Net Present Value Vs Internal Rate Of Return

Imagine you've got two fantastic opportunities to make some money, like two different paths to a treasure chest. You've found them, and now you need to figure out which one is going to fill your pockets with more shiny gold coins. This is where our two financial pals, Net Present Value (let's call him NPV for short, he's the laid-back one) and Internal Rate of Return (meet IRR, he’s the flashy, energetic guy), come into play.

Think of NPV as the guy who hands you a perfectly wrapped gift right now. He looks at all the money you'll make from an investment, but he’s also super smart about the fact that money today is worth more than money in the future. Why? Because if you have money today, you can go buy that amazing ice cream cone now, or maybe even invest it and make even more money later. NPV basically takes all those future promises of cash and discounts them back to what they're worth today. It's like he’s a time traveler, bringing future riches into the present. If NPV tells you the present value of all the future earnings is more than what you have to spend upfront, then, woohoo! You're on your way to a profitable adventure. He’s all about the absolute amount of extra cash you'll have in your hand at the end of the day, in today’s dollars. He’s the sensible one, the one who makes sure you’re not just dreaming of riches, but actually getting them.

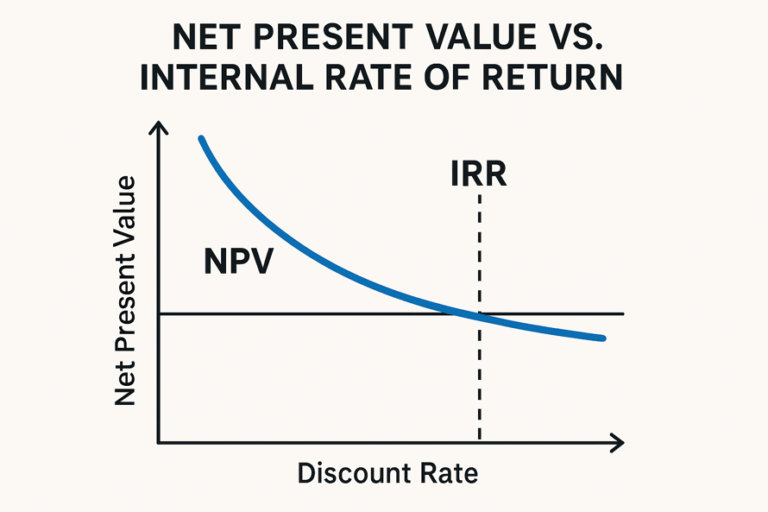

Now, IRR is a different character. He's more like the enthusiastic salesperson who shows you a dazzling chart. He doesn't tell you the exact dollar amount you'll end up with. Instead, he tells you the percentage rate of return you're likely to get from your investment. Think of it as the "oomph" factor. IRR calculates the discount rate that makes the net present value of all the cash flows from an investment equal to zero. Sounds complicated? Let’s simplify. Imagine you’re planting a money tree. IRR is telling you how fast and how big that tree is going to grow, expressed as a percentage. If this percentage is higher than what you could get from, say, putting your money in a super-safe savings account (your "hurdle rate"), then IRR gives you a big thumbs up. He’s all about the efficiency of your money, how much it’s working for you.

Here’s where the fun and sometimes the confusion starts. They're both trying to help you make smart money decisions, but they go about it in slightly different ways. Imagine you’re choosing between two job offers. Offer A pays you a steady $50,000 a year for five years. Offer B starts at $30,000 but jumps to $70,000 in the last two years.

NPV, with his practical mind, would look at both and say, "Okay, let's see the total extra cash you’ll have at the end, adjusted for today's value." He’d give you a clear number. For Offer A, he might say, "You’ll have an extra $10,000 in today’s money." For Offer B, he might say, "You’ll have an extra $15,000 in today’s money." In this scenario, NPV clearly points you to Offer B because it brings you more actual wealth.

IRR, on the other hand, would be looking at the growth potential. He might look at Offer A and say, "This will give you a solid 5% return." Then he’d look at Offer B and exclaim, "Wow! This has an exciting 8% return!" If your personal "hurdle rate" (what you need to make to be happy, maybe 6%), is lower than 8%, IRR would be shouting about Offer B.

So, when do they agree? Most of the time, they're like best buds. If an investment looks good according to NPV (meaning it’s going to make you richer), it’s probably also going to have an IRR that’s attractive (meaning your money is working hard). When NPV is positive, IRR is usually higher than your minimum acceptable rate.

But, and this is where it gets a little spicy, sometimes they can disagree! This often happens when you have investments that are really different in size. Imagine you have a small, quick project that gives you a decent percentage return (high IRR), but it won’t make you a ton of money overall. Then you have a massive project that might have a slightly lower percentage return (lower IRR), but because it's so big, it generates a huge amount of absolute cash (high NPV). In this case, NPV would be the one saying, "Go for the big one, it’s going to make you seriously wealthy!" while IRR might be tempted by the flashy, high percentage of the smaller one.

Think of it like choosing a restaurant. NPV is like looking at the total bill and saying, "This meal, after I factor in the deliciousness I'm getting right now and the satisfaction later, is worth $50 more than I'm paying!" IRR is like saying, "For every dollar I spend, I'm getting $2 worth of pure joy and flavor back!" If you have a limited budget, a high IRR might seem great because it's efficient. But if your goal is just to have a seriously satisfying feast, a high NPV might be what you’re after, even if the individual "flavor-per-dollar" isn't the absolute highest.

Ultimately, both NPV and IRR are vital tools in the financial toolbox. NPV is often considered the king when it comes to making decisions about individual projects because it directly measures the increase in wealth. It’s the one that says, "This is how much richer you’ll be." IRR is fantastic for understanding the efficiency and attractiveness of an investment, especially when comparing different opportunities that have similar initial costs. It tells you, "This is how hard your money is working." So, the next time you're faced with a financial choice, you can think of NPV as the steady hand that counts the gold, and IRR as the excited dance that celebrates the speed and sparkle of your treasure!