The Par Value Per Share Of Common Stock Represents

Alright, gather ‘round, you magnificent bunch of humans! Let’s talk about something that sounds as exciting as watching paint dry, but is actually, dare I say it, kind of a big deal. We’re diving headfirst into the glorious, the mysterious, the… well, the par value per share of common stock. I know, I know, it’s not exactly a headline grabber. It doesn’t have the sizzle of a stock split or the drama of a hostile takeover. But stick with me, because understanding this little nugget is like finding a hidden compartment in your favorite armchair – you might not have known you needed it, but it’s there, and it’s… vaguely useful!

Imagine you’re at a fancy-pants auction, the kind where people wear monocles and bid on Faberge eggs with a flick of their wrist. The auctioneer, with a voice like a foghorn wrapped in velvet, announces, "And now, for our first item: one share of 'Sparkle & Shine Inc.'! We start the bidding at… one cent!"

Wait, what? A penny? For a share of a company that probably makes those glitter pens I loved in third grade? That’s the par value, my friends. It’s the absolute rock bottom, the basement of value, the microscopic amount that a company assigns to each share of its stock when it first issues it. Think of it as the company’s little pinky toe dipped in the kiddie pool of ownership. It's so small, you could probably lose it in your couch cushions and not even notice.

So, why on earth do companies bother with this minuscule number? Is it some ancient ritual passed down from the stock market gods? Well, not exactly. In the olden days, par value had a bit more weight. It represented the minimum amount that shareholders could be held responsible for if the company went belly-up. Like saying, "Okay, you own a piece of the pie, but if the pie explodes, you're only on the hook for the crumbs."

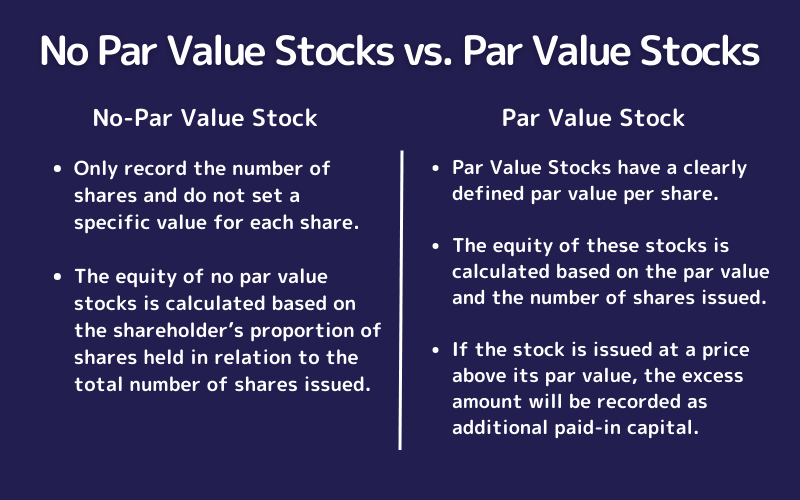

But fast forward to today, and this responsibility thing has pretty much vanished in most places. It’s like that childhood rule about eating your vegetables – everyone knows it exists, but nobody really enforces it anymore. Most modern companies issue stock with a very low par value, often just $0.01 or even less. Some might even have "no-par value" stock, which is like saying the company decided par value was too much hassle and just skipped it altogether. Imagine trying to explain that to your grandma: "So, Grandma, you own a share, but it doesn't technically have a value assigned to it." She’d probably just nod and offer you a cookie.

So, Why Does It Even Matter Then?

If it’s practically worthless, why do we even talk about it? Ah, this is where it gets a little more interesting, though still not exactly a page-turner. For accounting nerds and finance wizards, par value plays a role in how a company records its initial stock issuance. When a company sells shares for more than the par value (which, let’s be honest, they almost always do, otherwise, who would bother?), the difference is recorded as paid-in capital in excess of par. Fancy term, right? It’s basically the extra dough the company got for its shares, beyond that initial penny-toe-dip.

Think of it like this: You’re selling a perfectly good, slightly-used rubber chicken. The ‘par value’ of this rubber chicken is one cent. But you know it’s got some serious squawk-potential, so you sell it for $5. That extra $4.99? That’s your paid-in capital in excess of par. It’s the real prize, the gravy, the cherry on top of the par value sundae.

The Surprising (and Slightly Less Surprising) Truth

Here’s a fact that might blow your mind: Some companies, especially in the past, used higher par values. Imagine a company issuing stock with a par value of $100! That’s like saying your rubber chicken is worth a hundred bucks! Could you imagine trying to sell it? "Yes, sir, this chicken has a proven track record of… well, not being eaten." It’s almost comical how inflated some of those original valuations were. They were probably expecting their shares to be traded for actual gold bars. Alas, the market had other plans.

Another fun tidbit: In some legal jurisdictions, especially for older companies, there might still be some residual legal implications related to par value. It’s like that one old law about not being allowed to whistle after dark in a certain town. Technically on the books, but nobody’s getting arrested for it. It’s mostly an administrative detail, a relic of a bygone era of stock market dealings.

So, when you’re looking at stock information, you might see a tiny number next to "Par Value." Don’t get too excited. It’s not a secret discount code for buying more shares. It’s not the hidden treasure map to eternal riches. It’s just… there. It’s the original, microscopic price tag that the company slapped on its ownership units way back when. It’s the company’s baby teeth in the grand, adult world of finance. Mostly symbolic, a nod to history, and a tiny accounting footnote.

In essence, the par value per share of common stock is like that one distant cousin you only see at weddings. You know they exist, they have a name, but their actual impact on your life is… minimal. It’s a number, a decimal point, a whisper in the wind of market fluctuations. It’s the starting point, the baseline, the humble beginnings before the wild ride of market trading takes over. So, the next time you see it, just give it a knowing nod, a little smirk, and remember the penny-pinching origins of corporate ownership. And then go back to focusing on the actual price of the stock, the one that actually matters when you’re trying to make your money do a little happy dance.