In A Service Type Business Revenue Is Recognized

Hey there, ever wondered how businesses that do stuff for you, like fixing your car or giving you a killer haircut, actually count their money? It's not as simple as you might think. It’s like a magic trick, but with spreadsheets! We’re talking about something super cool called Revenue Recognition. Sounds fancy, right? But trust me, it’s actually quite fascinating, especially in the world of service businesses.

Imagine your favorite coffee shop. They don’t get paid for the coffee beans until they’re roasted and brewed, do they? And even then, they only really earn the money when you take that first delicious sip. That’s the basic idea behind revenue recognition. It’s all about figuring out when a service business has actually earned its cash. It’s not just about when you get the bill, or even when you pay the bill. It's about when the service is delivered. Pretty neat, huh?

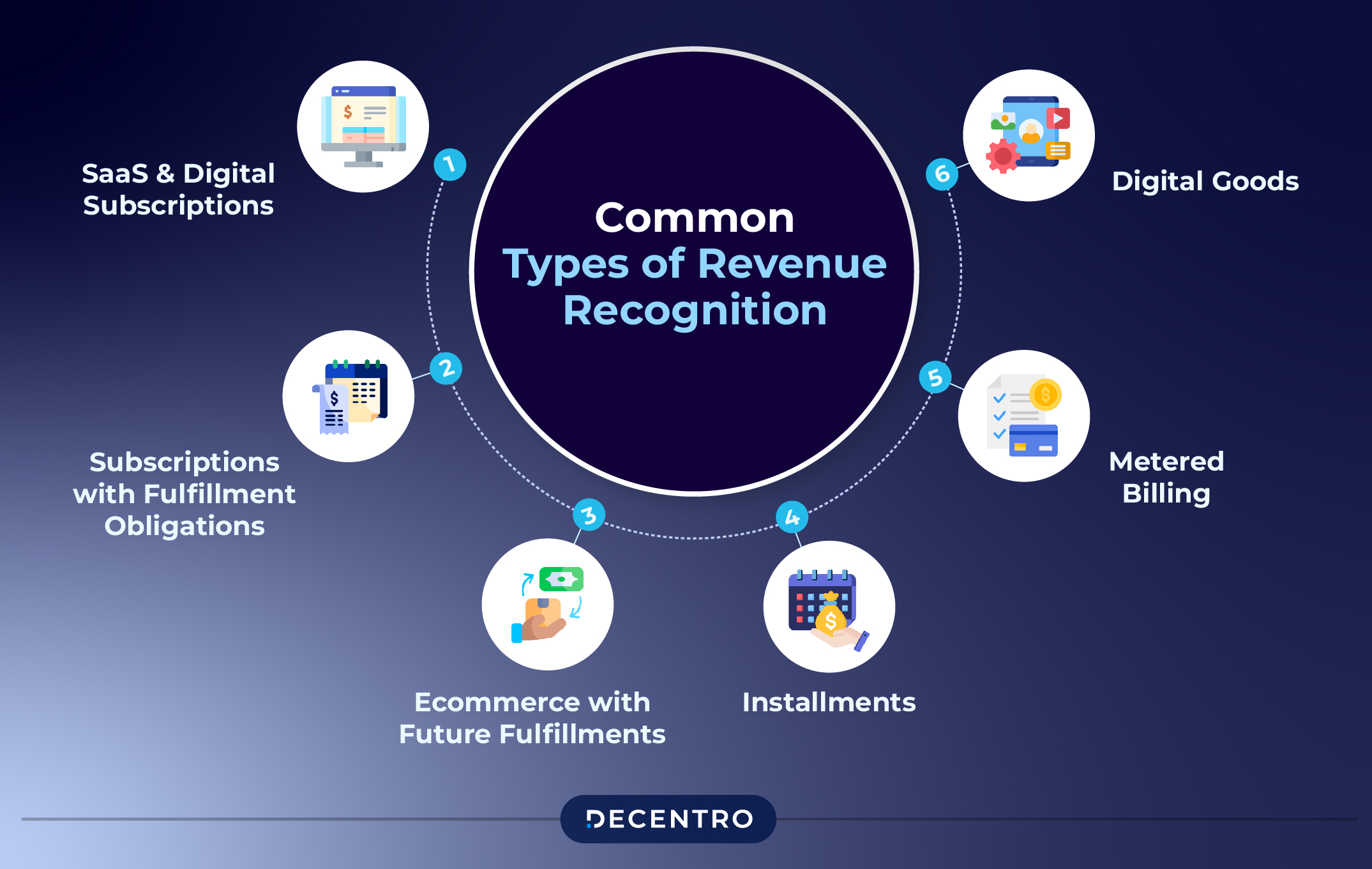

Think about a gym membership. You pay upfront for a whole year, right? But the gym doesn't get to say, "Cha-ching! We made all that money on day one!" Nope. They have to spread that money out over the entire year, month by month, as you get to use their treadmills and participate in those ridiculously energetic Zumba classes. This is where the fun begins. It’s like a slow-burn payday, where the earnings trickle in over time.

This whole process is guided by some super important rules, kind of like the recipe for a perfect chocolate chip cookie. These rules help make sure everything is fair and square for everyone. They’re laid out by organizations that are, well, pretty serious about numbers. The big players you’ll often hear about are the Financial Accounting Standards Board (FASB) in the U.S. and the International Accounting Standards Board (IASB), which keeps things tidy globally. They’re the choreographers of this financial dance!

So, what makes this so entertaining? It’s the puzzle of it all! Businesses are constantly trying to figure out the best way to track when they’ve truly completed their part of the bargain. It’s like detective work, but instead of finding clues to a crime, they’re finding clues to earned income. For example, a software company that offers a subscription service has to recognize the revenue over the period the software is available. They can't just pretend they earned it all on the day you clicked "subscribe." That would be like a chef claiming they've baked a cake before even mixing the flour!

Let’s dive a little deeper into the exciting steps. There are usually five main steps. It’s like a five-course meal for your finances! First, you have to identify the contract. This is like the handshake that seals the deal. It’s the agreement between the business and the customer. Second, you identify the performance obligations. This is the nitty-gritty of what the business has promised to do. Is it just a simple repair, or a complex project that involves multiple stages? Third, you determine the transaction price. This is simply how much the customer is going to pay. Easy peasy!

Now for the truly thrilling part: allocating the transaction price. If there are multiple things the business is doing for you, they have to figure out how much each individual thing is worth. It’s like splitting a pizza into perfectly sized slices. And finally, the grand finale: recognize the revenue when (or as) the entity satisfies a performance obligation. This is the moment of truth! When the job is done, or the service is provided, that's when the money is officially earned.

Think about a wedding photographer. They might get paid a big chunk upfront, but they don't earn all of it until they've shot the wedding, edited the photos, and delivered the final album. That’s a lot of steps! Each step, as it’s completed, contributes to the earned revenue. It’s a journey, not a sprint. And for the business, keeping track of all this can be a real juggling act.

What makes it special? It’s the commitment to accuracy and transparency. It’s about ensuring that businesses aren't overstating how much money they've made. This is crucial for investors, lenders, and even just for the business owners themselves to get a true picture of their health. It builds trust, and in the service world, trust is everything. It’s like the secret ingredient that makes a business truly shine.

Consider a consulting firm. They might have a contract to help a company improve its efficiency. They’ll likely bill monthly, but the revenue is recognized as they provide those valuable insights and strategies. If they complete a major project milestone, they can recognize a portion of the revenue associated with that milestone. It's all about matching the earning to the effort.

It’s a constant dance between fulfilling promises and recording the rewards. It’s a testament to the hard work that goes into providing a service. So next time you’re enjoying a perfectly brewed coffee, getting your car fixed, or even attending that awesome Zumba class, remember the fascinating world of revenue recognition. It’s the unsung hero behind how these service businesses count their success. It’s a behind-the-scenes look at how the magic of earning happens, one fulfilled service obligation at a time!