Telematics And Usage-based Auto Insurance Trends

Imagine this: your car, that trusty metal steed that ferries you through life's adventures, is about to get a whole lot smarter. And guess what? It might even start paying you back for being a super-duper safe driver! We're talking about something called Telematics, and it's shaking up the world of car insurance like a shaken-up soda can, but in a good way!

So, what exactly is this magical Telematics thing? Think of it as your car giving your insurance company a little wink and a nod, sharing anonymous tidbits about your driving habits. It's not about spying on your every turn, but rather about understanding how you handle that steering wheel.

These days, insurance isn't just a one-size-fits-all deal anymore. Gone are the days of paying the same price as the guy who treats his minivan like a Formula 1 race car! Now, it's all about Usage-Based Insurance (UBI), and it's like getting a personalized discount just for you.

Picture this: you're an angel behind the wheel. You brake gently, you accelerate smoothly, and you never, ever text while driving (because, let's be honest, that's just asking for trouble!). Your car, through Telematics, sees all this awesomeness. And then, poof, your insurance bill magically shrinks!

It's kind of like getting rewarded for being a good kid. Remember when your parents praised you for cleaning your room without being asked? This is like that, but for your car and your wallet. Your good driving habits are actually being seen and valued.

So how does this amazing Telematics magic happen? Usually, it involves a tiny device that plugs into your car, or sometimes it's an app on your smartphone that does the heavy lifting. It’s less intrusive than a secret agent and more like a helpful little elf living in your car.

This little helper is busy collecting data. It’s looking at things like how many miles you drive, when you drive (night owls might pay a bit more, sorry!), and how you accelerate and brake. No, it's not judging your questionable taste in 80s power ballads on repeat, it's just tracking your driving style.

And that’s the beauty of Usage-Based Insurance. It's all about fairness. If you drive less, you’ll likely pay less. If you’re a cautious driver, you can potentially save a bundle. It’s like finally getting paid for all those times you patiently waited for that pedestrian to cross, even when you were really craving that drive-thru coffee.

Think about your neighbor, Gary. Gary loves his car. Gary also has a lead foot and a penchant for late-night joyrides. Under the old system, Gary might have paid the same as you, the saintly driver who only uses their car for the occasional trip to the farmer's market.

But with Telematics and UBI, Gary's driving habits are now on full display. He might find his insurance premiums going up faster than a rocket ship, while your careful driving leads to a gentle descent of your own bill. It’s a system that rewards responsibility, which is pretty darn cool.

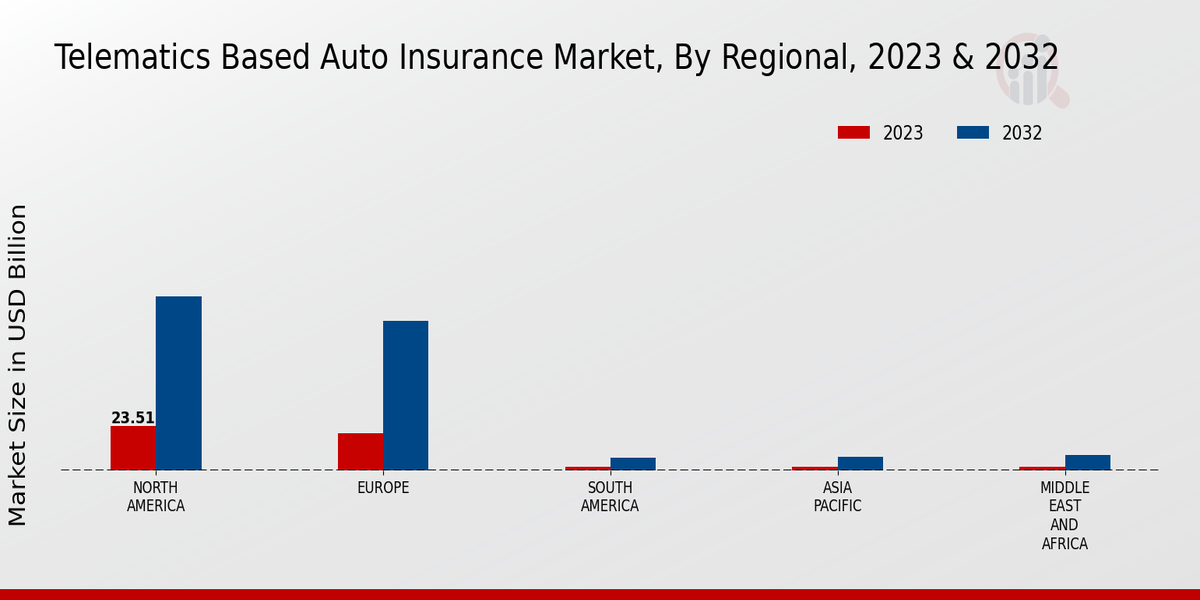

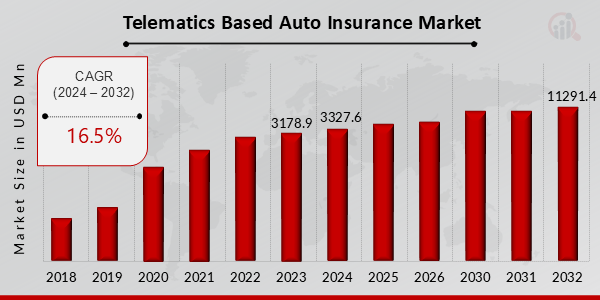

The trends are pointing towards more and more people embracing this technology. Insurance companies are catching on that rewarding good behavior is a smart business move. And let’s face it, who doesn’t love saving money, especially when it’s tied to something as simple as not slamming on the brakes?

Some of these Telematics programs even offer fun challenges or leaderboards. Imagine competing with your friends to see who can be the most fuel-efficient or the smoothest driver! It’s like a video game, but the prize is actual cold, hard cash, or at least a nice discount.

Plus, these systems can be incredibly helpful for promoting safer driving. Knowing you're being tracked, even in a friendly way, can be a gentle nudge to be more mindful on the road. It’s like having a tiny, digital co-pilot whispering encouragement in your ear.

We’re seeing exciting developments like apps that can detect if you’re using your phone while driving and give you a little warning. Some even offer distracted driving scores. It's like your phone is saying, "Hey, buddy, focus up! We've got places to be, safely!"

The technology is also getting more sophisticated. We’re talking about systems that can distinguish between normal braking and emergency braking, or between gentle acceleration and flooring it. It’s becoming incredibly precise, like a tiny detective meticulously gathering clues about your driving.

And it’s not just about saving money. Some Telematics programs offer personalized feedback to help you improve your driving. You might get tips on how to avoid harsh braking or how to drive more smoothly. It's like having a personal driving coach in your pocket, cheering you on.

Think about all the benefits: lower insurance costs for good drivers, increased road safety, and even a better understanding of your own driving habits. It’s a win-win-win situation!

Some people might worry about privacy, and that's a valid concern. But most Telematics programs are designed with privacy in mind. They focus on aggregated data and anonymized driving patterns, not on tracking your every move like a paparazzi photographer.

The data collected is generally used to calculate your insurance premium, and sometimes for safety improvements. It’s not about selling your personal diary to the highest bidder. It’s about making insurance fairer and roads safer.

So, what does this mean for you? It means there’s never been a better time to explore your options for Usage-Based Insurance. Do a little digging, ask your insurance provider about their Telematics programs. You might be surprised at how much you can save by simply being a good driver.

It’s an exciting evolution in how we insure our vehicles. It's moving away from guesswork and towards personalized, data-driven policies that reward responsible behavior. Your car is becoming your ally, and that's a trend worth celebrating!

So, buckle up, drive safe, and get ready for an insurance experience that’s tailored just for you. It’s a future where your good driving habits don’t just keep you safe; they actually put money back in your pocket. How awesome is that?

It’s like your car is saying, "Thanks for being so awesome, human! Here's a little treat for your good behavior." And who are we to argue with a car that’s offering financial incentives for being responsible?

The future of auto insurance is here, and it’s looking bright, affordable, and incredibly smart. Thanks to Telematics and Usage-Based Insurance, being a good driver has never been more rewarding!