Personal Loan With Land As Collateral Bad Credit

Hey there, fellow humans! Life, right? It’s a rollercoaster with loop-de-loops and unexpected dips. One minute you're happily humming along, the next you're facing a surprise expense that makes your wallet do a quick vanishing act. We've all been there, staring at a bill that looks like it belongs to a billionaire, and suddenly, your credit score, that mysterious number that governs so much, feels like a grumpy gatekeeper.

Now, imagine this: you've got a little patch of earth. Maybe it's a charming backyard where you grow your prize-winning tomatoes, or perhaps it's a larger plot of land that's been in your family for ages. It’s your slice of the world, and it’s got value, even if it’s not a glittering mansion. What if I told you that this very land could be your secret superpower when your credit score decides to take a holiday?

Unlocking Your Land's Hidden Potential

Let's talk about a "personal loan with land as collateral for bad credit." Sounds a bit fancy, right? But honestly, think of it like this: you're using something tangible, something you own, to get a little financial breathing room. It’s like having a golden ticket, but instead of Willy Wonka's chocolate factory, it’s for your financial emergencies.

Imagine you’re planning that dream kitchen renovation. You've got the Pinterest boards overflowing, the paint samples scattered everywhere, and then BAM! The furnace decides it’s had enough and unleashes its inner ice queen. Suddenly, that dream kitchen is on hold because you need a new heating system, like, yesterday. And your credit score? Well, it's currently sporting a "needs improvement" sticker.

This is where your land steps in. Lenders see your land as a form of security. It's like saying, "Hey, I know my credit score isn't perfect, but I've got this solid piece of earth. If things go sideways, you can be sure I'll be able to repay you because of it." It’s a way to prove your commitment and ability to repay, even when your credit history has a few bumps and bruises.

Why Should You Even Care About This?

Because life happens! It’s not always about grand plans; sometimes it’s about the everyday emergencies that can snowball if you don’t have the cash on hand. Think about:

- Unexpected medical bills: Your furry best friend suddenly needs a pricey surgery. That's a heartache and a hefty bill all rolled into one.

- Urgent home repairs: A leaky roof that’s starting to look more like a water feature than a protective shield.

- Debt consolidation: Maybe you've got a few smaller debts that are like a tangled ball of yarn, making it hard to keep track. Consolidating them into one manageable payment can be a game-changer.

- A business opportunity: That little side hustle you’ve been dreaming about needs a bit of a boost to get off the ground.

These aren't luxuries; they're often necessities. And when your credit score is playing hide-and-seek, options can feel limited. But with your land as collateral, you’re opening a door that might have been firmly shut.

So, How Does This Magic Work?

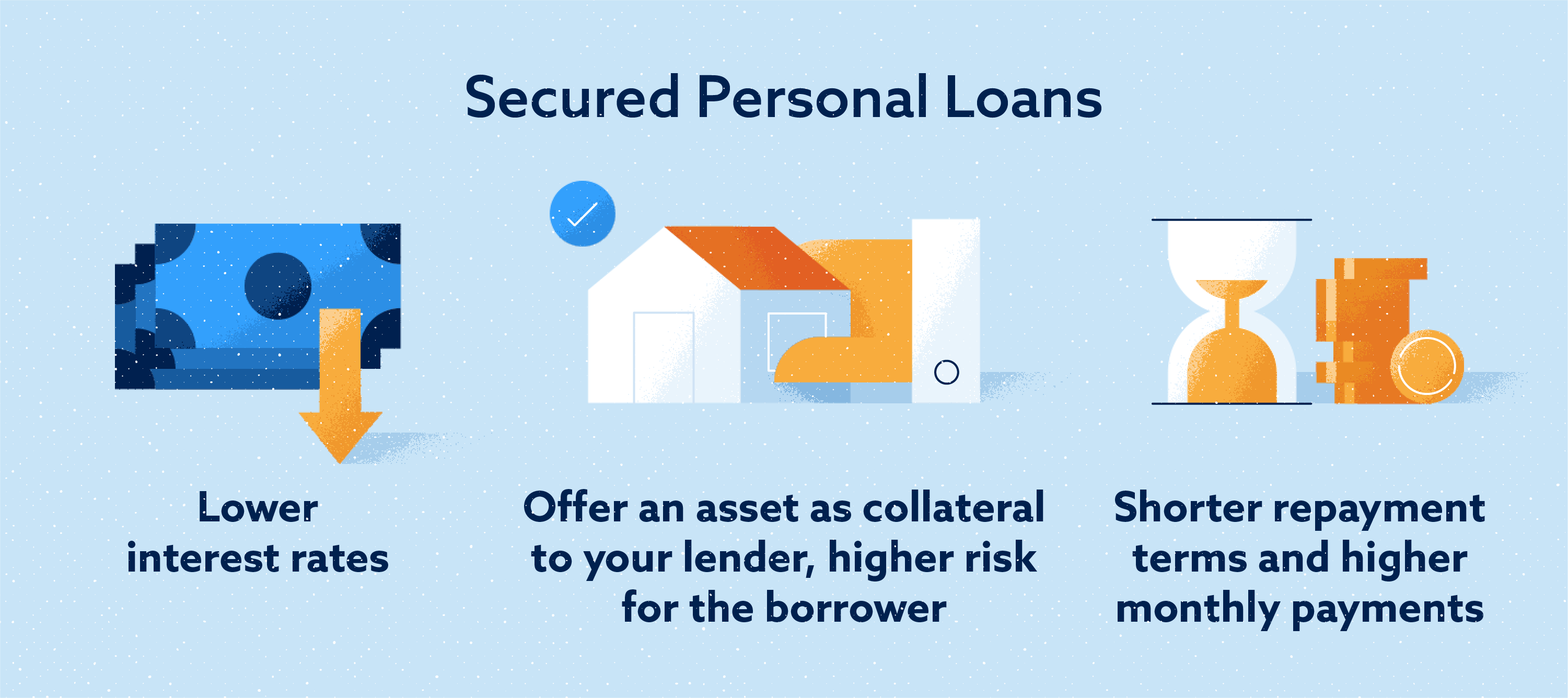

Essentially, when you apply for this type of loan, your land becomes the security, or collateral, for the loan amount. This reduces the risk for the lender. Because they have something to fall back on, they're more willing to consider applicants with less-than-perfect credit histories. It’s like offering a really good handshake and a promise backed by something solid.

Imagine you're borrowing your neighbor's expensive lawnmower. You might offer to leave your bike with them as a sort of informal guarantee that you'll bring it back in one piece. It’s a similar concept, but with much more official paperwork and larger sums of money!

The loan amount you can get will depend on the equity you have in your land. Equity is basically the difference between what your land is worth and what you still owe on it. So, if your land is worth $100,000 and you owe $30,000, you have $70,000 in equity. The lender will typically lend a percentage of that equity.

The "Bad Credit" Part: Let's Get Real

We’ve all made financial missteps. Maybe a job loss, a divorce, or just some youthful indiscretions with credit cards have left your score looking a bit sad. It happens. The good news is that a bad credit score doesn't mean you're doomed. It just means you need to find alternative ways to prove your financial reliability. And your land, in this case, is a very convincing testament.

Think of your credit score as a report card. If it's not stellar, it doesn't mean you're not a good person or that you can't manage your finances. It just means there are some areas that need attention. Using your land as collateral is like offering a portfolio of your best work alongside that report card – it shows your strengths and your potential.

Lenders offering these types of loans understand that life isn't always a smooth sail. They are more focused on the value of the asset (your land) and your ability to generate income to repay the loan. They'll still look at your income and your overall financial situation, but the collateral plays a significant role.

Putting It All Together: A Little Story

Let's meet Sarah. Sarah is a single mom who loves her little cottage with the sprawling garden. She's always been a responsible person, but a few years back, a serious illness in the family meant a lot of missed work and mounting medical bills. Her credit score took a nosedive. Now, her beloved dog, Buster, needs emergency surgery. The vet bill is daunting, and Sarah’s heart sinks.

She remembers her grandfather talking about the value of their land. After some research, she finds a lender who offers personal loans with land as collateral, even for those with less-than-perfect credit. Her land, which she inherited, has significant equity. She applies, providing details about her income and the appraisal of her land. The lender, seeing the solid value of her property and her steady job, approves her loan.

Sarah gets the surgery for Buster, and her beloved companion is back to chasing squirrels in no time. She’s able to manage her loan payments comfortably, knowing her home and her land are secure, and most importantly, Buster is healthy. It was the land, her own piece of the earth, that acted as the lifeline when she needed it most.

The Bottom Line: Don't Let Your Credit Score Be the Only Storyteller

Your credit score is important, no doubt. But it’s not the only thing that defines your financial worth or your ability to navigate life’s challenges. If you own land, and you're facing a financial crunch, don't dismiss the possibility of using that land to your advantage. It's a powerful asset that can offer a path forward when other doors seem closed.

It’s about having options, about securing peace of mind, and about knowing that sometimes, the simplest things – like the ground beneath your feet – can be your greatest financial allies. So, next time you're looking at your land, remember its potential to be more than just a place to live or grow things. It could be the key to unlocking your financial solutions. How cool is that?