Net Income Will Result During A Time Period When

Hey there! So, we're gonna chat about something that sounds super serious, but honestly, it's not that scary. We're talking about when that magical thing called net income actually shows up. You know, that number that makes you want to do a little happy dance (or at least exhale a big sigh of relief)?

Think of it like this: you’re baking cookies. You’ve got your flour, your sugar, your chocolate chips – all those yummy ingredients. Those are your revenues, right? The good stuff coming in. But then, uh oh, you realize you’re out of eggs. Or maybe you have to buy new baking sheets because your old ones are toast. Those are your expenses. The things that cost you a little something-something.

Net income? That’s what’s left after you’ve factored in all the costs of making those delicious cookies. It’s the sweet reward for all your hard work (and sugar consumption!).

So, when exactly does this wonderful net income make its grand entrance? It's not like it’s waiting behind a curtain, ready to jump out on a specific date. It’s more of a process, a beautiful, sometimes messy, ongoing thing.

Basically, net income will result during a time period when your money coming in is more than your money going out. Simple, right? Well, as simple as life can be, anyway. Imagine your bank account. Every time someone pays you for something, that’s your revenue pouring in. Cha-ching!

But then, whoops! Your rent is due. Or you had to buy that new video game. Or maybe you treated yourself to a fancy coffee (or three, no judgment here!). Those are your expenses, zapping away at your precious funds.

Net income happens when, by the end of a specific chunk of time – we’re talking a month, a quarter, a whole year – you look at the totals and see that the “cha-chings” outweigh the “whoopsies.” It’s like a financial scorecard, and net income is when you’re winning.

Let’s break down the “time period” part a bit more. Because this is where it gets a little more official, like setting a deadline for your cookie baking. Businesses, bless their organized hearts, don’t just eyeball their money. They have these things called accounting periods.

These are set chunks of time where they tally up everything. Think of it as giving yourself a report card at regular intervals. Most common? Monthly, quarterly (every three months, like school report cards!), and annually (once a year, a big end-of-year review).

So, if you’re a business owner, you’re not just waiting for a feeling. You’re actively tracking. You’re watching those revenues climb and those expenses creep up. And at the end of your chosen time period, you do the big calculation.

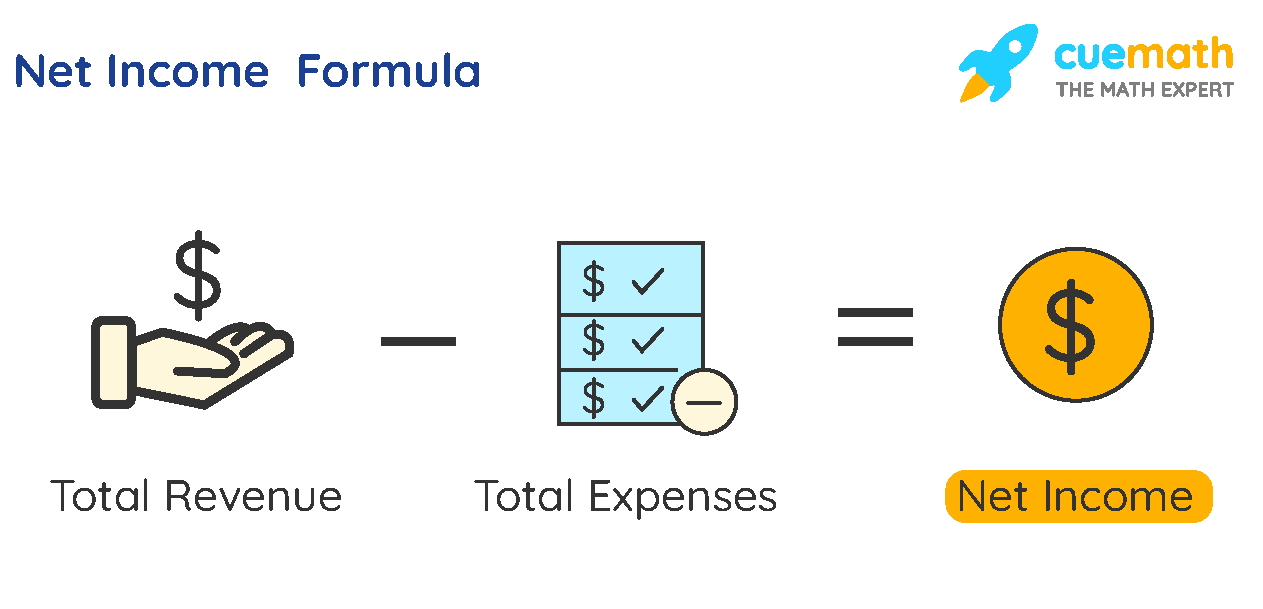

Revenues - Expenses = Net Income (or net loss, if things went a little sideways, which can also happen!).

It’s like a really important math equation. And the answer you get? That’s your net income. Ta-da!

Now, what counts as revenue? Oh, everything good! For a shop, it’s the sales of all those awesome things they sell. For a consultant, it’s the fees they charge for their brilliant advice. For a freelancer, it’s the money clients pay for their amazing work. It’s the money earned from your primary business activities. The stuff you’re actually supposed to be doing.

And expenses? That’s the whole other side of the coin. It’s the cost of goods sold (like the ingredients for our cookies!), the rent for your shop (even if it’s a home office!), the salaries you pay your amazing team (if you have one!), the marketing you do to get the word out, the electricity to keep the lights on… basically, all the costs associated with running your business.

It’s not just the big stuff, either. Even those little things add up. That daily coffee, the postage stamps, the occasional office supply splurge – they all chip away at your bottom line. So, being mindful of your expenses is pretty darn crucial.

Think about a lemonade stand. Sounds simple, right? Revenue: all the money you make from selling lemonade. Expenses: the lemons, the sugar, the cups, the water, maybe even a little sign you made. If you sell 50 cups of lemonade for $1 each, that’s $50 in revenue. If your lemons, sugar, and cups cost you $20, then your net income for that day is $30. Easy peasy!

But for bigger businesses, it gets… well, more complicated. They have things like cost of goods sold (COGS). This is directly tied to the products you sell. If you sell t-shirts, the COGS would be the cost of the blank t-shirts, the printing, and maybe even the tags. It’s the direct cost of producing what you sell.

Then you have operating expenses. These are the everyday costs of running the show. Rent, salaries, utilities, marketing, insurance – all that jazz. These are the things you need to keep your business doors open and humming.

And sometimes, there are other things that can affect your net income. Like if you have to pay interest on a loan. Or if you sell an old piece of equipment for more (or less!) than it was worth. These are usually called non-operating income or expenses, because they’re not part of your core business day-to-day. But they still need to be accounted for!

So, when does net income result? It results at the end of each of these accounting periods. You can’t say you have net income for “all time.” It’s tied to a specific chunk of time. It’s like asking, “When does your report card come out?” Not whenever you feel like it, but at the end of the semester!

It’s also important to remember that revenue isn’t always cash in hand. Sometimes you make a sale, but the customer hasn’t paid you yet. That’s called accounts receivable. You’ve earned the revenue, but it's not technically your cash until they pay up. This is where accrual accounting comes in, which is a whole other kettle of fish, but essentially, you recognize the revenue when you earn it, not just when the cash hits your account.

Similarly, expenses can sometimes be things you owe but haven’t paid yet. Like your electricity bill that just arrived but isn’t due for another week. That’s accounts payable. You owe that money, so it’s an expense for that period.

This is why businesses have accounting systems. They need to track all of this meticulously. They can’t just make it up as they go along. Imagine trying to figure out your net income if you just guessed at how much you spent on coffee last month! (Okay, maybe some of us can relate to that, but it’s not exactly good business practice!).

So, net income results when the final tally is done for a specific accounting period. It's the bottom line. The number that tells you if your business is profitable during that time. Is it a positive number? Hooray! You’ve got net income! Is it a negative number? Well, that’s a net loss, and it means you spent more than you earned. Time to go back to the drawing board, or maybe just a stern chat with your expenses.

Think about your personal finances. If you get paid twice a month, you’re essentially looking at your “net income” for those two-week periods. Did your paycheck cover your rent, your bills, and still leave you with some wiggle room for fun? That’s your personal net income in action!

For a business, this is so much more than just having a little extra cash. It's the indicator of success. It’s what allows you to reinvest in your business, to pay dividends to owners or shareholders, to hire more people, to grow, to innovate… to do all the exciting things that make a business thrive.

It’s also crucial for taxes. Governments love to know your net income. They want their cut, and who can blame them? They need to fund roads and schools and all those other things we rely on. So, calculating net income accurately is also a legal requirement.

And it’s not just about the current period. Looking at net income over several accounting periods helps you see trends. Are you making more money over time? Or is your net income shrinking? This information is golden for making strategic decisions. Maybe you need to boost your marketing, or perhaps it’s time to cut back on some of those less-than-essential expenses.

So, to recap, net income happens when the scales tip in your favor during a defined period. It's the reward for smart revenue generation and careful expense management. It's the big payoff at the end of the accounting rainbow.

It’s that beautiful moment when you can look at your books (or your spreadsheets, or your carefully curated notes) and say, "Yep, we did it! We made money!" It’s the feeling of accomplishment that comes from turning your efforts and resources into profit. It’s why entrepreneurs put in those long hours and why businesses strive to be efficient and innovative.

It’s the sign that your business is healthy and sustainable. It’s the fuel that keeps the engine running and allows for future growth and development. Without net income, a business is just… well, it’s just spending money without making it back, and that, my friends, is a one-way ticket to “uh oh” land.

So, the next time you hear someone talking about net income, you’ll know it’s not some mystical force. It’s a tangible result, born from careful planning, diligent tracking, and the fundamental principle of making more than you spend. It’s the sweet, sweet reward for a job well done!

And that, my friend, is the simple (well, mostly simple!) truth about when that lovely net income makes its appearance. Cheers to profitable periods!