Price Equals Average Total Cost In The Long Run

Ever wondered why, over time, the price of things seems to settle around a certain point? It's not magic, and it’s definitely not random. There's a fascinating economic principle at play that helps explain this stability, and understanding it can be surprisingly fun and insightful. We're talking about the idea that in the long run, price tends to equal average total cost. Sounds a bit technical, but stick with us – it’s more relatable than you might think!

So, what's the big deal about this "price equals average total cost" thing? Essentially, it's a cornerstone of how markets work when they're allowed to operate freely. Its primary purpose is to explain why businesses operate where they do and how that impacts the prices we pay. The main benefit is that it paints a picture of a healthy, competitive market, where resources are allocated efficiently.

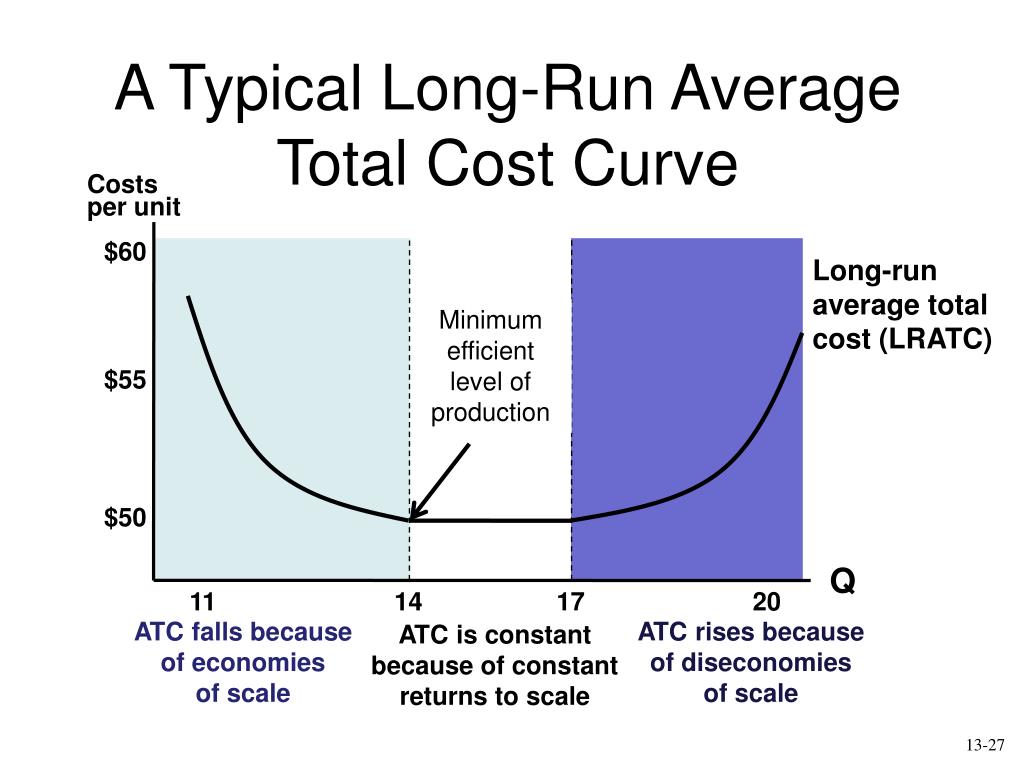

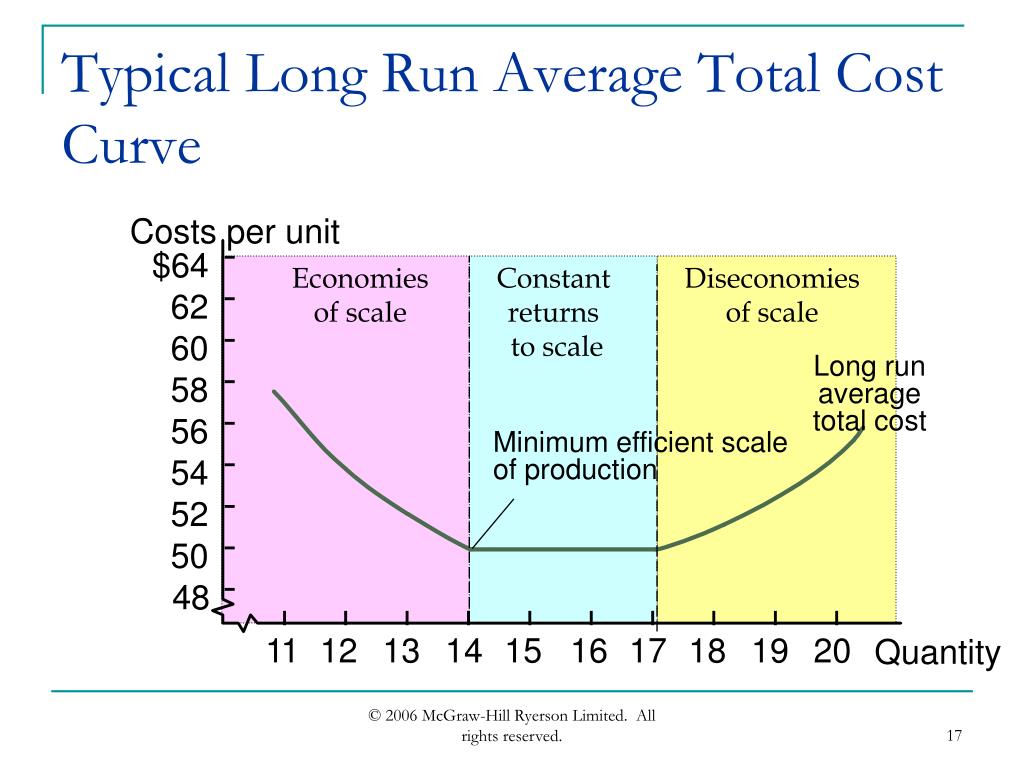

Think about it this way: if a company is consistently selling its product for more than it costs them to make, on average, over the long haul, what happens? Other businesses will see that profit and think, "Hey, that looks like a good opportunity!" They'll jump into the market, start producing the same thing, and their increased supply will push prices down. Conversely, if the price is consistently less than the average total cost, businesses will start losing money. They'll eventually pack up and leave, reducing supply and, you guessed it, pushing prices back up.

This principle helps us understand why, for example, the price of a smartphone, after the initial hype and innovation, tends to hover around a point where manufacturers can still make a reasonable profit but consumers aren't paying an astronomical amount. It’s not that they're magically deciding on a price; it’s the invisible hand of the market nudging it there.

In education, this concept is a staple in introductory economics courses. It helps students grasp the fundamental dynamics of supply and demand, market equilibrium, and the role of competition. For us in daily life, it helps us make sense of why prices for many goods and services remain relatively stable once a market matures. It explains the difference between the initial high price of a brand-new gadget and its price a year or two down the line.

How can you explore this idea further? It’s simpler than you might imagine! Start by observing prices of everyday items that have been around for a while. Think about things like basic T-shirts, a loaf of bread, or even the cost of a haircut in your local area. Notice how these prices don't fluctuate wildly from week to week, but rather tend to stick within a certain range.

Another fun way to think about it is to imagine you're starting a small business, perhaps selling homemade cookies. You'd figure out the cost of ingredients, your time, packaging – that's your average total cost. Then, you'd have to decide on a price. If you price too high, you might not sell many. If you price too low, you won't be able to sustain your business. This practical exercise brings the economic principle to life!

So, the next time you see a price that seems just right, remember the quiet economic dance happening behind the scenes, where price and average total cost are often doing a long-term waltz, ensuring that markets hum along efficiently.