What Is A Pos Adjustment Navy Federal

Okay, so you’ve probably heard the term “POS adjustment” thrown around, especially if you’re part of the Navy Federal Credit Union crew. And if you’re scratching your head, don’t worry, you’re not alone! It sounds super official, right? Like something straight out of a top-secret mission briefing. But honestly, it’s way less spy-thriller and a lot more…well, financial wizardry for your everyday cash flow.

Think of it like this: you’re at your favorite coffee shop, ordering that latte that’s basically a hug in a mug. You swipe your Navy Federal card. The machine does its thing. Sometimes, though, there’s a little hiccup. Maybe the transaction takes a moment longer to finalize than usual. Or perhaps there’s a slight difference between what the store initially rings up and what eventually hits your account. That’s where our hero, the POS adjustment, swoops in.

What Even IS a POS? (No, Not That Kind!)

First things first. POS stands for Point of Sale. It’s not about your attitude at the checkout counter, thank goodness! It’s simply the spot where the magic (or the money exchange) happens. Think of your debit card reader, that little machine humming away. That’s the POS!

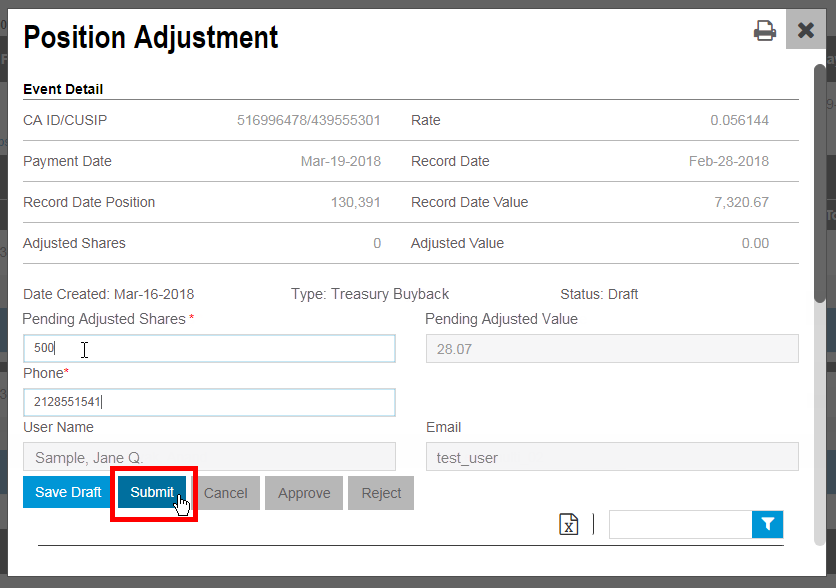

So, a POS adjustment? It’s basically Navy Federal’s way of saying, "Hey, we noticed a little tweak needed for this transaction that happened at the Point of Sale." It’s like a tiny, behind-the-scenes tidy-up of your account.

Why Does This Even Happen? It's Kinda Funny When You Think About It.

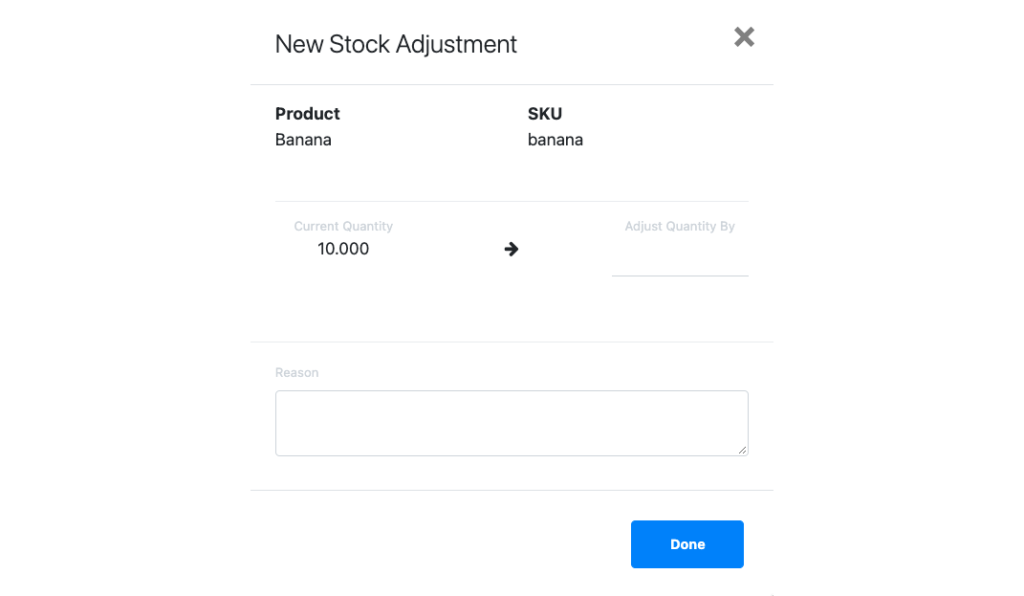

Now, why would your money need adjusting? It’s not usually because you bought too many of those delicious cookies (though, who can blame you?). It’s more about the quirky ways technology and banking talk to each other. Sometimes, there’s a temporary hold on funds. Ever seen that when you fill up your gas tank? The station puts a placeholder amount, then corrects it later to the actual cost of the gas you pumped. That’s a mini-POS adjustment in action!

Or maybe you’ve bought something online, and the final shipping cost is slightly different than the initial estimate. Your bank needs to reflect that actual amount. These little dance steps between merchants and banks are where POS adjustments come in. It’s all about making sure the numbers on your statement are as accurate as a perfectly brewed espresso.

Navy Federal’s Touch: Making Things Smoother

Navy Federal, being the awesome credit union it is, tries to make these adjustments as seamless as possible. You won’t usually see a big flashing neon sign saying, "POS ADJUSTMENT HAPPENING NOW!" Nope. It’s usually just a quiet correction. You might see a transaction that was pending suddenly update, or a slightly different amount appear on your statement than what you initially remembered.

It's like when you get your favorite snack from the vending machine. You put your money in, press the button, and voila! snack. But sometimes, the machine gets a little confused, and you have to nudge it a bit. A POS adjustment is kind of like Navy Federal nudging the system to make sure you get your exact snack, at the exact price.

The Mystery of the Vanishing Dollar (or the Appearing One!)

This is where it gets kinda fun. Sometimes, a POS adjustment can make a pending transaction disappear for a bit, only to reappear later with a slightly different total. Or, it might show up as a credit, almost like a little financial surprise! It’s like a tiny financial magic trick happening in your account.

Imagine you bought a book for $15.99. But then, the bookstore decided to offer a small discount you didn’t know about. That $15.99 might show as pending, and then the POS adjustment changes it to, say, $15.49. Poof! A little bit of money saved, thanks to the magical POS adjustment. Or, on the flip side, if there was a tiny undercharge, the adjustment corrects it. It’s all about that final, accurate tally.

When Should You Actually Care About This?

Honestly, for most everyday purchases, you probably won’t need to give POS adjustments a second thought. Navy Federal’s systems are usually on top of it. But there are a couple of times it might be worth a quick peek:

- If a transaction looks way off: If you see a charge that's drastically different from what you remember, it's always good to check. A POS adjustment could be the reason, but it’s also good to rule out any other issues.

- When you're tracking your budget closely: If you're meticulously planning your spending, understanding these little financial nudges can help you see the actual cost of things.

- For those pesky holds: Like we talked about with gas stations or hotels, these temporary holds are classic examples of transactions that will eventually need a POS adjustment to reflect the final amount.

It's Not a "Problem," It's a "Feature"!

The funniest thing is, people sometimes get a little worried when they see these adjustments. They think something went wrong. But really, it's often a sign that things are working correctly. It's the system fine-tuning itself to be super precise. Think of it as the credit union’s way of saying, "We've got your back, and we're making sure your money is accounted for exactly."

It’s the unsung hero of your transaction history. The little behind-the-scenes fixer. The financial equivalent of a perfectly placed comma that makes a sentence make sense. Without these adjustments, our banking world would be a much messier, and frankly, less accurate place.

The Navy Federal Difference

Navy Federal is known for its member-focused approach. They want to make banking as easy and transparent as possible. So, while the term "POS adjustment" might sound a bit technical, the purpose behind it is all about clarity and accuracy for you, their members. They're not trying to trick you; they're trying to be precise.

It’s a little peek into the complex world of how your money moves. And when you’re dealing with a credit union that’s all about serving its members, even these little financial nuances are handled with care. So next time you see a transaction adjust, don't sweat it. It's just Navy Federal doing its thing, keeping your finances in shipshape!