Which Of The Following Assets Is The Most Liquid

Alright, gather 'round, fellow adventurers in the wild and wacky world of "what do I do with my money besides hoarding it under a mattress?" Today, we're diving headfirst into the thrilling, edge-of-your-seat debate: Which of these assets is the most liquid?

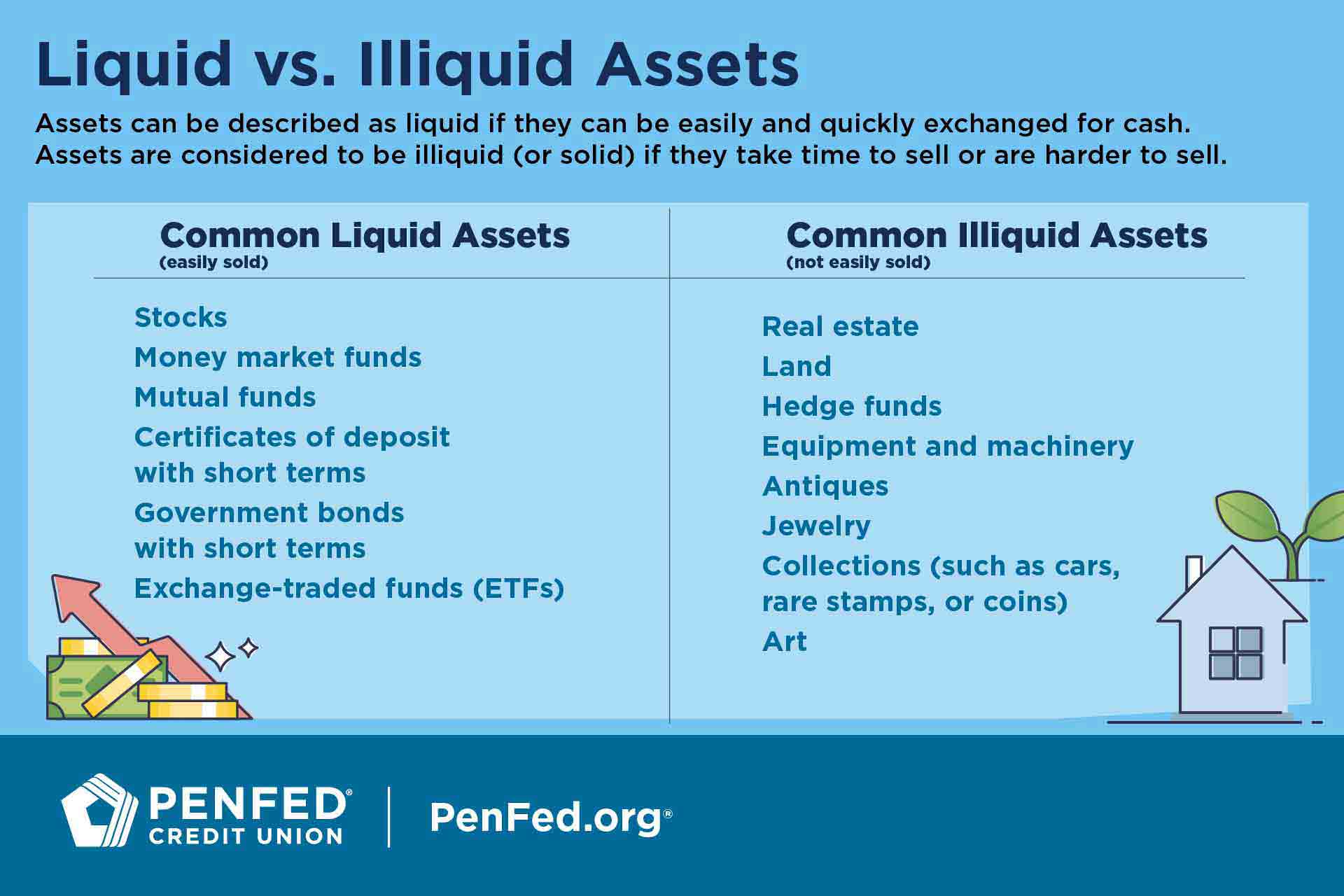

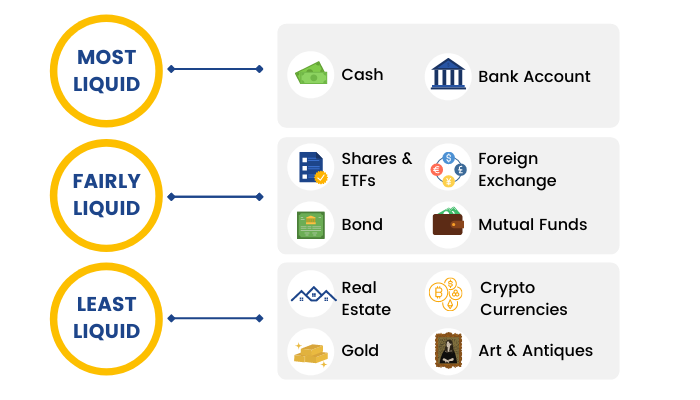

Now, before you all start sweating and picturing yourselves in a high-stakes game of Wall Street Monopoly, let's define "liquid." Think of it like this: if you suddenly need cash to, say, buy a private jet to escape a rogue squirrel invasion (it happens!), how quickly can you turn your stuff into actual, usable moolah? That's liquidity, my friends. Fast and furious cash conversion. No waiting around for a buyer to appreciate your antique doorknob collection, unless that buyer is also fleeing the squirrels.

We've got a few contenders in this high-octane race. Let's meet our contestants!

Contestant Number 1: A Slightly Used Sports Car

Ah, the sports car. Sleek, fast, and guaranteed to make your neighbor's poodle weep with envy. But when it comes to liquidity? Well, it’s like trying to sell a unicorn. Sure, someone might want it, but they’ll probably want a hefty discount, a soundtrack of engine revs, and maybe a signed autograph from the car itself.

Selling a car is a process. You've got to clean it, take way too many photos, list it on various platforms, deal with tyre-kickers who just want to hear it roar (and then disappear), and then haggle like you're buying a camel in a Moroccan bazaar. It’s not exactly "instant gratification" territory. More like "delayed gratification with a side of existential dread about depreciation." Plus, has it been in a minor fender-bender involving a rogue ice cream truck? Suddenly, its liquidity plummets faster than a poorly thrown Jell-O shot.

Contestant Number 2: A Rare Stamp Collection

Now, this is where things get interesting. Imagine a meticulously organized album, filled with tiny squares of paper that, to the untrained eye, look like they were salvaged from a particularly boring stationery drawer. But to a true philatelist? These are treasures! Priceless! Worth more than your weight in gold… or at least, more than your weight in slightly stale crackers.

The problem? Finding that specific stamp collector. It’s like trying to find Waldo, but Waldo is wearing a monocle, lives in a mansion made of wax, and only communicates through interpretive dance. You might have the world’s most valuable stamp, but if there are only three people on the planet who know its worth and are actively looking to buy, your cash-conversion speed is going to be measured in geological epochs. It's highly illiquid, unless you happen to be at a secret stamp convention and can facilitate an immediate, whispered transaction.

Contestant Number 3: A Piece of Art (Think Modern, Abstract, and Possibly Confusing)

Let’s say you’ve got a masterpiece. A splash of color here, a chaotic swirl there. It might have cost you a king's ransom, and it definitely sparks conversation. Is it a pigeon having an existential crisis on a Tuesday? Or perhaps a deeply profound commentary on the fleeting nature of existence? Who knows! That's the beauty (and terror) of art.

But when it comes to liquidity, art is in a league of its own. It’s the ultimate "it depends." If you own a Picasso that the Louvre desperately needs, you’re golden. You could probably sell it before the paint even dries. But if your masterpiece is by "Brenda from accounting" (no offense, Brenda, your interpretive dance collection was avant-garde), you might be waiting a while. The market for niche art can be as fickle as a toddler offered broccoli. You need the right buyer, at the right time, with enough disposable income to justify buying something that looks suspiciously like a paint spill. So, while potentially super valuable, it's often stuck in a slow-moving gallery of sorts.

Contestant Number 4: Cash (Yes, Actual Green Paper or Digital Bits)

And then there’s our dark horse, the unassuming champion: cash! Whether it’s crisp bills in your wallet or the blinking numbers on your online banking statement, cash is king, queen, and the entire royal court when it comes to liquidity.

Need to buy that emergency unicorn tranquilizer? Bam! You’ve got it. Want to spontaneously book a trip to Tahiti to escape said squirrels? Done. Cash is the purest form of liquidity. There’s no waiting for appraisals, no finding niche collectors, no dealing with the existential dread of selling a depreciating asset. It’s immediately spendable. It’s universally accepted. It’s the ultimate "get out of jail free" card for any sudden financial whim or dire need.

Think about it. You can use cash to buy the sports car, fund the stamp collector’s next acquisition, or even purchase that abstract masterpiece. But can you use the abstract masterpiece to buy a loaf of bread at the corner store? Probably not. Unless the baker is really into Brenda's work, which, as we discussed, is unlikely.

The Verdict: Drumroll Please!

So, to answer our burning question: Which of the following assets is the most liquid? It’s not the shiny sports car that might need a new muffler, or the rare stamp that only three people in the world care about, or the art that looks like a Rorschach test gone wild.

It’s cash!

It’s the boring, the everyday, the utterly unglamorous superhero of the financial world. While other assets might promise dazzling returns or bragging rights at fancy dinner parties, cash promises something far more valuable: instant accessibility. So next time you’re pondering your assets, remember the humble dollar bill. It might not be as exciting as a sports car, but it’s the one that’ll get you out of a squirrel-induced panic faster than you can say "nutty situation!"