue for each day that passes. Sneaky, huh? But also, kinda smart.

When Does the Money Not Count Yet?

Now, for the fun contrast. What if your neighbor promised to pay you for mowing their lawn next month, but you haven't even touched a mower yet? That's not accrued revenue. That's just a promise, a hopeful "maybe." Businesses are all about what's real and earned, not just what might happen.

It's like buying a lottery ticket. You hope to win, but until you hear those winning numbers, that ticket is just a piece of paper. It's not revenue. Accrued revenue is about something tangible that's already happened.

The "Unearned" But Received Counterpart

This is where things get a little extra interesting. Sometimes, a business receives money before they've actually earned it. This is called unearned revenue. Think of those gift cards you get for your birthday. The store has your money, but they haven't provided the goods or services yet. They owe you something!

It’s the opposite of accrued revenue. Instead of money earned but not received, it's money received but not earned. It’s like getting paid for a job you haven’t started. The company is holding onto it, waiting to do the work. When they do the work, that unearned revenue then becomes earned revenue – sometimes it even becomes accrued revenue if they've done some work but haven't billed yet!

Why Bother With This Stuff?

Okay, I know what you’re thinking. "Why do I need to know this?" Well, besides impressing your friends at your next trivia night, understanding accrued revenue is super important for businesses. It gives them a real picture of their financial health.

If a business only counted money when it hit their bank account, they’d be missing out on a whole lot of what they've actually accomplished. It’s like only counting the fish you’ve caught and ignoring all the ones you’ve hooked and are just about to reel in. You’ve got them on the line, right? So they count!

The Timing is Everything!

Accrued revenue is all about the timing. It’s about matching the revenue to the period in which it was earned, not necessarily when the cash changes hands. This is a core principle in accounting, and it helps paint a much more accurate financial story.

Imagine a company that sells custom-made furniture. They might take a deposit upfront, but they don't truly earn the full revenue until the furniture is built and delivered. The work they've done on the furniture before delivery is their accrued revenue. It's a clever way to show their progress!

The "So, Which One Is It?" Reveal!

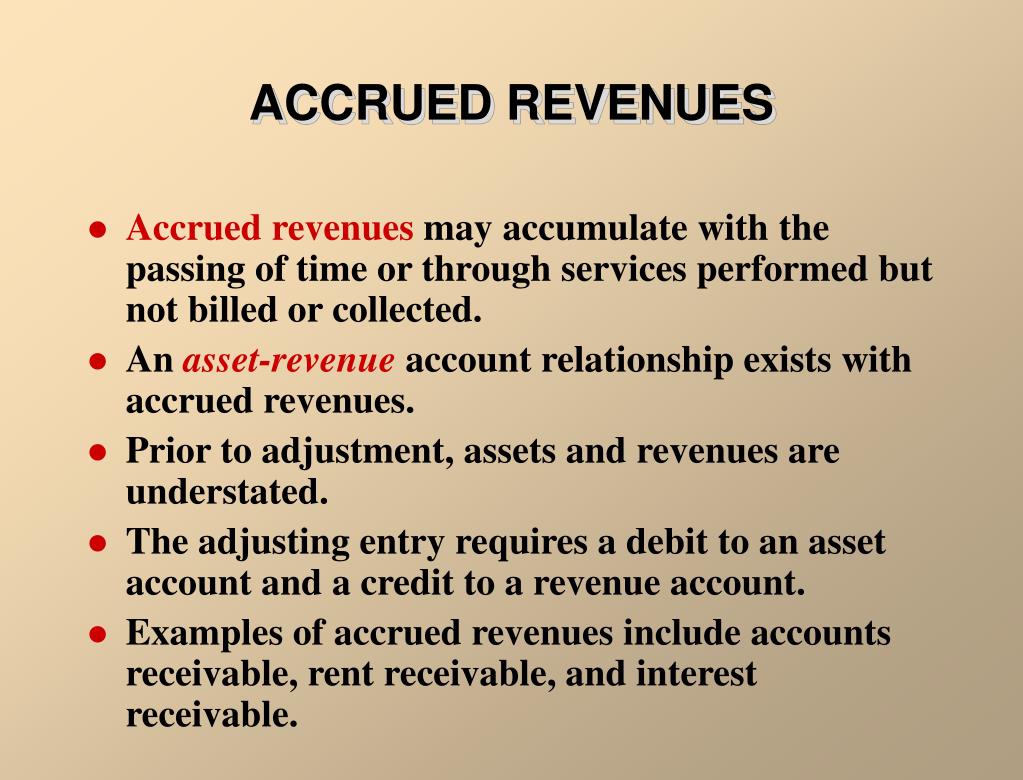

So, to circle back to our original question: Which of the following describes accrued revenue? It describes revenue that has been earned but not yet received.

It's the tip you're waiting for from that customer who paid with a check. It's the interest that has built up on your savings account but hasn't been credited yet. It's the satisfaction of knowing you've done the work and are entitled to the reward, even if the cash is still on its way.

A Little Quirky, A Lot Useful

So next time you hear "accrued revenue," don't just think of boring numbers. Think of the hard work that's been done, the services that have been provided, and the money that's just around the corner. It’s a little bit quirky, a little bit about timing, and a whole lot about understanding how businesses truly make their money. Pretty cool, right? Keep an eye out for it – you'll start seeing it everywhere!