Ishares Msci Usa Value Factor Etf

Alright, imagine you're at a giant, super-awesome sale at the world's biggest department store, but instead of sweaters and gadgets, you're buying little pieces of the coolest companies in the United States. And guess what? Some of these companies are currently marked down, like they're on the "value" rack, just waiting for you to snag them up before everyone else realizes what a steal they are! That's kind of what we're talking about today, but with a fancy ETF.

This isn't about chasing the shiny, brand-new toys that everyone's buzzing about. This is about finding those tried-and-true treasures that are maybe a little less flashy, but have a solid foundation and are just… well, a fantastic deal right now. Think of it like finding that amazing vintage leather jacket that’s way cooler and better made than anything you'd find in the fast-fashion section, and it cost you a fraction of the price.

We're diving headfirst into the wonderful world of the iShares MSCI USA Value Factor ETF. Don't let the name intimidate you! It sounds like it belongs in a secret Wall Street lair, but really, it's just a clever way to invest in a basket of companies that are generally considered "value" stocks.

So, what does "value stock" even mean in plain English? Imagine you're looking at two ice cream shops. One charges $10 for a scoop because it has a famous celebrity spokesperson and a fancy neon sign. The other charges $3 for a scoop, but their ice cream is incredibly delicious, made with the finest ingredients, and the owner is super friendly. Which one feels like the better deal for the quality you're getting? That second shop, my friends, is like a value stock!

Companies that are considered "value" often have a few things going for them. They might be a bit older, more established, and not exactly the flavor of the month. They could have a history of paying out dividends, which is like getting a little "thank you" check from the company just for owning a piece of it. And most importantly, their stock price might be lower than what their actual business is worth. It's like finding that perfectly ripe avocado for half the price because it's not perfectly round.

Now, the iShares MSCI USA Value Factor ETF isn't just picking one or two of these amazing deals. Nope! It's like a master curator, hand-selecting a whole collection of these "value" gems from across the United States. So, instead of you having to hunt for every single bargain yourself (which, let's be honest, sounds exhausting and requires a cape), this ETF does the heavy lifting for you.

The "Value" Advantage: Why It's Like a Treasure Hunt

Think of it this way: when everyone is scrambling to buy the latest hyped-up stock, the price can get pushed sky-high, sometimes way beyond what it's truly worth. It's like when a limited-edition sneaker drops, and suddenly people are paying insane amounts for it. The iShares MSCI USA Value Factor ETF, on the other hand, is all about looking at the fundamentals.

It’s about companies that are solid, dependable, and maybe just a little bit overlooked. They might be in industries that aren't as glamorous as, say, the latest tech craze, but they're the backbone of the economy. Think of the companies that make the stuff you use every day, the ones that keep things running smoothly. These are often the unsung heroes of the stock market.

And here’s the super cool part: by focusing on these "value" companies, this ETF aims to capture potential upside when the market eventually recognizes their true worth. It's like buying a classic car for a song because it needs a little polish, knowing that once you buff it up, it'll be worth a fortune. The iShares MSCI USA Value Factor ETF is doing the buffing, in a way, by investing in companies that are poised for appreciation.

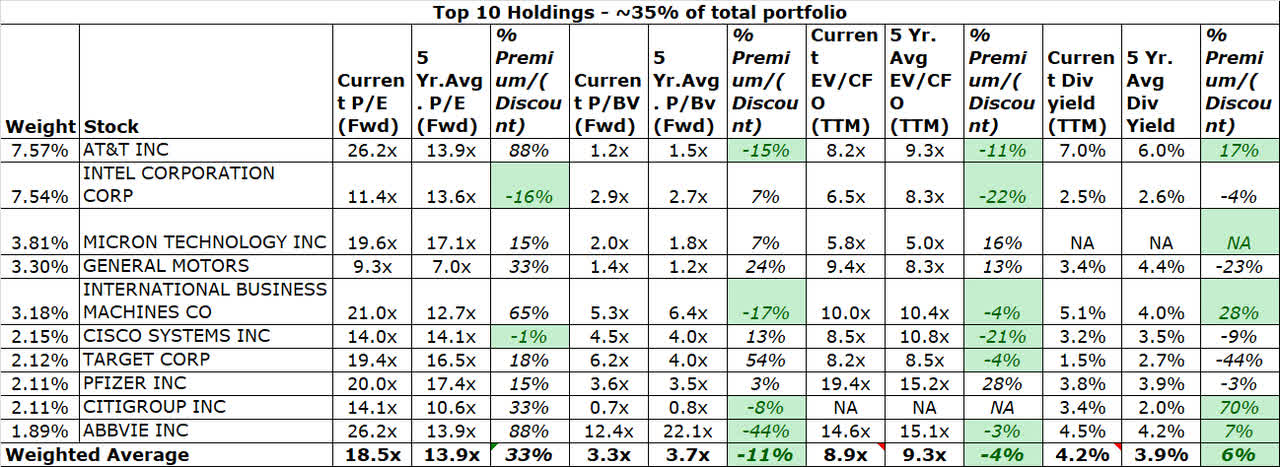

This ETF is designed to track the performance of the MSCI USA Value Index. That index is like the ultimate rulebook for identifying these value superstars. It's got specific criteria, like looking at things like a company's price-to-earnings ratio (basically, how much you're paying for each dollar of profit the company makes) and its dividend yield (how much it pays out in dividends compared to its stock price).

If a company meets these "value" standards, it gets a VIP ticket into the iShares MSCI USA Value Factor ETF. It’s like having a personal shopper for your investments who knows exactly where to find the best quality at the best prices. You get a diversified basket of these opportunities, which is always a good thing because it spreads out your risk.

Making Your Money Work Smarter, Not Just Harder

So, why should you even care about a "value factor" ETF? Because it's a smart way to potentially boost your investment returns over the long haul. While growth stocks (the flashy, high-flying ones) can have explosive growth, value stocks often offer a smoother, more consistent ride, with less of the wild ups and downs.

Imagine you're on a roller coaster. Growth stocks are the ones that shoot straight up at breakneck speed, then plummet down just as quickly. Value stocks are more like a steady, scenic train ride. There might be a few gentle hills, but you're generally moving forward at a reliable pace, with fewer stomach-churning drops.

The iShares MSCI USA Value Factor ETF is all about that steady, reliable growth. It's for investors who understand that sometimes, the best opportunities are the ones that are quietly humming along, waiting to be discovered. It's like finding a hidden gem of a restaurant that everyone else is still overlooking, but you know you're getting an incredible meal for your money.

Plus, ETFs are generally super accessible and easy to trade. You can buy and sell them just like you would a regular stock. This means you can easily add them to your investment portfolio and benefit from the diversification and professional management that the iShares MSCI USA Value Factor ETF offers, all without needing a degree in rocket science.

It's a fantastic tool for anyone looking to add a different dimension to their investments. It’s about owning a piece of solid, reliable American companies that are trading at what could be considered bargain prices. Think of it as building a strong, sturdy foundation for your financial future.

So, next time you hear about the iShares MSCI USA Value Factor ETF, don't get lost in the jargon. Just remember the super-sale, the delicious ice cream, and the classic car. It’s about smart investing, finding great deals, and letting your money work for you in a way that’s both entertaining and potentially very rewarding. Go get 'em, value hunter!