What Is The Underlying Concept Of Level Premiums

Ever stumbled upon something that just makes sense, like finding the perfect comfy spot on the couch? That’s kind of how level premiums feel, but for a much bigger, more important thing: insurance! Think of it like this: you're buying a super cool, long-lasting promise from an insurance company. This promise will be there for you, no matter what life throws your way.

Now, when you’re younger, you might be thinking, “Insurance? That’s for old people or when things go wrong.” But here’s the secret sauce of level premiums. It’s a clever way to make that promise affordable and predictable for a really, really long time. Imagine you're signing up for a subscription to your favorite streaming service. You pay the same amount every month, right? That’s the essence of a level premium. It’s one steady, predictable payment that helps you sleep at night.

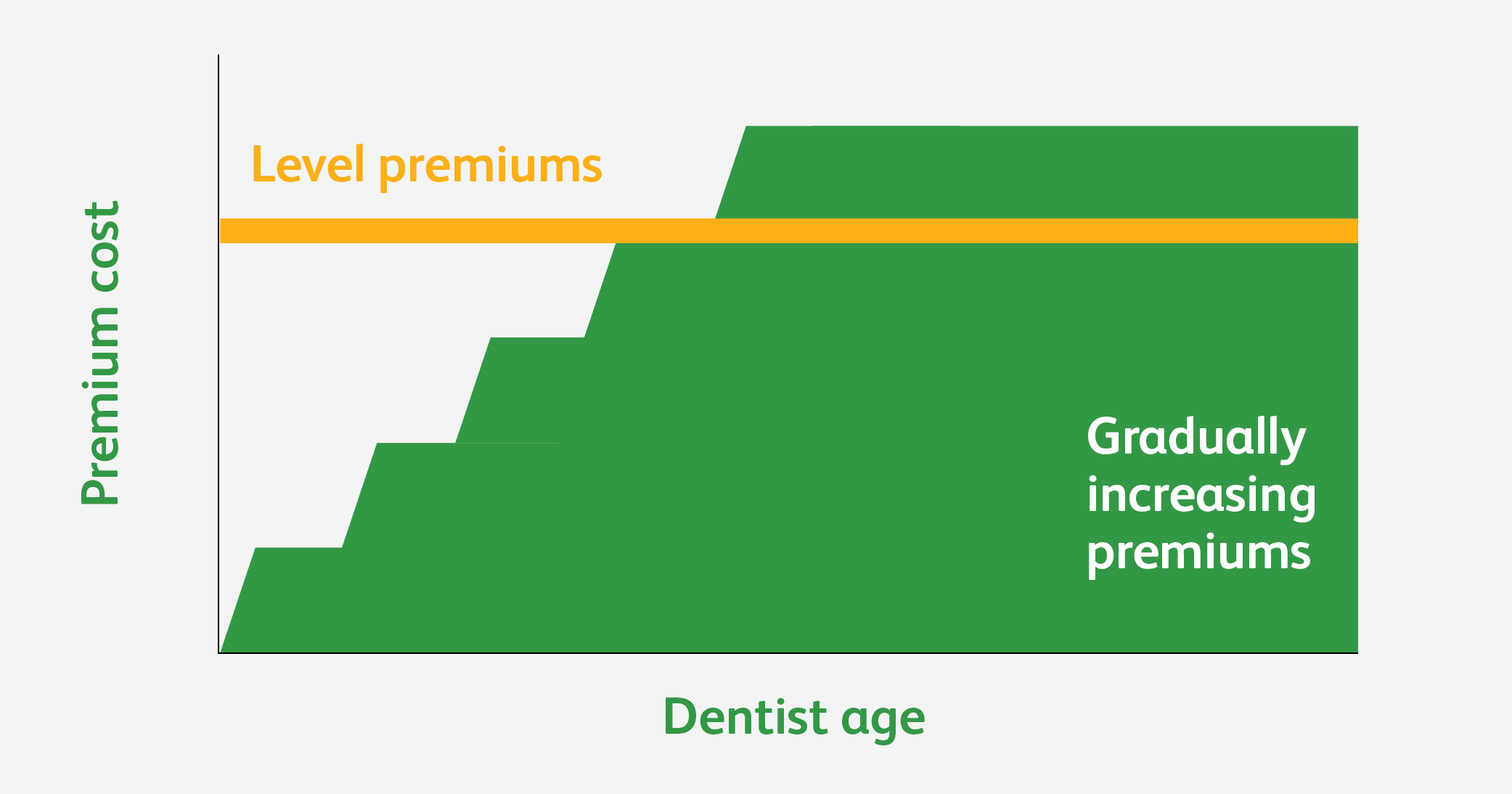

Why is this so awesome? Well, let’s dive into the fun part. Think about life insurance, for instance. When you’re young and spry, you’re generally seen as less of a risk by the insurance folks. So, if you were to pay for insurance based on your age right now, your payments would be super low! But what happens when you get older? Life still happens, and maybe your health isn’t quite as robust. If your premiums weren’t level, they’d start creeping up and up, year after year. Suddenly, that important promise becomes a lot heavier on your wallet.

This is where level premiums really shine! They take that initially lower cost from your younger years and spread it out evenly over the entire life of the policy. So, you pay a little bit more when you’re younger than you might have to, but in return, you get the fantastic benefit of a consistent, unchanging payment for decades to come. It’s like pre-paying for future peace of mind at a discount! How cool is that?

The underlying concept is all about smoothing things out. Imagine a bumpy road versus a perfectly paved highway. Level premiums are the paved highway for your insurance payments. You’re not going to hit unexpected potholes of rising costs. This predictability is a HUGE deal. It allows you to budget with confidence. You know exactly what that insurance promise is going to cost you, today, tomorrow, and way down the line.

It’s like buying a really good quality, timeless piece of furniture. You might pay a bit more upfront compared to a cheap, flimsy knock-off, but you know it’s going to last. And the price you paid today is the price you'll always pay. There are no surprise price hikes for the craftsmanship or durability!

So, what makes this concept so entertaining? It’s the sheer cleverness of it! It’s a win-win situation. For the insurance company, it helps them manage their risks more effectively over the long haul. For you, the customer, it's a magical way to lock in an affordable rate for a crucial safety net. It’s like getting a sneak peek at the future and securing a great deal!

Think about all the things in life that change their prices. Your grocery bill, the cost of gas, maybe even your favorite coffee. It can be frustrating, right? But with level premiums, your insurance payment stays the same. It's a little island of stability in a sea of ever-changing costs. This mental peace is worth its weight in gold. It frees up your brain space to focus on other things, like planning your next adventure or enjoying time with loved ones, knowing that one important piece of your financial future is completely sorted.

What makes it special is that it’s designed for the long haul. It’s not a quick fix; it’s a foundational element of financial planning for many people. It allows you to build a solid plan for your family’s security without the worry of constantly adjusting your budget due to rising insurance costs. It’s like having a secret superpower for financial predictability!

When you hear about level premiums, don't let the fancy name scare you. It’s just a smart, straightforward idea that makes a really important service much more accessible and manageable. It’s all about making that promise of security a comfortable and consistent part of your life, year after year.

So, next time you hear the term level premium, give a little nod of appreciation. It’s a brilliant concept that brings stability, predictability, and a whole lot of peace of mind. It's a little bit of financial magic designed to keep your important promises affordable and steadfast. It’s one of those concepts that, once you get it, makes you think, "Wow, that's just plain smart!" And isn't that kind of cleverness inherently entertaining?

It’s this commitment to consistency that makes level premiums so appealing. It removes the guesswork and allows you to focus on the benefits of your insurance rather than the fluctuating costs. It’s a promise of stability in a world that’s always on the move. And that, my friends, is pretty special indeed.

Level premiums are like a perfectly balanced seesaw for your insurance payments. Always at the same height, always reliable!

What Is The Underlying Concept Of Level Premiums

So, if you're looking into insurance, especially for the long term, keep an eye out for the magic of level premiums. It might just be the simplest, most brilliant way to secure your future and enjoy a consistent, predictable payment. Give it a thought, and you might just find yourself smiling at how ingeniously simple it all is!