The Par Value Per Share Of Common Stock Represents The

Ever wondered about the little details that make up the big picture of the stock market? Sometimes, the most seemingly minor figures hold surprising significance. Today, let's dive into something called the par value per share of common stock. It sounds a bit technical, but understanding it can actually be quite illuminating, and dare we say, a little bit fun!

Think of it like this: when a company first issues its stock, it assigns a nominal, often very low, value to each share. This is the par value. It's like a legal placeholder, a minimum stated value. It’s not usually tied to the actual market price you’ll see later, but it has its own distinct purpose.

So, what’s the point of this seemingly arbitrary number? Historically, par value served as a minimum capital requirement. It meant that for every share issued, the company received at least that amount, protecting creditors by ensuring a baseline of capital. It also played a role in accounting, helping to distinguish between the stated capital and any additional capital contributed by shareholders.

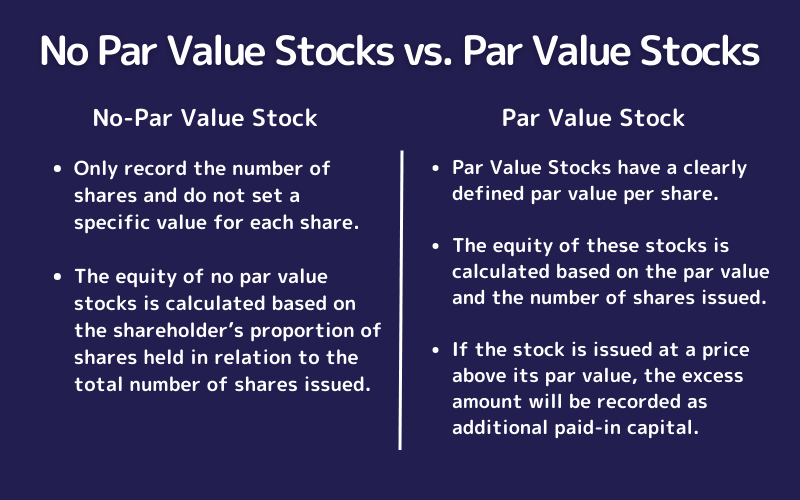

While its historical significance is more pronounced, par value still has some practical applications. For instance, it can be important in determining things like dividends on preferred stock, which might have a par value and a fixed dividend rate tied to it. For common stock, its role is largely historical, and in many modern companies, it's set at a very minimal amount, like $0.01 or even less. This is often referred to as no-par value stock, where a specific par value isn't assigned.

Where might you encounter this concept in a more relatable way? Well, if you’re ever looking at a company's financial statements, particularly the balance sheet, you might see a line item for "Common Stock" with a par value and the number of shares outstanding. It’s a small piece of the puzzle that tells a story about the company's financial structure.

In an educational setting, learning about par value helps to build a foundational understanding of corporate finance. It’s a step on the ladder to grasping more complex concepts like paid-in capital and the evolution of how companies fund themselves. It's a good reminder that even the smallest numbers can have a history and a function.

Ready to explore this a little further without diving into dense textbooks? You can easily look up the par value of stocks for publicly traded companies. Simply search for a company’s name followed by "investor relations" or "financial statements." You’ll likely find their annual reports (10-K filings) on the SEC's EDGAR database, which will detail their stock structure, including par value.

Another simple way is to browse financial news websites. Sometimes, in simplified company profiles, you might even find a mention of the par value, or at least a note about their stock structure. It's a subtle detail, but noticing it can spark further curiosity about how businesses are capitalized. So, the next time you see a mention of par value, don't just skim past it – there's a little bit of history and finance tucked away in that number!