Irs Transcripts How Long Does It Take

So, you're curious about IRS transcripts, huh? Maybe you need one for a loan. Or perhaps you're just a tax enthusiast. Whatever the reason, let's dive into the world of these official documents. And don't worry, we'll keep it light and breezy. Think of this as your friendly guide to transcript timing. No stuffy legalese here!

IRS transcripts. They sound a bit… intense, right? Like something you'd need a secret decoder ring for. But they're really just a summary of your tax history. Think of them as your personal tax report card. Super handy! And the big question on everyone's mind is: how long does it take to get one?

This is where things get a little interesting. The IRS isn't exactly known for lightning-fast delivery. They're more of a… steady tortoise. But that's okay! We can work with that.

The Speedy Gonzales Option: Online!

If you're looking for the quickest way to snag your transcript, the internet is your best friend. Seriously. The IRS website has a dedicated tool for this. It's called the "Get Transcript Online" service. And it's pretty slick.

You create an account. You answer some security questions that might make you scratch your head a bit. Like, "What was the name of your first pet goldfish?" (Okay, maybe not that specific, but you get the idea.) And then, bam! You can usually download your transcript right then and there.

This is for tax return transcripts, tax account transcripts, and even wage and income transcripts. It's the express lane, people! If you need it for a mortgage application that's on a tight deadline, this is your go-to. Instant gratification, IRS style!

But here's a fun little quirk: sometimes, the system needs to do a little more digging. So, even with the online option, there might be a slight delay. It's not always 100% instant. The IRS is a big operation, after all.

The Not-So-Speedy, But Still Reliable, Mail Option

What if you're not a fan of online accounts? Or maybe you're just old school and prefer the feel of paper? The IRS has got you covered. You can request your transcript by mail.

This involves filling out Form 4506-T, the "Request for Transcript of Tax Return." It's a bit more involved than clicking a few buttons. You'll need to be precise. No scribbling! The IRS takes their forms very seriously. Think of it as a test of your penmanship.

Once you've filled it out, you mail it to the address specified on the form. And then… you wait. This is where our tortoise analogy really kicks in.

How long does it take by mail? The IRS estimates 5 to 10 calendar days for them to process your request. That's just for them to get it in their system. Then, it's another 5 to 10 calendar days for them to actually mail you the transcript.

So, in total, you're looking at a good couple of weeks. Maybe even three. It's a waiting game! This is when patience becomes your superpower.

Why the wait? Well, think about it. They have to receive your form, manually enter the information (or have systems that do), locate your records, print them, and then put them in the mail. It's a whole production!

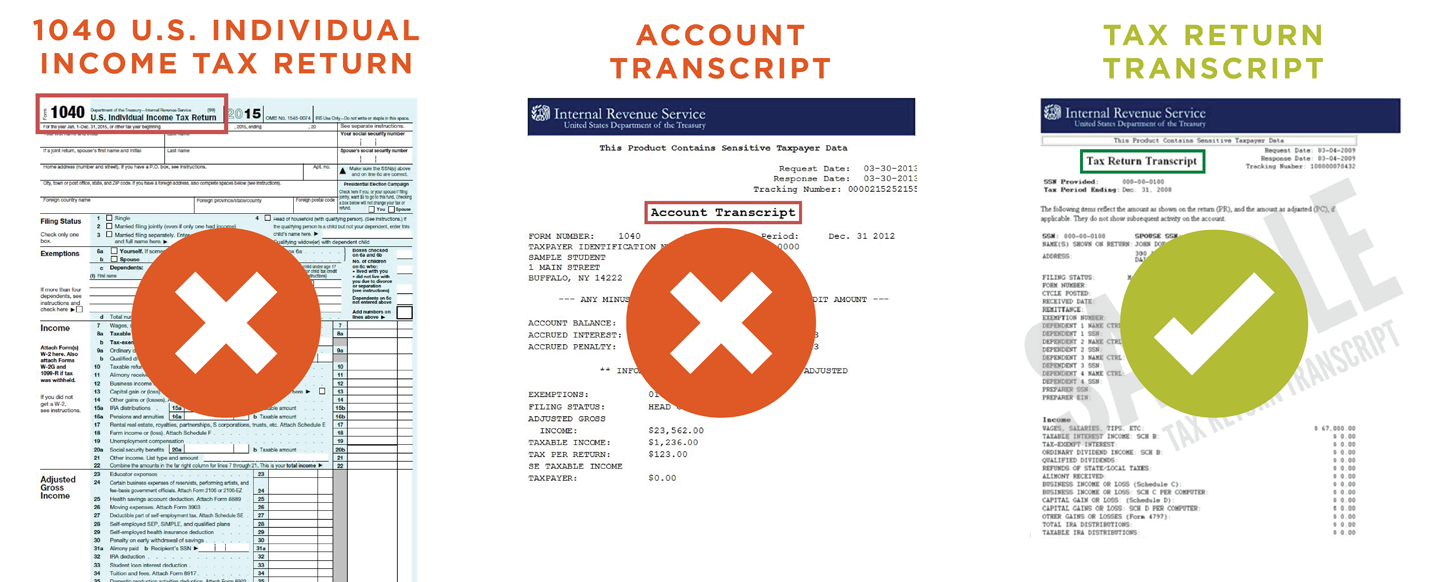

What Kind of Transcript Do You Need?

The type of transcript you request can also play a tiny role in the timing. There are a few main types:

- Tax Return Transcript: This shows most of the line-item details from your original Form 1040. It’s like a snapshot of what you filed.

- Tax Account Transcript: This shows changes made after you filed, like penalties and interest. It’s more about your account’s status.

- Wage and Income Transcript: This shows data from information returns the IRS received, like W-2s and 1099s. It’s about the money coming in.

Generally, the online retrieval is pretty consistent across these. The mail option might have slightly different processing times depending on the complexity of your record. But the 5-10 days for processing and 5-10 days for mailing is a good ballpark figure.

Why is This So Interesting?

Okay, I know what you're thinking. "Transcripts? Timing? This isn't exactly a thrilling novel." But hear me out! There's a quirky charm to it.

Think about the sheer volume of data the IRS handles. Billions of documents. Millions of taxpayers. And they’re trying to get you your specific information. It’s a logistical marvel, really. A testament to bureaucracy at its finest!

And then there's the anticipation. That moment when you check your mailbox, hoping today's the day. Will it be there? The suspense! It's like waiting for a surprise gift, but instead of toys, it's… tax documents.

Plus, understanding how long things take with the IRS can save you a whole lot of stress. If you know it takes a couple of weeks by mail, you won't be frantically calling them after three days, wondering where your transcript has gone.

It’s also a fun little peek behind the curtain of how the government works. They have systems, they have forms, and they have timelines. It’s not always exciting, but it’s… necessary. And sometimes, knowing the process makes it feel less mysterious.

Pro Tips for Faster Transcripts (Sort Of)

So, how can you speed things up? Well, the best way is the online method. If you can use it, do it!

If you're mailing it in, double-check everything. Make sure your address is crystal clear. No smudges. No typos. The cleaner your form, the smoother the process.

And here’s a quirky one: sometimes, requesting your transcript during off-peak tax seasons might be slightly quicker. Think late summer or fall, not right before the April deadline. The IRS is less swamped then.

Patience is key! Seriously, this is the most important tip. The IRS operates on its own clock. It's not yours. It's not mine. It's the IRS clock. And it ticks… steadily.

So, to recap: online is usually the fastest. Mail takes longer. And understanding the process is half the battle. Don't be surprised by the timelines. Embrace them! They're part of the grand adventure of dealing with your taxes. Now go forth and conquer your transcript needs!