How To Report Accrued Market Discount On 1099-b

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at10.53.11AM-3e34b458ed634edf8d428777afabc1d3.png)

Okay, so you've got some nifty investments, right? And maybe, just maybe, some of those investments are a little… well, discounted. Like finding a vintage gem at a garage sale, but for your portfolio. We're talking about market discount. Sounds fancy, I know. But stick with me, because this is actually kind of cool.

Imagine buying a bond for less than its face value. That's the general idea. When you sell it later, you pocket not just the original purchase price, but also that sweet, sweet difference. This difference? That's your market discount. Think of it as a little bonus your investment was holding onto for you. It’s like a hidden treasure map, and the ‘X’ marks the spot where your profits are!

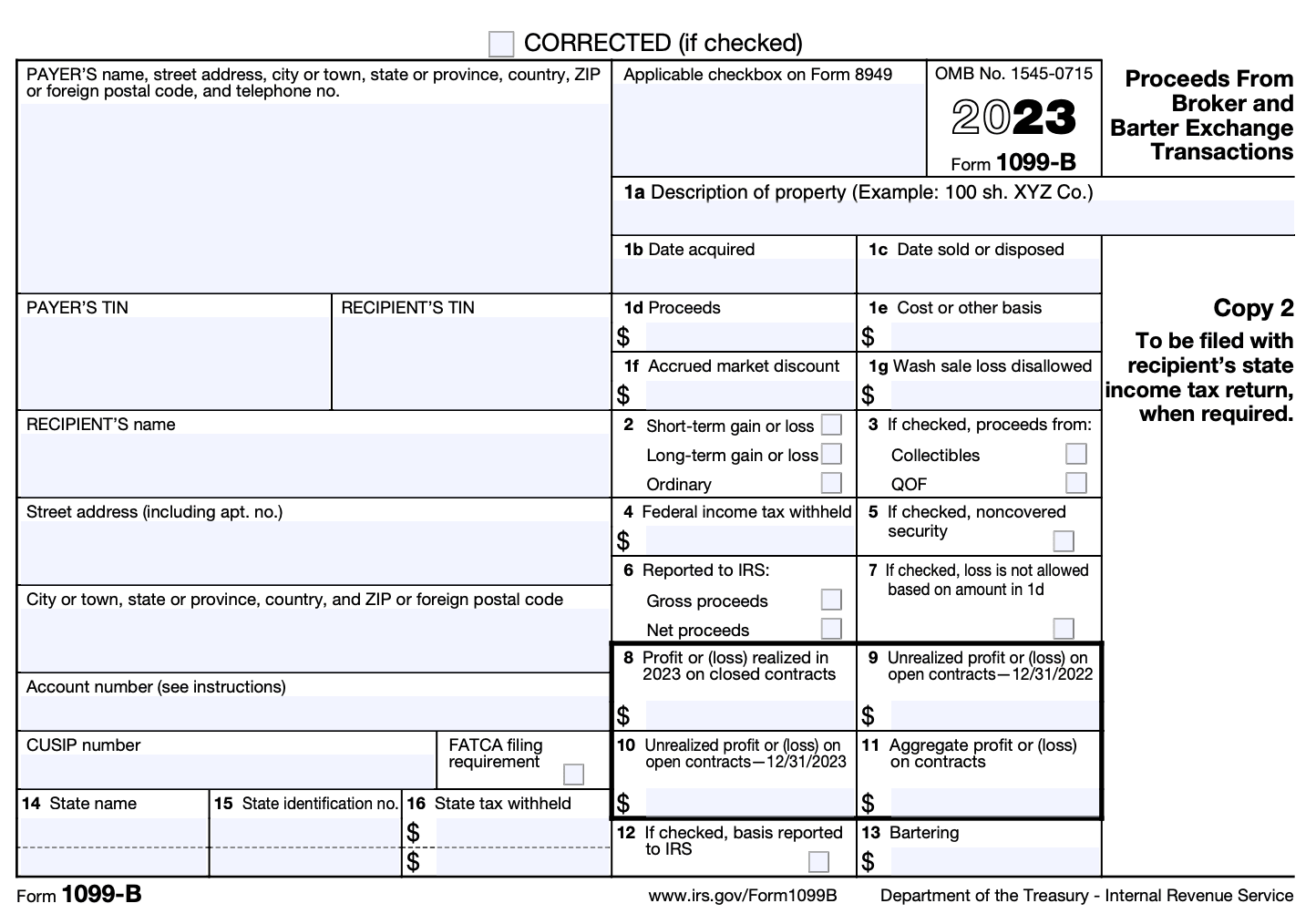

Now, the IRS wants to know about your treasure. And that’s where your trusty Form 1099-B comes in. This is the document your broker or investment company sends you, basically saying, "Hey, look at all the money you made (or lost, but let's focus on the wins!)." It’s like your investment's report card, but instead of grades, it has dollar signs.

So, how do you spill the beans about this market discount on your 1099-B?

It's not as scary as it sounds. Think of it like telling your friend about that amazing deal you snagged. You just need the right words, and in this case, the right boxes on the tax form.

The Nitty-Gritty (But Not Too Gritty!)

First off, you need to figure out if you actually have market discount. Generally, it applies to bonds bought for less than their stated redemption value. And it has to be a certain amount, otherwise, the IRS is like, "Meh, not worth our time." So, if your discount is tiny, you might be off the hook for reporting it. It’s like finding a single penny – nice, but probably not worth a fuss.

But if it's a decent chunk of change, then hello, reporting time! The good news is, you usually don't have to do anything extra when you first buy the discounted bond. It’s like buying that vintage lamp – you just take it home and admire it. The reporting magic happens when you sell the darn thing.

When you sell your investment, your 1099-B will likely show your proceeds (the selling price) and your cost basis (what you originally paid for it). The difference, as we established, is your profit. But where does the market discount hide in all this?

Here’s the fun part: The market discount is part of your profit. It’s like finding a secret ingredient in your favorite cookie recipe. You taste the deliciousness, but you don't necessarily see the ingredient itself. On the 1099-B, that discount often gets baked into the gain calculation.

So, what's the actual reporting process?

This is where we get to be a little bit like detectives. Your 1099-B will have a box for your sales proceeds and a box for your cost basis. The market discount is essentially added to your cost basis over time, or recognized when you sell. Confusing? A little! But that’s why we have professionals, or at least a good tax software.

If you’re using tax software, it’s usually pretty smart. You’ll input the information from your 1099-B, and it’ll ask you some follow-up questions. One of those questions might be about whether you elected to accrue (that’s a fancy word for "build up over time") your market discount. Most people don't elect to do this annually; they wait until the sale. So, the discount gets recognized then.

The tax software will then calculate your total gain, which will include the market discount. It’s like your software is saying, "Aha! I see the bonus you got!" And then it plugs that into the correct spot on your tax return.

What if you're doing it by hand? (Bless your adventurous soul!)

Okay, if you’re tackling this with a calculator and a dream, you’ll need to look at your 1099-B. The key is understanding your adjusted cost basis. This is your original cost basis plus any accrued market discount. When you sell, you subtract your adjusted cost basis from your sales proceeds to get your total gain.

The tricky part is how the market discount is reported on the 1099-B itself. Sometimes, the 1099-B might have a separate line item for market discount, or it might be implicitly included in the gain. It really depends on the type of security and how the issuer reports it. It's like trying to guess which ingredient makes your favorite sauce taste so good – it could be the secret herb, or maybe just a pinch of extra love!

A quirky fact: Some bonds are issued with original issue discount (OID), which is similar to market discount but happens at the time of issuance. Those get reported a bit differently, often with their own separate forms! It’s like having two slightly different flavors of ice cream, both delicious but served in different cups.

Another fun detail: If you hold onto a discounted bond for a while, that discount is generally considered ordinary income when you sell, not capital gains. So, while it’s a nice bonus, it’s taxed at your regular income tax rate. Think of it as earning a little extra "salary" from your investments.

Why is this whole market discount thing even fun?

Because it’s all about finding hidden value! It’s like being a smart shopper, snagging something for less than it's really worth. And the tax reporting, while it sounds dry, is just the final act of cashing in on your shrewdness. It’s your victory dance in tax form!

Plus, it makes you feel like a bit of a financial wizard. You’re not just passively holding investments; you’re understanding the little nuances, the hidden benefits. You’re seeing the forest and the fascinating little mushrooms growing at the base of the trees.

The main takeaway? Don't panic about market discount on your 1099-B. Your broker has likely done the heavy lifting. Your job is to input the info into your tax software or consult a tax pro if you’re feeling particularly adventurous or confused. They’ll help you translate the financial jargon into actual tax forms. It’s like having a translator for a secret code – makes everything so much easier!

So, the next time you see that 1099-B, don't just see a pile of numbers. See the potential for bonus earnings, the little wins your investments have been cooking up. And know that reporting that market discount is just you claiming your well-deserved prize!