Retained Earnings Is Decreased By All Of The Following Except

Ever wonder what happens to a company's leftover money? It's not quite like finding a forgotten twenty in your jeans, but the concept of retained earnings is surprisingly fascinating and super useful to understand, even if you’re just dipping your toes into the world of business or finance. Think of it as the company's piggy bank for future adventures!

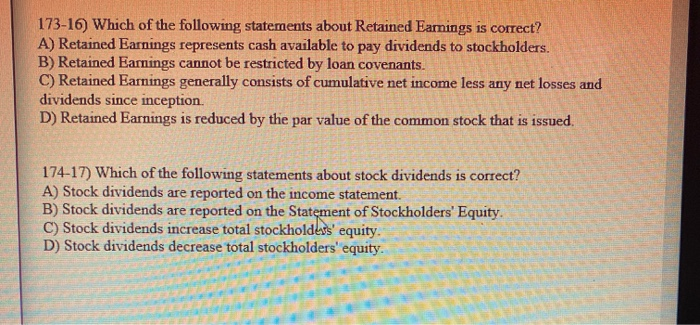

So, what exactly are retained earnings? Simply put, they are the profits a company has kept over time, instead of distributing them to shareholders as dividends. This leftover cash is a crucial indicator of a company's financial health and its potential for growth. For beginners, it’s a key piece of the puzzle in understanding how businesses reinvest in themselves. For families, thinking about retained earnings can even offer a fun analogy for saving for big purchases or future goals. Hobbyists who might be thinking about turning their passion into a small business will find this concept invaluable for planning expansion.

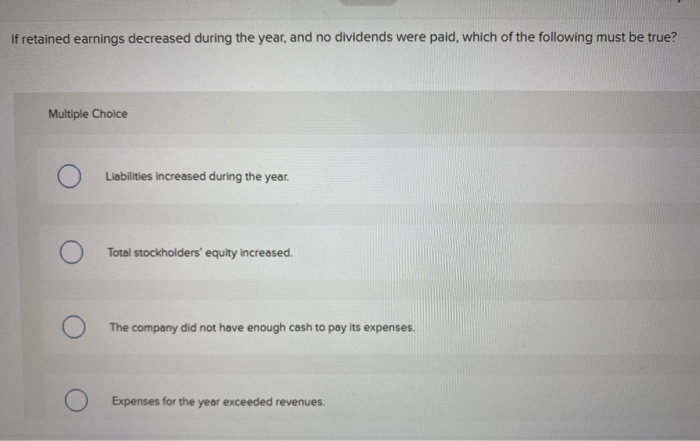

Now, the intriguing part: what makes these retained earnings go down? It's like asking what makes your savings account decrease. The question we’re exploring is, "Retained Earnings Is Decreased By All Of The Following Except..." This means we’re looking for something that doesn't reduce the company's leftover profits. Let’s consider some common ways retained earnings shrink:

One major reason is paying out dividends. When a company shares its profits with its owners (shareholders), that money comes directly out of retained earnings. It’s like withdrawing from your savings account to treat yourself or buy something nice.

Another factor is net losses. If a company doesn't make a profit in a given period, or worse, it loses money, that loss is subtracted from its accumulated retained earnings. This is like having an unexpected expense that dips into your savings.

Also, remember those fancy projects companies undertake? Significant investments in new assets, like building a new factory or buying a fleet of vehicles, can sometimes be funded by retained earnings, thus reducing them. Think of it as a large planned withdrawal from your savings to make a significant purchase.

So, if dividends, net losses, and large asset purchases decrease retained earnings, what doesn't? The answer lies in activities that either increase profits or represent a different way of accounting for money. For instance, recording a gain on the sale of an asset increases the company's overall profit, which would then add to retained earnings, not decrease them. Similarly, certain non-cash accounting adjustments might not directly impact retained earnings in the way a cash outflow does.

Getting started with understanding retained earnings is easier than you think! Start by looking at the financial statements of companies you admire or are curious about. Many publicly traded companies make their financial reports available online. You can often find sections on "Shareholders' Equity" which will include retained earnings. It's like browsing through recipe books to find inspiration for your next meal!

The value of grasping this concept is immense. It gives you a clearer picture of a company's ability to grow and reward its investors. Plus, it’s a small step towards understanding the fascinating world of finance. So, the next time you hear about retained earnings, you’ll know it’s not just numbers on a page, but a vital sign of a company’s enduring strength and its capacity for future success. It’s a rewarding bit of knowledge that can truly enhance your understanding of the business landscape!