What Is A Co Pay In Health Insurance

So, picture this: I’m feeling a bit… off. You know that feeling? Like a weird tickle in your throat that’s just begging to become a full-blown concert of sneezes. Naturally, my first thought isn't about filing insurance claims or understanding deductibles. It's usually, "Ugh, do I really need to see a doctor for this?" But after a sleepless night of coughing symphonies, I caved. Dragged myself to the clinic, feeling like a tragic hero in a germ-infested drama.

The receptionist, bless her efficient soul, took my insurance card. And then came the question that always makes my brain do a little somersault: "And your co-pay today will be $30." Thirty bucks. For… a doctor’s visit? My brain, still foggy from lack of sleep and an impending cold, went into overdrive. "Wait, what? Isn't that what insurance is for? And is this different from that other thing I pay every month?"

If you’ve ever found yourself in a similar situation, nodding along with bewildered resignation, then welcome to the club. Navigating health insurance can feel like trying to assemble IKEA furniture without the instructions – baffling, frustrating, and often involving extra pieces you weren't expecting. And right at the heart of this charming confusion lies the humble, yet oh-so-important, co-pay.

So, What Exactly Is a Co-Pay?

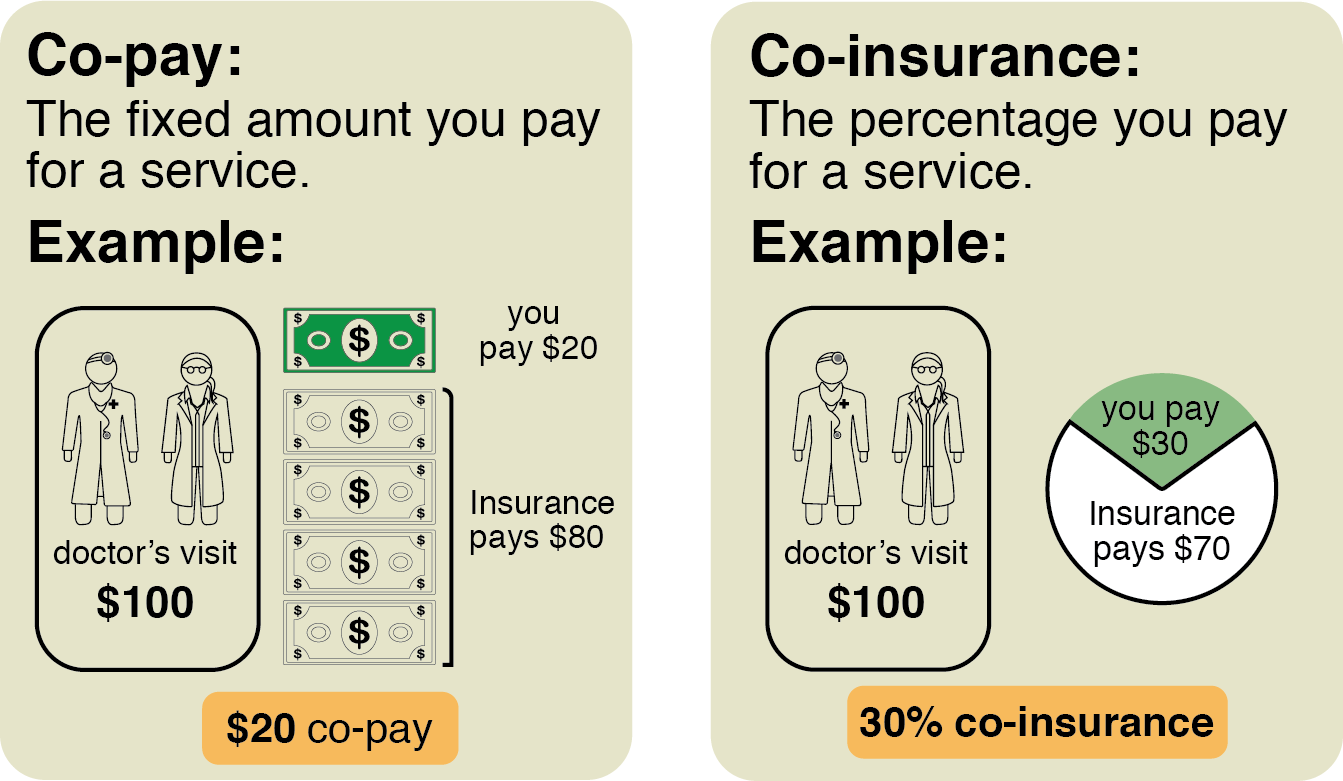

Let's break it down, shall we? Think of your health insurance plan like a really fancy gym membership, but for your body. You pay a monthly fee (that’s your premium, by the way – another term to add to the ever-growing dictionary of insurance jargon) to have access to the "gym" (your network of doctors and hospitals). Now, when you actually use the gym equipment – I mean, visit the doctor, get a prescription, or undergo a procedure – the gym (your insurance company) doesn't always foot the entire bill. A co-pay is your share of the cost for a covered healthcare service, usually a fixed amount, that you pay at the time you receive the service.

It’s like a little down payment for your healthcare. You’ve got your membership (premium), and then for each workout (doctor’s visit), you pay a small fee at the door. Simple enough, right? Well, sometimes. Let’s dive a little deeper into this magical world of shared costs.

The "Fixed Amount" Dance

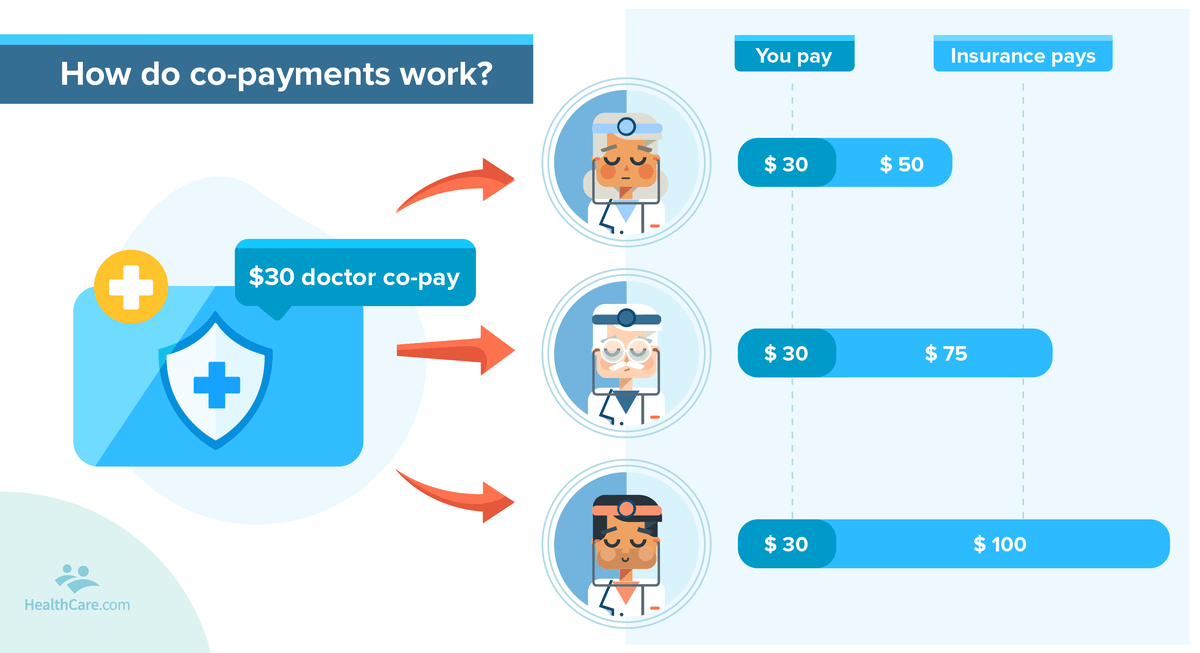

The key word here is fixed. This is what differentiates it from other cost-sharing mechanisms. For example, if your co-pay for a primary care physician visit is $30, you’ll likely pay $30 whether the doctor’s actual service cost $100 or $500. Of course, this doesn't mean the insurance company is paying the rest of the bill for free. They are, but that’s a story for another day involving deductibles and co-insurance. For this moment, with this specific service, your responsibility is that predetermined $30.

It’s a way for insurance companies to encourage you to use their network and also to deter you from going to the doctor for every little sniffle. Think of it as a gentle nudge, a little hurdle to make you consider if that cough really needs a professional ear. And honestly, for minor things, it probably doesn't. But when you’re genuinely feeling unwell, that $30 feels like a tiny price to pay for peace of mind and the hope of feeling human again.

What's interesting is that co-pays often vary depending on the type of service. So, that $30 for your GP might be different for a specialist. A visit to a cardiologist or a dermatologist might set you back a bit more, say $50 or even $75. It’s like the "premium" tier of healthcare access within your plan. Higher-level expertise often comes with a slightly higher co-pay.

Co-Pays vs. Other Insurance Buzzwords

Now, this is where things can get really exciting. Or, if you're anything like me, really confusing. The co-pay is just one piece of the health insurance puzzle. Let's shine a little light on its friends and cousins, so you don't accidentally confuse them during your next medical adventure.

Deductibles: The Big Kahuna

Ah, the deductible. This is probably the most misunderstood part of health insurance for many people. Think of it as a threshold. You have to pay a certain amount out-of-pocket for covered healthcare services before your insurance plan starts to pay its share. For example, if your deductible is $1,000, you'll pay the first $1,000 of your medical expenses yourself. Once you’ve hit that $1,000 mark, then your insurance kicks in, and you’ll typically start paying a percentage of the costs (that’s co-insurance) or a fixed co-pay for subsequent services.

So, if you have a $30 co-pay for a doctor’s visit, and you haven't met your deductible yet, you might actually have to pay the full cost of that visit, not just the $30 co-pay. This can be a shocker! Always, always, always check if your deductible has been met before assuming that co-pay is all you'll owe. It’s like reaching for your wallet at the checkout and then finding out you still have to pay for the entire grocery cart, not just your usual $5 for the special offer item.

It's worth noting that some plans have separate deductibles for different types of services, like prescription drugs or specific medical procedures. It can get complicated, I know. Imagine trying to keep track of how many times you’ve reached for the salt shaker versus the pepper shaker to reach your "seasoning deductible."

Co-insurance: The Partnership Deal

If your deductible has been met, you might then encounter co-insurance. This is where you and your insurance company share the costs of a covered healthcare service in a percentage. For example, after you’ve met your deductible, your insurance might pay 80% of the cost, and you’d be responsible for the remaining 20%. This 20% is your co-insurance.

So, while co-pays are a fixed dollar amount, co-insurance is a percentage. It’s less predictable because the actual dollar amount you pay depends on the total cost of the service. If you're having a procedure that costs $10,000 and your co-insurance is 20%, you're looking at a $2,000 bill. Ouch. This is where having a good understanding of your plan’s co-insurance is crucial, especially for major medical events.

It's like sharing a pizza. With a co-pay, you pay a fixed price for your slice, regardless of how big or small the pizza is. With co-insurance, you pay a set portion of the entire pizza, so if it’s a giant family-sized pizza, your portion will be bigger than if it’s a personal pan.

Premiums: The Monthly Membership Fee

We touched on this earlier, but it’s worth reiterating. Your premium is the amount you pay your insurance company regularly (usually monthly) to keep your insurance plan active. This is the foundation of your coverage. Without paying your premium, your insurance wouldn't be valid. It's the price of admission to the whole healthcare system.

Plans with lower premiums often have higher deductibles, co-pays, or co-insurance. Conversely, plans with higher premiums might offer lower out-of-pocket costs when you actually need care. It's a trade-off, and figuring out which balance works best for you is a whole other ballgame that depends on your health needs and financial situation.

Think of it as choosing between a basic subscription to a streaming service versus the premium one. The basic one is cheaper per month but might have ads or fewer features. The premium one costs more upfront but offers a smoother, more comprehensive viewing experience. Your health insurance is similar.

Why Do Insurance Companies Use Co-Pays?

It might seem like just another hoop to jump through, but co-pays serve a few purposes from the insurance company's perspective. And honestly, some of them make a bit of sense.

Encouraging Responsible Healthcare Utilization

As I mentioned before, a small co-pay acts as a slight deterrent for unnecessary doctor visits. If every minor ailment sent you running to the doctor and the insurance company paid 100% of the cost, healthcare costs would skyrocket even faster. The co-pay makes you pause and think, "Is this really worth the $30?" For the insurance company, this helps manage their overall costs, which in turn can help keep premiums lower for everyone.

It's a bit like a "convenience fee" for using a service. You're not paying the full price of the service, but you're contributing a little to make sure the system stays functional and accessible. It’s a way to ensure resources aren't over-burdened.

Predictability for the Insured

For the person needing care, a fixed co-pay offers a degree of predictability. When you visit your primary care doctor, you know you're likely going to owe $30. You can budget for that. It's much easier to plan for a $30 expense than an unknown percentage of an unknown medical bill, especially if you haven't met your deductible yet.

This predictability is a huge relief when you're already feeling stressed about your health. You don't want to be caught off guard by a massive bill after a simple check-up. The co-pay, for all its potential confusion, offers a clear, upfront cost for that specific interaction.

Cost-Sharing and Affordability

Co-pays are a fundamental part of how health insurance plans share the cost of care. By having members contribute a fixed amount for each service, insurance companies can spread the risk and keep the overall cost of providing insurance more manageable. This cost-sharing is what makes comprehensive health insurance plans affordable for a larger segment of the population.

If insurance companies had to cover the entire cost of every single healthcare interaction, premiums would be astronomically high, making insurance inaccessible for many. The co-pay is a small contribution that allows the larger insurance pool to function effectively.

When Do You Pay Your Co-Pay?

Generally, you'll pay your co-pay at the time of service. This means when you check in at the doctor's office, pick up a prescription at the pharmacy, or when you're being admitted for a procedure. The receptionist or billing staff will tell you the amount you owe, and you hand over your cash, card, or sometimes even a check.

It’s important to note that co-pays usually only apply to covered services. If you visit a doctor for something that isn’t covered by your plan, or if you go outside your insurance network without proper authorization, you might end up paying the full cost of the service, not just a co-pay. So, always double-check what's covered and if you're within your network.

This is why it's so crucial to have your insurance card handy and to be familiar with your plan’s details. A quick call to your insurance provider or a peek at your plan documents can save you a lot of confusion and potential unexpected bills down the line. It's like carrying a map when you're exploring a new city – you don't want to get lost!

The Bottom Line (Pun Intended!)

So, the next time you're handed that insurance form or asked for your "co-pay," you'll have a slightly clearer picture. It's that fixed amount you pay for specific healthcare services, a small but important part of how your health insurance works to share the costs of your care. It's not your deductible, and it's not your co-insurance, but it's a key component of your out-of-pocket expenses.

While it can seem like just another expense, remember that co-pays contribute to making healthcare more accessible and affordable for everyone by helping to manage the costs of the system. They encourage responsible use of services and provide a predictable expense for you at the point of care. Embrace the co-pay, my friends, as a small, sometimes annoying, but ultimately necessary part of staying healthy and keeping your wallet from imploding entirely when you need medical attention.

And hey, if you ever feel like you're drowning in insurance terms, you're not alone. We're all just trying to make sense of it together, one co-pay at a time. Now, if you'll excuse me, I think I hear my sneeze concert reaching its crescendo, and I might just need to book that follow-up appointment. Wish me luck with my $30!