Office Of The Superintendent Of Financial Institutions Osfi

Ever wondered who’s quietly keeping an eye on your hard-earned money, making sure your bank isn't doing anything too wild, or that your pension plan is actually going to be there when you retire? It’s not some shadowy cabal, but a very real, very important organization called the Office of the Superintendent of Financial Institutions, or OSFI for short. Think of them as the grown-ups in the room, making sure the whole Canadian financial playground stays safe and sound for everyone playing in it. And honestly, knowing this stuff is surprisingly useful – it’s like having a superpower for understanding how your money works!

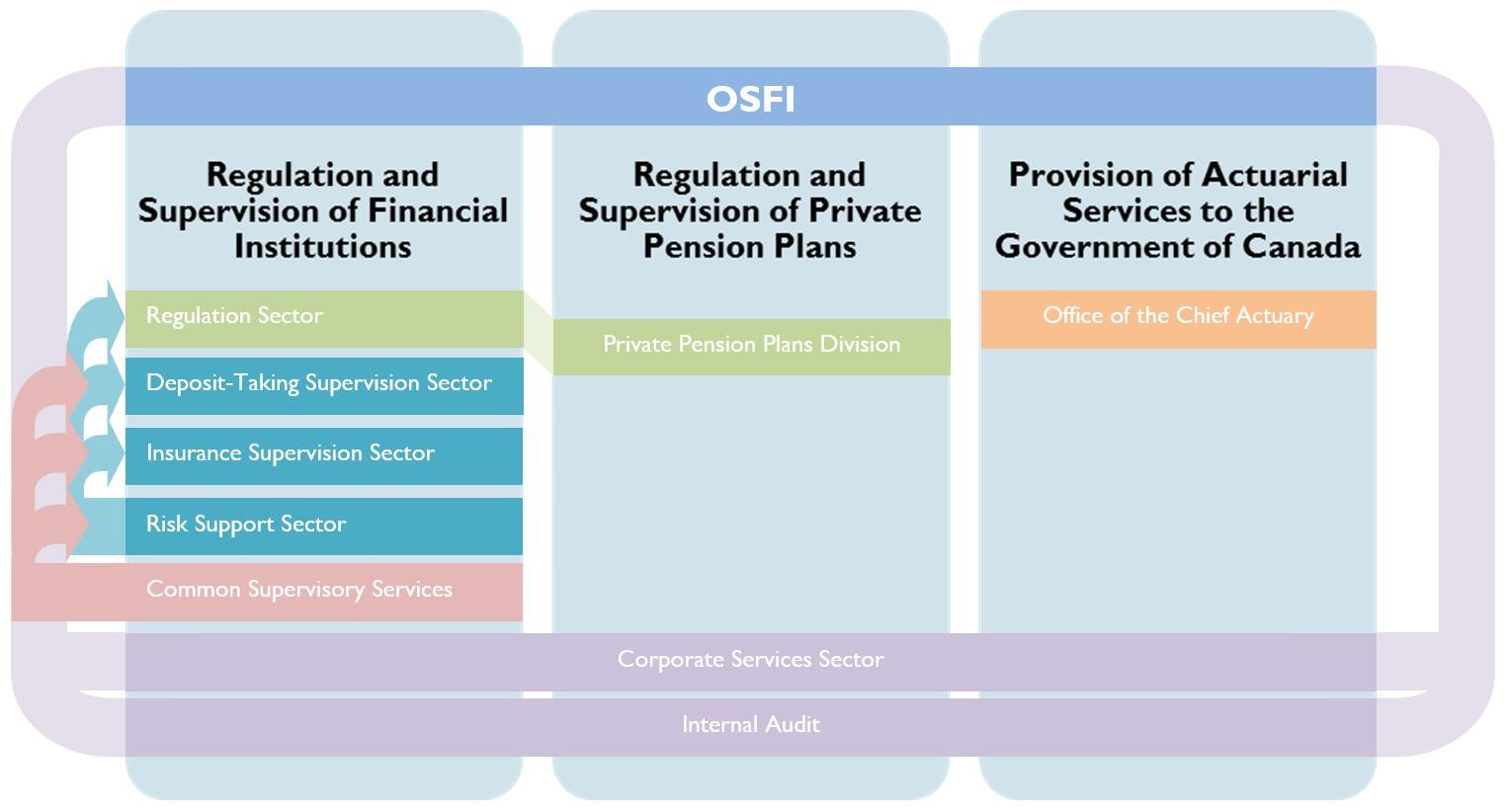

So, what exactly does OSFI do? Their main gig is pretty straightforward: they supervise and regulate federally regulated financial institutions. This isn't just about banks, though that’s a big part of it. It also includes things like insurance companies (both life and property/casualty), trust and loan companies, pension plans, and even credit unions in some cases. Their primary goal is to ensure that these institutions are financially sound and conduct their business in a manner that protects the rights and interests of their depositors, policyholders, and plan members. In simpler terms, they’re there to prevent the kind of financial meltdowns you might have seen in the news from other countries. Pretty important stuff, right?

OSFI is the silent guardian of your financial well-being in Canada.

What is Office of the Superintendent of Financial Institutions (OSFI)?

The benefits of having OSFI around are huge, even if you don’t interact with them directly. For starters, their oversight contributes significantly to the overall stability of the Canadian financial system. This means a more predictable economic environment, which is good for everyone, from small business owners to families saving for a down payment. When people have confidence that their money is safe, they're more likely to invest, spend, and participate in the economy, leading to growth and job creation. It’s a bit like having a sturdy foundation for a house – you don’t always think about it, but without it, everything else crumbles.

One of the key ways OSFI achieves this is by setting and enforcing prudential standards. These are essentially the rules of the road for financial institutions. They dictate things like how much capital a bank needs to hold to absorb potential losses, how well they need to manage their risks (like credit risk, market risk, and operational risk), and how they should handle things like liquidity. Imagine a race car driver needing to have a certain level of safety equipment and a well-maintained engine to compete; OSFI sets similar standards for financial institutions to ensure they can handle the bumps and turns of the financial world.

Think about it from the perspective of a bank. If a bank were allowed to lend out every single dollar it received, and then some, without any oversight, what would happen if a lot of people suddenly needed their money back? Or if many borrowers defaulted on their loans? The bank would likely collapse, and a lot of people would lose their savings. OSFI steps in to ensure that banks maintain adequate reserves and sound lending practices, creating a buffer against these kinds of risks. This makes your deposits, whether in a chequing account or a savings account, far more secure.

For those of us with insurance, OSFI plays a critical role in ensuring that insurance companies are financially capable of paying out claims. Whether it’s life insurance that provides for your loved ones or auto insurance that covers damages, you need to know that the company you’re paying premiums to will be there when you need them most. OSFI’s solvency requirements and oversight help guarantee that insurers have the funds to meet their obligations, providing peace of mind for policyholders.

And what about retirement? Many Canadians rely on pension plans to fund their later years. OSFI supervises these plans to ensure they are managed responsibly and have the financial capacity to pay out benefits as promised. This is crucial for long-term financial security, and knowing that a regulatory body is keeping an eye on things can be a significant comfort to plan members. It’s a vital safeguard against the risk that a pension fund might underperform or become insolvent, leaving retirees in a difficult position.

Beyond just setting rules, OSFI also actively monitors institutions. They conduct regular assessments and examinations to ensure compliance with the standards. If an institution is found to be falling short, OSFI has the authority to take corrective action, which can range from requiring the institution to increase its capital to, in extreme cases, stepping in to manage or wind down its operations. This proactive approach is key to preventing problems from escalating.

It’s also worth noting that OSFI doesn’t operate in a vacuum. They work closely with other domestic and international regulatory bodies to share information and best practices, contributing to a more interconnected and robust global financial system. This collaboration is increasingly important in today’s interconnected world, where financial markets can be influenced by events far beyond Canada’s borders.

So, while you might not be sending thank-you notes to OSFI every day, their work is fundamental to the stability and trustworthiness of the Canadian financial landscape. They are the behind-the-scenes heroes ensuring that when you deposit money, buy insurance, or plan for retirement, you can do so with a strong sense of security. Understanding their role just adds another layer to how we can appreciate and navigate our financial lives with more confidence. They are, in essence, guardians of our financial future, and that’s something worth knowing about!