When Investors Purchase A Commodity They Believe

Ever feel like you've stumbled upon a secret handshake, a little wink and nod among a special group of people? That’s kind of what happens when investors buy into a commodity they truly, madly, deeply believe in. It’s not just about numbers on a screen; it’s about a gut feeling, a spark of excitement that says, “This! This is the next big thing!”

Imagine your favorite snack. Now imagine everyone suddenly craving it. That’s the energy we’re talking about, but instead of cookies, we’re talking about things like gold, oil, or even something as quirky as specialty coffee beans.

When an investor’s heart (and wallet) sings for a particular commodity, it’s a bit like falling in love. They’ve done their homework, sure, but there’s also that undeniable pull, that feeling that this isn’t just a passing trend. It’s a future, a bright, shiny, potentially very profitable future.

Think about the folks who were convinced that electric cars were the way to go, way back when. They weren't just looking at spreadsheets; they were picturing a world powered differently. That same conviction is what drives some to invest in the raw materials that will make that future happen. It's a vote of confidence, a personal endorsement written in cold, hard cash.

The Magic of Conviction

What’s so magical about this belief? Well, it’s contagious! When an investor is genuinely enthusiastic about a commodity, their confidence can ripple outwards. They talk about it, they share their insights, and suddenly, others start to listen. It’s like being the first person to discover the coolest new band before they hit the charts – you just know they’re going to be huge!

This isn't about blindly throwing money around, mind you. It’s about a calculated leap of faith, fueled by research and a dash of intuition. It’s the difference between buying a lottery ticket and investing in a company with a revolutionary new product.

When you buy into a commodity you believe in, you’re essentially saying, “I see something here that others might be missing, or that they will soon realize is incredibly valuable.” It's a bold statement, and one that can lead to some truly spectacular outcomes.

Let’s talk about solar power. Years ago, it might have seemed like a niche idea. But the investors who believed in its potential, who saw the power of the sun as an endless resource, they were the ones paving the way. They weren’t just buying panels; they were investing in a cleaner, brighter tomorrow.

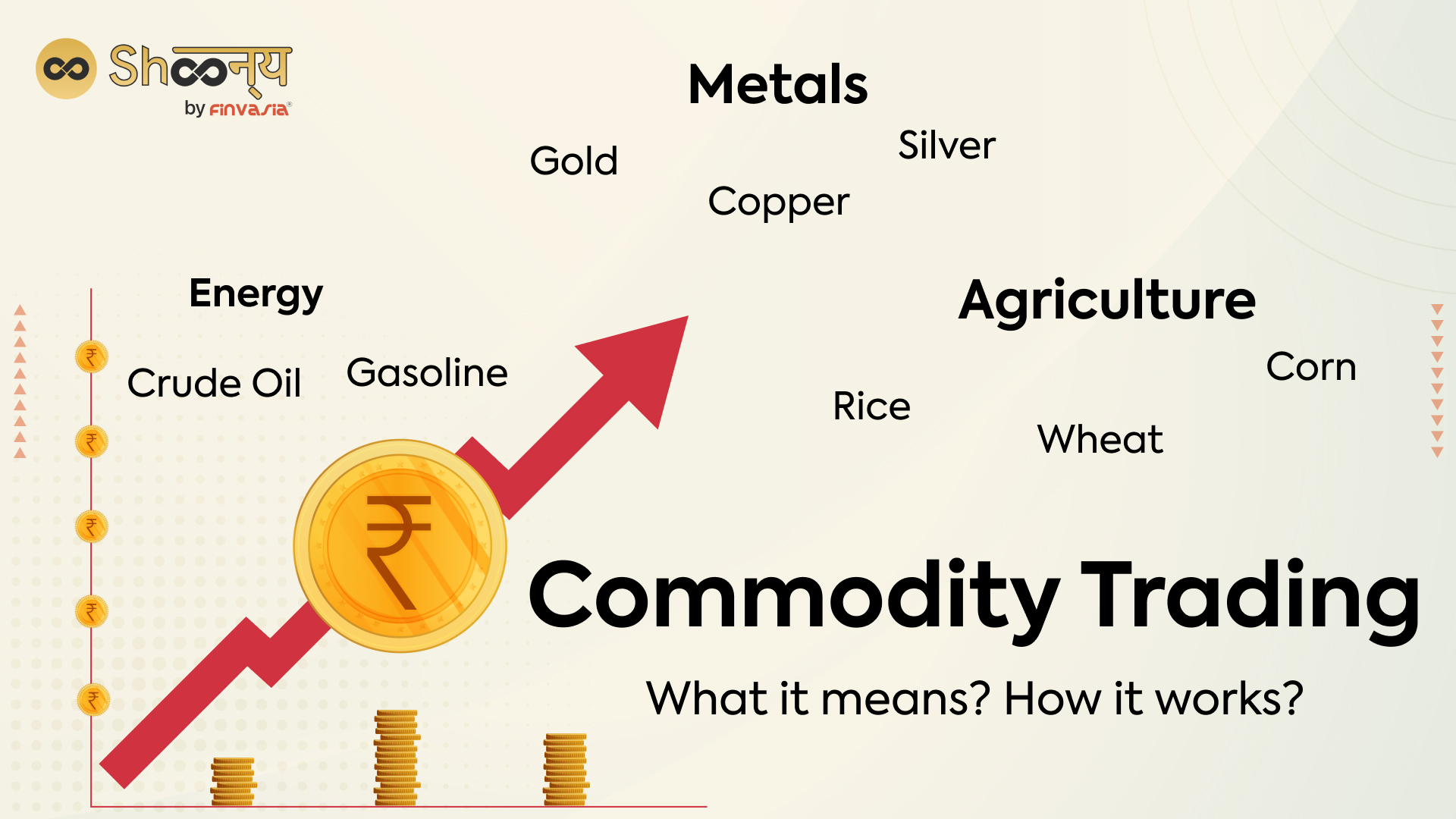

It’s More Than Just Metal or Oil

Commodities can be anything from the tangible to the slightly less so. Take agricultural products, for instance. Some investors have an unshakable faith in the future demand for, say, avocados. They envision a world where guacamole is not just a dip, but a fundamental food group!

And then there are the more traditional players. Copper, for example. This humble metal is the backbone of so much modern technology, from your smartphone to the wiring in your home. When investors believe in the unstoppable march of progress, they often look to commodities like copper to fuel it.

It’s like being a prospector in the old days, but instead of a pickaxe and a mule, you’ve got your market analysis and your unwavering optimism. You’re digging for value, and you’re convinced you’re going to strike gold!

Sometimes, the belief is tied to global trends. Think about the growing demand for lithium, essential for all those electric car batteries. An investor who sees the future of transportation is likely to have a strong conviction about lithium.

The Power of Being Early

Being an early believer in a commodity is like having a secret map to a treasure chest. You get in on the ground floor, when the price is still relatively low, and then you get to watch as the world catches up to your vision.

It’s that feeling of being ahead of the curve, of seeing the wave coming before it even crests. It’s exhilarating, and it’s the driving force behind many successful investments.

Consider rare earth elements. These are the unsung heroes of our tech-driven lives, found in everything from your laptop to your headphones. Investors who understand their critical importance are often the ones who reap the biggest rewards.

They aren’t just buying a material; they’re investing in the very fabric of our modern world, a world that seems to get more technologically advanced by the minute.

This kind of conviction can also extend to commodities that have a more… elemental appeal. Like water. As the world’s population grows and climate challenges mount, the value of this precious resource is only going to increase. Investors who see this future are making a powerful bet.

When Your Gut Meets Your Intellect

Ultimately, when investors purchase a commodity they believe in, it's a beautiful dance between their intellect and their gut. They do the research, they understand the supply and demand, they analyze the geopolitical landscape. But there’s also that undeniable spark, that feeling that this is more than just a transaction.

It’s an investment in a story, a vision, a future they are confident will unfold. It’s the thrill of being a part of something bigger, something that has the potential to shape the world in meaningful ways.

Think about the immense potential of bioplastics. As we become more conscious of our environmental impact, the demand for sustainable alternatives will skyrocket. Investors who champion this cause are not just buying into a material; they're buying into a solution.

And let’s not forget the sheer, unadulterated romance of diamonds. While often seen as a luxury, their scarcity and perceived eternal value have made them a cornerstone of investment for centuries. The belief in their lasting allure is a powerful force.

It’s the kind of investment that makes you wake up with a smile, knowing you're part of a grander narrative, a story of growth, innovation, and yes, sometimes, a little bit of well-deserved profit!