Which Of The Following Decreases Owner's Equity

Ever found yourself staring at a spreadsheet, a bank statement, or even just a company's financial report and wondered what all those numbers really mean? You're not alone! Understanding a bit about how businesses work, especially when it comes to the money side of things, can be surprisingly fascinating. Think of it like a peek behind the curtain of your favorite restaurant or the online store where you snagged that amazing deal. It’s all about how they manage their treasure chest!

One of the core concepts that helps us understand a business’s financial health is called owner's equity. Don't let the fancy term scare you. Simply put, it represents the owner's stake in the company. It's what would be left over for the owners if all the company's assets were sold and all its liabilities (debts) were paid off. It's a really important measure because it shows how much of the business is truly theirs, not owed to others.

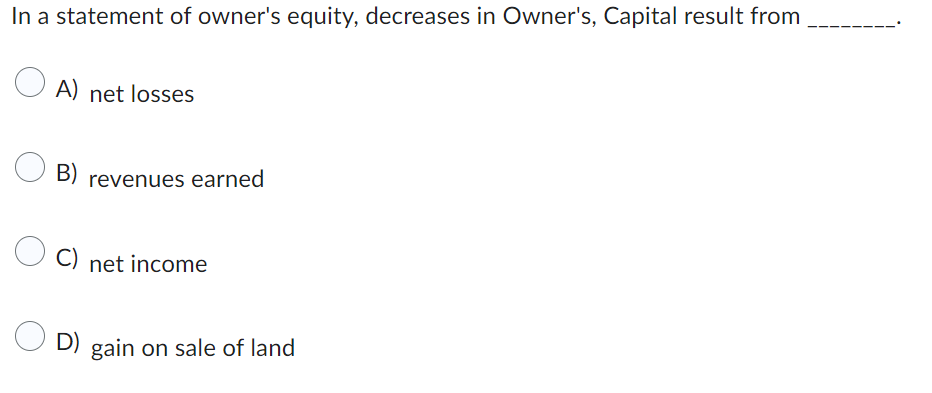

Now, the fun part: how does this owner's equity change? Businesses are dynamic, constantly in motion, and that means their equity can go up or down. Today, we're going to explore a specific way this happens: what decreases owner's equity? It’s a question that might pop up if you're dabbling in your own small business, thinking about investing, or just curious about the intricate dance of business finances.

So, which of the following decreases owner's equity? Let's dive into the common culprits. The most straightforward way owner's equity decreases is through dividends or drawings. For a sole proprietorship or partnership, this is often referred to as drawings – when the owner takes money or assets out of the business for personal use. For larger corporations, these payouts to shareholders are called dividends.

Think of it this way: if the business is making profits, the owners might decide to share some of those profits. While this sounds great for the owners, from the business's perspective, it's money leaving the company. This reduces the amount of money available within the business, thus decreasing the owner's equity. It's like taking a slice of the pie – the pie itself gets smaller!

Another significant factor that can decrease owner's equity is expenses. This is a big one, and it happens constantly. Every time a business pays for rent, salaries, utilities, supplies, or marketing, these are expenses. When a business incurs an expense, it uses up resources (often cash) that would otherwise contribute to owner's equity. Over time, these accumulated expenses, if they exceed revenues, will eat into the owner's stake.

This is why understanding your business's expenses is crucial! Tracking them meticulously ensures you know where the money is going and how it’s impacting your equity. It’s the fundamental principle of profit and loss – if your expenses are higher than your income, you’re losing money, and that directly reduces your ownership stake.

To enjoy this bit of financial sleuthing more effectively, start small. If you have a personal budget, think of your "spending" as expenses that reduce your personal "equity" (your savings and assets). For business owners, diligent bookkeeping is your best friend. Use accounting software or a good old-fashioned ledger to track every expense and every drawing. This clarity allows you to make informed decisions about profitability and how much you can afford to take out of the business.

So, next time you hear about a company issuing dividends or see a lengthy list of expenses, you'll have a better grasp of how these actions directly influence that all-important owner's equity. It’s not just numbers; it’s the story of a business’s financial journey!