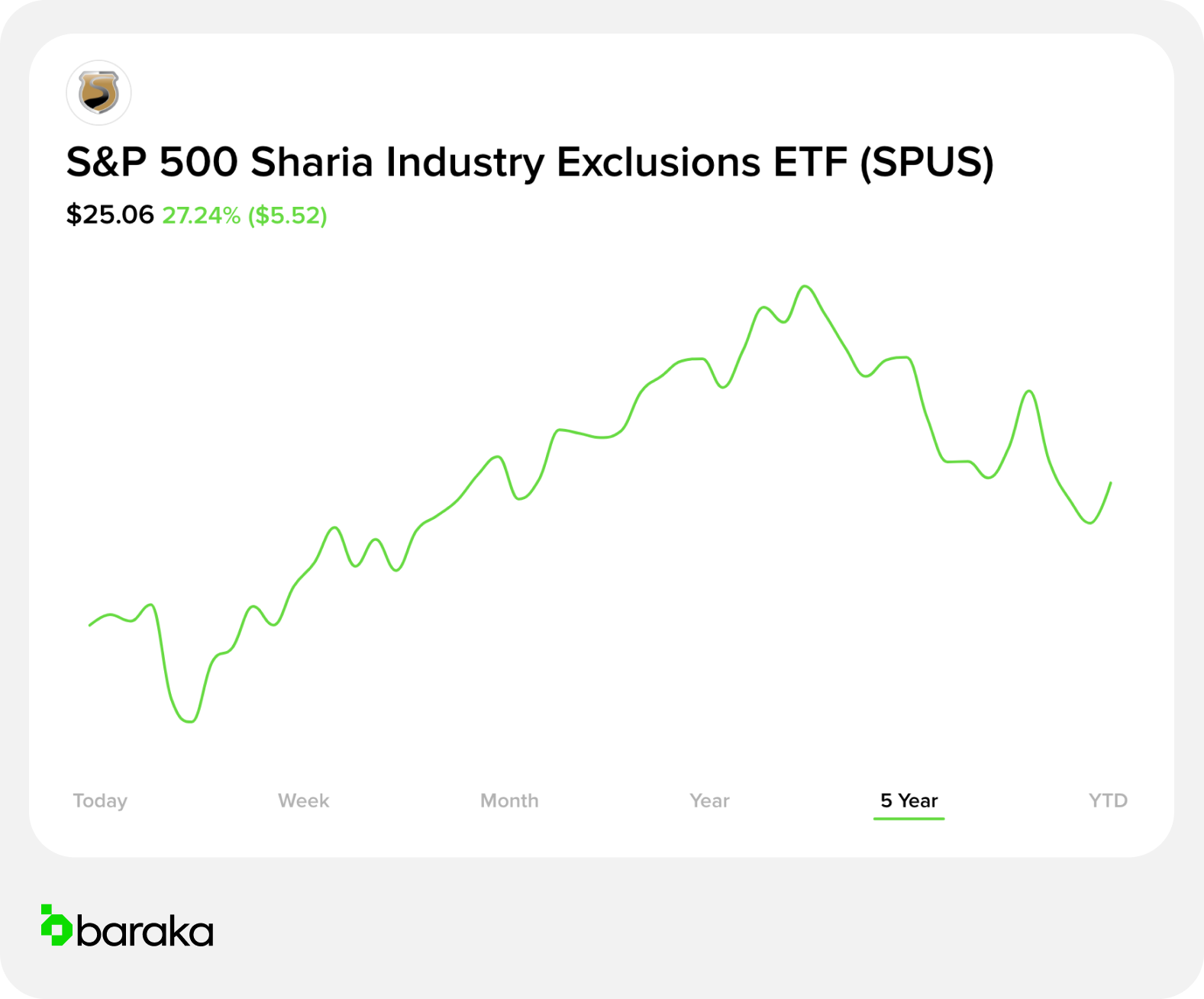

Sp Funds S&p 500 Sharia Industry Exclusions Etf

Hey there! So, you know how we’re always looking for ways to make our money work harder, right? Well, I stumbled upon something kinda cool the other day, and I thought, “Hey, this is totally something my coffee buddy needs to know about!” It’s this thing called the SP Funds S&P 500 Sharia Industry Exclusions ETF. Rolls right off the tongue, doesn’t it? Haha, just kidding. It sounds a bit fancy, I know, but stick with me, it’s actually pretty interesting.

Basically, think of it like this: you want to invest in the big, established companies that make up the S&P 500 – you know, the titans of industry, the household names. That’s the S&P 500 part. But here’s the kicker: this ETF takes it a step further. It’s like giving your investment portfolio a moral compass, if you will. It’s designed to follow Sharia investment principles.

Now, what does that even mean, you might be asking? Great question! It means they’re steering clear of certain industries that just don't align with those principles. Think of it as a filter, but a pretty important one. They’re not just picking random companies; they’re picking ones that pass a specific ethical test. Pretty neat, huh?

So, what kind of companies are we talking about not investing in here? Well, it’s all about avoiding things that are considered harmful or unethical from a Sharia perspective. This usually includes stuff like alcohol, gambling, conventional financial services that deal with interest (that’s a big one!), pork, and tobacco. Yep, those industries are basically saying, “Thanks, but no thanks” to this ETF. And honestly, for some people, that’s a huge win. Who wants their hard-earned cash funding… well, that stuff?

The cool part is that even though they’re excluding certain sectors, they’re still aiming to capture the broad market performance of the S&P 500. It’s like saying, “Okay, we’re going to get the cream of the crop, but we’re also going to make sure that cream is… well, halal cream, I guess?” Again, a little quirky, but you get the idea! They’re trying to give you exposure to the big American companies without getting your hands dirty with the industries you might prefer to avoid.

This isn’t just for people who follow Islam, either. I mean, sure, that’s a primary driver, and it’s fantastic that there’s a way for them to invest in line with their beliefs. But let’s be real, a lot of people these days are looking for more ethically screened investments. We’re talking about ESG investing, right? Environmental, Social, and Governance. This Sharia-compliant approach is like a really specific, well-defined subset of that. It’s about investing with intention, and who doesn’t want that?

Imagine you’re picking out ingredients for a really important meal. You want the freshest produce, the best cuts of meat, right? You wouldn’t just grab anything from the grocery store. This ETF is kind of like that for your investment portfolio. It’s a curated selection, designed to meet specific criteria. And that level of care? I can totally get behind that.

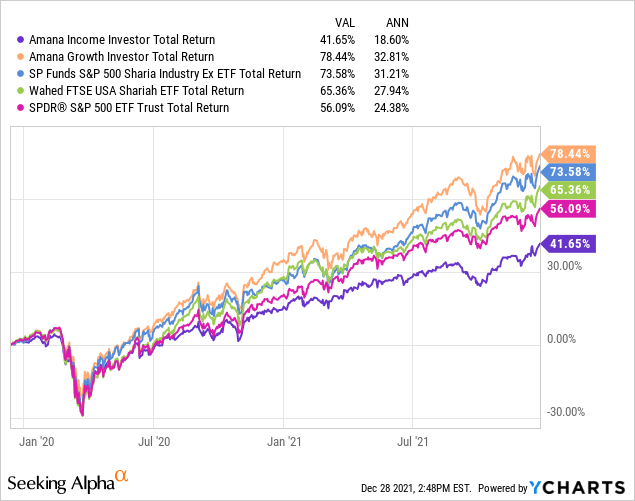

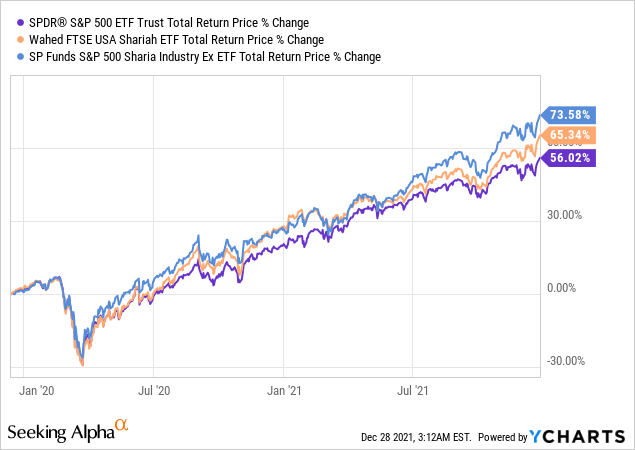

Now, you might be wondering, “Does this mean I’m going to miss out on massive gains?” That’s the million-dollar question, isn’t it? And honestly, the answer is… maybe. But then again, any investment has its risks, right? The S&P 500 itself is a benchmark, and while it’s historically done pretty darn well, there are always market fluctuations. The point is, this ETF is designed to mirror that performance as closely as possible, after applying its ethical filters.

So, instead of just having a generic S&P 500 ETF, you’re getting one with an added layer of… well, let’s call it conscious investing. It’s like getting your favorite ice cream, but with sprinkles that are also made from sustainably sourced unicorn tears. Okay, maybe I’m getting carried away, but you get the vibe! It’s about making choices that feel good, not just financially, but also on a deeper level.

One of the things I found really interesting is how they handle the “conventional financial services” exclusion. You know, banks and stuff that earn interest. That’s a big deal in Sharia law. So, this ETF has to find ways to invest in companies that aren’t heavily reliant on that kind of income, or they have specific purification processes for any incidental interest earned. It’s a whole process, and it shows a real commitment to adhering to the principles. They’re not just saying “no” to things; they’re actively building a portfolio that aligns with their guidelines.

And for those of us who are maybe a little… skeptical about investing in general, or just overwhelmed by all the options out there, having a clear set of rules can be incredibly helpful. It simplifies the decision-making process. Instead of sifting through hundreds of companies, you know you’re looking at a pre-vetted group. That’s a big stress reliever, honestly. It’s like having a trusted friend who’s already done the homework for you.

Let’s talk about the companies themselves. The S&P 500 is pretty diverse, right? You’ve got tech giants, healthcare innovators, consumer staples… the whole shebang. When you exclude certain industries, you are trimming down that universe. But the beauty of the S&P 500 is its sheer size. Even after exclusions, there are still tons of incredibly successful and innovative companies left. It’s not like they’re left with just a handful of obscure startups.

Think about it: Apple, Microsoft, Amazon, Google – these are the powerhouses. Are they all Sharia-compliant? Probably not entirely, given their diverse business models. But the index that this ETF tracks has already done the heavy lifting of identifying companies that do meet the criteria. So, you’re still getting exposure to some of the biggest and most influential companies in the world, but in a way that’s aligned with specific ethical and religious guidelines. Pretty cool if you ask me.

It’s also worth noting that this isn’t some niche, experimental thing. The SP Funds are a real entity, and they’re providing a legitimate investment product. This isn’t just a hobby project; it’s a serious offering for investors who are looking for this particular type of investment. And the fact that it’s tracking the S&P 500, one of the most watched and important stock market indices out there, means it’s operating within a well-established framework.

So, why is this important for you to know? Because the investment landscape is constantly evolving. There are more options than ever before, and investors are increasingly demanding that their money reflects their values. This ETF is a perfect example of that trend. It’s catering to a specific need, and it’s doing it in a transparent and systematic way.

If you’re someone who values ethical investing, or if you’re curious about how Sharia principles translate into the world of finance, then this ETF is definitely worth a closer look. It’s not just about making money; it’s about making money in a way that feels right. It’s about aligning your investments with your beliefs. And in a world that can sometimes feel a little… unsettling, that’s a pretty powerful thing.

Could this be your next investment? Maybe! It depends entirely on your personal financial goals, your risk tolerance, and, of course, your personal values. But it’s good to know that options like this exist. It shows that the financial world is becoming more inclusive and responsive to the diverse needs of investors.

So, next time you’re sipping your latte and pondering the mysteries of the universe (or, you know, your 401k), remember the SP Funds S&P 500 Sharia Industry Exclusions ETF. It’s a reminder that investing can be both smart and principled. And that, my friend, is something worth chatting about.

It’s all about giving you choices, right? Like choosing between a plain croissant and one filled with delicious almond paste. Both are good, but one might be just perfect for you. This ETF is like that almond-paste-filled croissant for a certain type of investor. It’s specialized, it’s delicious (in a financial sense!), and it meets a specific craving.

And let’s be honest, the thought of investing in companies that might be contributing to things we’d rather not support can be a real drag. So, if there’s a way to get broad market exposure without that nagging feeling, that’s a win. It’s like being able to enjoy a delicious meal without worrying about indigestion later. Peace of mind, people! That’s what we’re aiming for, isn’t it?

The folks behind these ETFs really do their homework. They have to. There are strict guidelines, and getting it wrong could mean they’re not really Sharia-compliant anymore. That means there are teams of people meticulously analyzing companies, looking at their revenue streams, their expenses, their debt… it’s a whole deep dive. It’s not just a quick glance; it’s a thorough investigation. And that’s reassuring, don’t you think?

So, while the name might be a mouthful, the concept is pretty straightforward. It’s about investing in the big, established U.S. companies of the S&P 500, but with a filter that removes industries that don’t align with Sharia principles. It’s a way to invest with intention, to align your money with your values, and to potentially gain the benefits of broad market exposure without some of the ethical concerns. It’s definitely a fascinating corner of the investment world, and one that’s becoming increasingly relevant for a wider range of investors. Pretty neat stuff!