Lpl Financial Partnership First Horizon Advisors

Ever find yourself wondering what’s going on behind the scenes with your money, or just generally curious about how the financial world works its magic? You’re not alone! It can feel like a big, complex beast sometimes, right? Well, today, let’s peek into a corner of that beast and talk about something that caught my eye recently: the partnership between LPL Financial and First Horizon Advisors. Sounds a bit formal, I know, but stick with me, because there’s a cool story here.

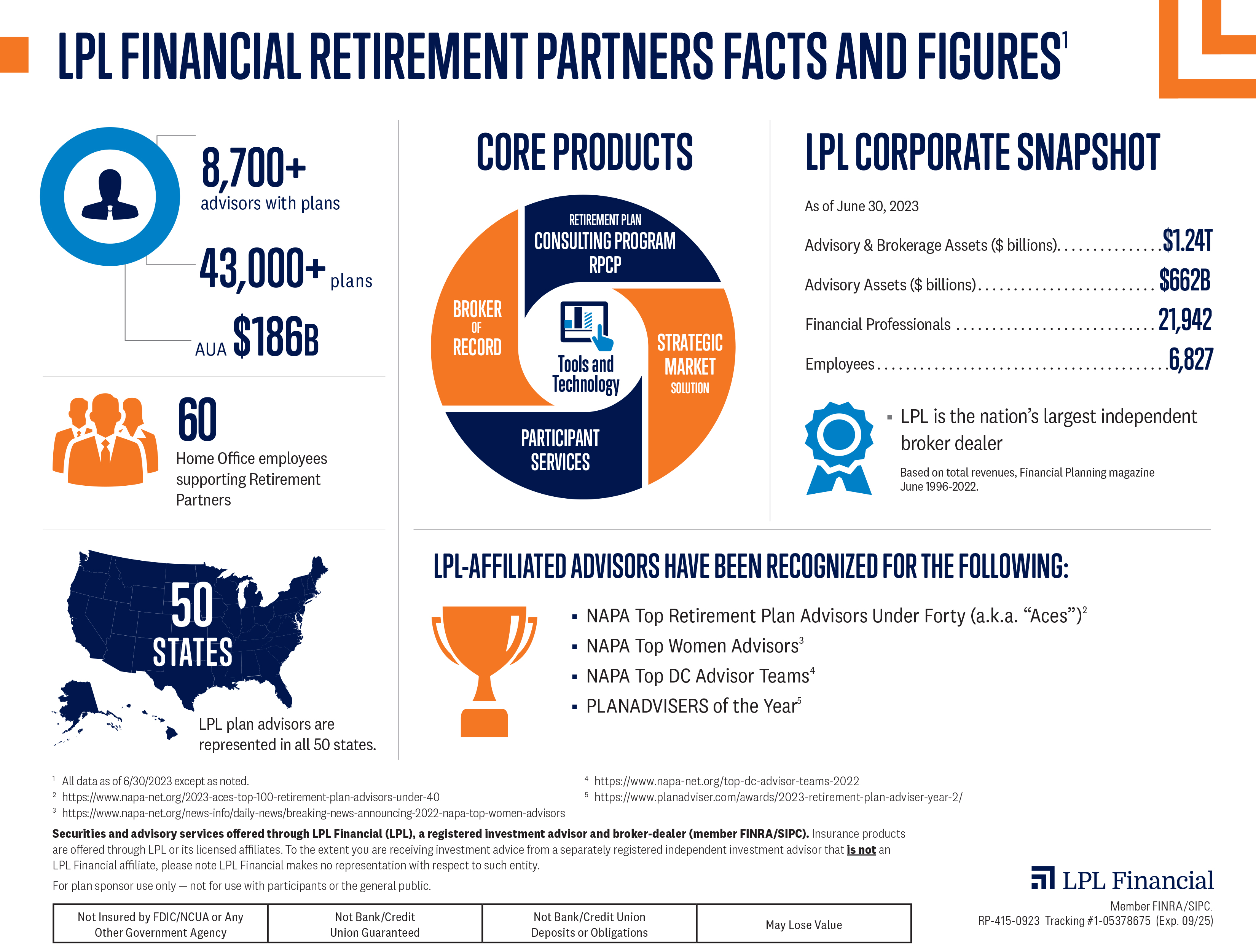

So, what is LPL Financial, you ask? Think of them as a massive, behind-the-scenes engine. They’re one of the biggest independent broker-dealers in the United States. That might sound like a lot of jargon, but essentially, they provide the infrastructure and support that a lot of financial advisors need to do their thing. It's like the power grid and the internet for your local coffee shop – they don't make the coffee, but without them, the shop couldn't even open its doors.

And First Horizon Advisors? They're the folks you might actually talk to. They're a team of financial advisors, people who help individuals and businesses plan for their financial futures. Think retirement planning, investments, all that good stuff. They’re the ones who sit down with you, listen to your goals, and try to map out a path to get you there. They're the friendly faces at the front counter, so to speak.

So, when these two join forces, it’s like a really smart chef (First Horizon Advisors) deciding to partner with an amazing, state-of-the-art kitchen supplier (LPL Financial). The chef gets access to all the best tools, ingredients, and support systems, which means they can focus on what they do best: creating incredible meals (or, in this case, financial plans) for their customers.

Why is this partnership interesting, though?

It’s interesting because it highlights a growing trend in the financial world: the desire for independence and specialization. For a long time, if you wanted to be a financial advisor, you often had to be tied to a big, well-known bank or investment firm. That meant following their specific products, their specific strategies, and sometimes, their specific sales goals. It could feel a bit like being on a very long, pre-determined conveyor belt.

But now, advisors like those at First Horizon Advisors are increasingly choosing to partner with independent platforms like LPL Financial. Why? Because it gives them a lot more flexibility and control. They can pick and choose the best tools and investment options from a wider universe, rather than being limited to what one particular company offers. It’s like a personal shopper being able to go to any store in the mall, instead of just the one attached to their office.

This means that when you work with an advisor who is supported by LPL Financial, they can potentially offer you a more personalized and objective experience. They aren't necessarily beholden to pushing a specific proprietary fund. Instead, they can look for what truly fits your needs. It’s a bit like having a doctor who can prescribe the best medication from any pharmacy, not just the one in their practice.

What does this mean for you, the customer?

Honestly, it can be a really good thing! For starters, it means advisors are likely to have access to some pretty cutting-edge technology and research. LPL Financial invests heavily in making sure their advisors have the latest software for planning, analysis, and client communication. So, your advisor might be able to show you more detailed projections, track your progress more effectively, and communicate with you in more convenient ways.

Think about it like this: Imagine you're building a dream house. Would you rather work with a builder who has a limited toolkit and a small selection of materials, or one who has access to the latest construction technology, a vast array of high-quality materials, and the freedom to choose the best options for your specific vision? It’s a no-brainer, right?

Furthermore, this partnership allows First Horizon Advisors to really focus on the relationship aspect of financial advising. When they don’t have to spend as much time worrying about the administrative heavy lifting or navigating complex internal systems, they can dedicate more time to understanding you. They can ask more questions, listen more intently, and build a deeper trust. It’s like a chef having a dedicated sous chef to handle all the prep work, allowing them to spend more quality time at the dining table with their guests.

It's also about having a broader menu of options. When advisors are truly independent, they can tap into a wider range of investment vehicles. This doesn't necessarily mean more risk, but it means more opportunities to find strategies that align perfectly with your risk tolerance and your unique financial goals. It’s like going to a buffet with endless choices versus a restaurant with a fixed menu.

A Bit More on Independence

The concept of an "independent advisor" is really gaining traction, and this partnership is a prime example of how that works in practice. It signifies a move away from the old-school, product-pushing model towards a client-centric approach. The focus shifts from selling a particular product to finding the best solution for the client’s individual circumstances. It’s like a personal trainer who designs a workout plan just for you, rather than giving everyone the same generic routine.

LPL Financial, by providing this robust platform, empowers advisors like those at First Horizon to act as true fiduciaries – meaning they are legally and ethically bound to act in their clients' best interests. This is a crucial distinction for anyone seeking financial advice. It means your advisor's recommendations are driven by what's best for your financial well-being, not by incentives tied to specific products.

So, when you see news about LPL Financial partnering with firms like First Horizon Advisors, it's not just a dry business announcement. It's a sign of evolution in how financial advice is delivered. It’s about advisors having the freedom and the tools to offer you a more tailored, responsive, and potentially more effective path to achieving your financial dreams.

It’s a bit like watching your favorite band collaborate with a legendary producer. The producer brings in the expertise, the equipment, and the vision to help the band create their best album yet. The band still has their unique sound and their connection with their fans, but now they have even more resources to make that magic happen. And in the end, we, the listeners (or in this case, the clients), get to enjoy the incredible final product.

It’s all about making financial planning feel less like a chore and more like a well-supported, personalized journey. And that, I think, is pretty cool. Makes you wonder what other interesting collaborations are brewing in the financial world, doesn't it?