Under The Allowance Method Of Accounting For Uncollectible Accounts

Remember Sarah, the super organized bakery owner? She’d meticulously track every cupcake sold, every croissant baked. Her spreadsheets were legendary. But one day, a big catering order came in – a wedding for a hundred people! All those fancy tiered cakes and delicate pastries. She handed over the goods, feeling pretty proud. The bill? A cool five grand. Fast forward a few weeks, and Sarah’s still waiting for that payment. The wedding planner? Vanished. The happy couple? Radio silent. Sarah, bless her organized heart, had to admit defeat. That five grand, though it felt like a real sale at the time, was never going to show up in her bank account. It was a painful lesson, but one that many businesses, big and small, have to learn.

And that, my friends, is where we stumble upon the quirky world of accounting for things you expect not to get paid for. Yep, you heard me right. In the grand, sometimes baffling, universe of business finance, we have a special little method to deal with those pesky customers who might, or might not, decide to pay up. It’s called the Allowance Method for Uncollectible Accounts. Fancy name, right? But honestly, it’s just a grown-up way of saying, "We know some of you aren't going to pay, so we're going to plan for it."

Now, you might be thinking, "Why on earth would I plan for losing money?" It sounds counterintuitive, like planning to spill your coffee on your new white shirt. But that’s the beauty (and the sometimes bewildering nature) of accounting. It’s all about being realistic. Sarah, in her distress over the wedding money, probably wished she’d factored in the possibility that not everyone pays their bills on time. Or ever.

So, what is this Allowance Method, really? At its core, it's an accounting technique that recognizes that not all of your sales will eventually be collected. Instead of waiting until a debt is officially deemed "uncollectible" (which can take ages and cause a whole heap of accounting headaches), you estimate the amount you think you won't collect and set it aside in advance. Think of it as a contingency fund for bad debts. You’re basically saying, "Okay, based on our past experiences, we anticipate that about X% of our sales will end up being worthless. Let’s make a note of that now."

Why Bother With All This Estimating?

This is the million-dollar question, isn't it? Why not just wait and see who stiffs you and then deal with it? Well, the folks who invented accounting (probably very patient people, considering the mess they had to sort out) realized that waiting can mess up your financial statements. If you record a sale as pure profit right away, but then later have to admit you never got paid, your profit picture for that earlier period looks way too rosy. It's like saying you aced that exam when you actually scraped by with a C-.

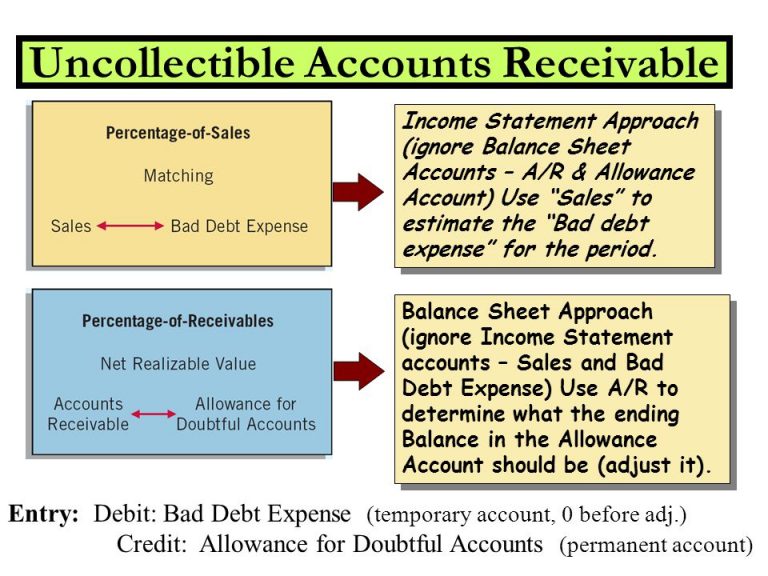

The Allowance Method helps to create a more accurate picture of your company's financial health right now. It adheres to the matching principle, which is a fancy accounting term for making sure your expenses are recorded in the same period as the revenues they helped to generate. In this case, the "expense" is the cost of having customers who don't pay, and it's matched against the sales revenue that brought them in. See? It all connects.

It’s also about being proactive, not reactive. Instead of being surprised and disappointed when a bill goes unpaid, you’ve already accounted for it. It’s like having an umbrella on a cloudy day. You might not need it, but it’s smart to have it ready, just in case. And let’s be honest, in business, there are always cloudy days.

How Does This Magical Method Actually Work?

Okay, let’s get a little less abstract and a little more concrete. The Allowance Method involves a couple of key steps. First, you need to estimate how much of your accounts receivable (that's the money that customers owe you) is likely to be uncollectible. There are a few ways to do this, and honestly, they can get a bit mathematical. But don’t worry, we’re keeping it light here. Think of it as a guided tour, not a deep dive into calculus.

One common approach is the percentage of credit sales method. This is probably the simplest and most commonly used. You look at your historical data and figure out what percentage of your credit sales have historically gone uncollected. So, if in the past, 2% of your credit sales have ended up as bad debts, you’d apply that 2% to your current credit sales to estimate your uncollectible amount. Easy peasy, right?

Another method is the aging of accounts receivable. This one is a bit more involved. You actually look at how old your outstanding invoices are. For example, you might assume that invoices less than 30 days old have a very low chance of being uncollectible, but invoices that are over 90 days old have a much higher chance. You then assign a percentage to each age category and calculate the estimated uncollectible amount for each. It’s like grading your outstanding invoices – the older they get, the more likely they are to fail.

Once you have your estimate, you make a journal entry. This is where the accounting magic really happens. You don’t actually write off specific customer debts yet. Instead, you debit an expense account called Bad Debt Expense and credit a contra-asset account called Allowance for Doubtful Accounts. Why a contra-asset account? Because it reduces the book value of your accounts receivable, making it a more realistic number on your balance sheet. It’s like putting a little asterisk next to your total receivables, saying, "Hey, some of this might not actually be collectible."

The Two Sides of the Coin: Recording and Writing Off

So, you’ve made your estimate and recorded your bad debt expense. Now what? Well, life goes on, and eventually, you'll have to face the music for individual accounts. When you’ve finally given up all hope on a specific customer's debt – maybe they’ve officially declared bankruptcy, or they’ve just gone completely off the grid – you’ll write off that specific account. This is when you debit the Allowance for Doubtful Accounts and credit Accounts Receivable for that specific customer. Notice, you don't debit Bad Debt Expense again. That expense was already recognized when you made your initial estimate. This write-off just reduces the specific amount that was sitting in your allowance account.

And then, the universe sometimes throws you a curveball. What if, after you’ve written off an account, the customer suddenly reappears and decides to pay you? It’s rare, but it happens! In this case, you’d reverse the write-off by debiting Accounts Receivable and crediting Allowance for Doubtful Accounts. Then, you’d record the cash payment by debiting Cash and crediting Accounts Receivable. It’s like finding a forgotten twenty-dollar bill in your old jeans – a little unexpected bonus!

Pros and Cons: Is It Always Sunshine and Rainbows?

Like most things in life, the Allowance Method isn't perfect. It has its upsides and its downsides. Let’s start with the good stuff, shall we?

The Upside:

- Accurate Financial Reporting: This is the big one. It gives a more realistic picture of your company's assets and profitability. You're not overstating your receivables or your net income.

- Matching Principle Adherence: As we touched on, it aligns expenses with the revenues they helped generate.

- Proactive Approach: You're anticipating potential problems rather than being caught off guard. This can lead to better financial planning.

- Smoother Income Statements: By spreading out the bad debt expense over time, you avoid large, sudden hits to your income statement when specific debts become uncollectible.

Now, for the less sunny side.

The Downside:

- Estimation Uncertainty: The whole method relies on estimates. And as we all know, estimates can be wrong. If your estimates are consistently off, your financial statements won't be as accurate as they could be. It’s a bit of guesswork, though hopefully, educated guesswork.

- Potential for Manipulation: Because it involves estimation, there’s a temptation for management to manipulate the allowance to achieve desired income results. (Shameful, I know, but it happens!)

- Complexity: For very small businesses, the added complexity of estimating and making these journal entries might seem like overkill.

Who Uses This Method and Why?

Pretty much any business that extends credit to its customers will, or at least should, be using some form of the Allowance Method. This includes everyone from massive corporations selling to other businesses on credit terms to smaller companies that let customers pay later. Think about:

- Manufacturers and Wholesalers: They often sell large quantities of goods to retailers on credit.

- Retailers: Especially those with their own store credit cards or loyalty programs that allow for deferred payments.

- Service Providers: Lawyers, accountants, consultants – they all bill clients and have to deal with clients who might not pay promptly.

The alternative method, the direct write-off method, where you only record bad debt expense when a specific account is deemed uncollectible, is generally not allowed under Generally Accepted Accounting Principles (GAAP) for material amounts. Why? Because it violates the matching principle and can lead to a distorted view of profitability. So, unless your uncollectible accounts are truly insignificant, the Allowance Method is the way to go.

Think of it this way: Would you rather have a doctor give you a diagnosis based on a quick glance, or a thorough examination and lab tests? The Allowance Method is like the thorough examination of your receivables. It’s more work upfront, but it gives you a much clearer picture of what’s really going on.

Sarah, our bakery owner from the beginning? She probably learned the hard way. Now, she might be a little more inclined to ask for a deposit on those huge orders, or perhaps she's now mentally budgeting for the occasional "lost cause" customer. It’s a tough business lesson, but a vital one.

So, the next time you hear about the Allowance Method, don’t be intimidated by the fancy name. It’s just a practical, albeit sometimes tricky, way for businesses to acknowledge that not every sale is a guaranteed payday. It's about being realistic, planning for the inevitable, and ultimately, presenting a more honest financial picture to the world. And in the grand scheme of things, isn’t that what good business (and good accounting) is all about?