How To Get Ketamine Treatment Covered By Insurance

So, you've heard the buzz. Ketamine treatment. It's not just for... well, you know. It's actually a thing for mental health. Pretty wild, right? Like, who knew that stuff could actually help people feel better? It’s like finding out your old childhood toy has a secret superpower. Mind. Blown.

But here's the million-dollar question, or maybe the thousand-dollar question depending on your deductible. Can you actually get your insurance to cough up the cash for this? It’s not exactly like getting a flu shot covered. This feels a bit more... underground. A bit more of a quest.

Let's dive in. Because honestly, the idea of insurance actually paying for something this… novel is kind of hilarious. It’s like the insurance gods looking down and saying, "Okay, fine, you win. We'll cover the psychedelic-adjacent therapy."

The Ketamine Kickstart: Why It’s a Thing

First off, why all the fuss? Ketamine, used in a controlled medical setting, is showing serious promise. Especially for those tough-to-treat cases of depression and anxiety. We're talking about folks who have tried everything else. The usual suspects. SSRIs. Therapy. You name it. And they're still stuck.

Ketamine is like a reset button. A powerful reset button. It works differently. It’s not just tweaking brain chemistry. It’s like… rewiring things. Like giving your brain a software update. A really, really good software update.

And the speed! This is the fun part. Some people feel better hours after treatment. Hours! Not weeks. Not months. Hours. Imagine. You're feeling low, you get ketamine, and suddenly, the sun seems brighter. The coffee tastes better. It’s almost like magic. Almost.

The Insurance Tango: Where the Fun Begins

Okay, so it works. But will your insurance company think it's worth a shot? This is where the adventure truly begins. It’s not a simple "yes" or "no." It's more of a cosmic riddle wrapped in an enigma, dipped in paperwork.

Most standard insurance plans don't automatically cover ketamine treatment for mental health. This is the kicker. They're used to covering things like… well, things that have been around forever. Things with fancy, established medical codes that everyone understands.

Ketamine for depression? That’s a bit of a rebel. A rockstar in a cardigan. It’s still making its case. It's like trying to convince your grandparents that TikTok is a legitimate form of communication. You have to explain, patiently, why it’s important.

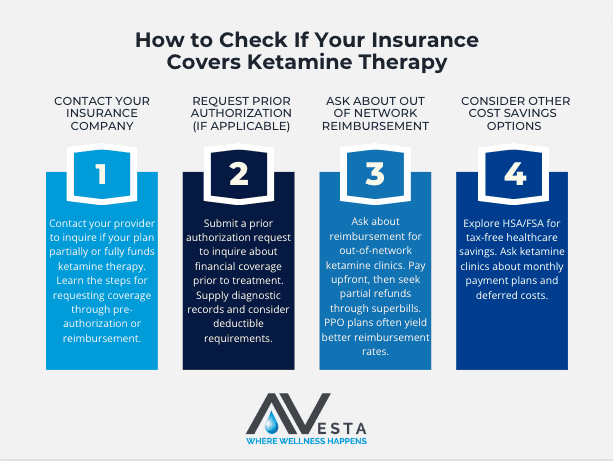

Step 1: The Pre-Authorization Ponderosa

So, the first hurdle. Pre-authorization. This is your insurance company's way of saying, "Hold on a sec. Let us think about this. And maybe call your doctor. A lot." You absolutely need this. Don't skip this step. It’s like trying to enter a secret club without the password. You’ll be standing outside awkwardly.

Your doctor plays a HUGE role here. They have to write a letter. A persuasive, compelling, no-holds-barred letter explaining why ketamine is the only viable option for you. They need to detail all the other treatments you’ve tried. And failed. This is where all those past struggles become your superpower. Your proof of concept.

Think of it like a detective story. Your doctor is the brilliant investigator, gathering clues (your treatment history) to present a watertight case to the jury (your insurance company). It’s dramatic. It’s intense. It’s… almost fun to imagine the paperwork flying.

Step 2: The Diagnostic Deep Dive

Your diagnosis is key. For insurance, this isn't just a casual chat. It needs to be a specific, documented diagnosis. Usually, treatment-resistant depression is the golden ticket. If you’ve been battling depression for a while, and the usual medications aren’t cutting it, you’ve got a stronger argument.

It’s not just about saying, "I'm sad." It's about showing a pattern. A history. A stubborn refusal of your brain to cooperate with standard protocols. This is where those long, sometimes difficult conversations with your mental health professionals become your ammunition. They’re documenting your journey, and that documentation is powerful.

Sometimes, they might also look at things like suicidality. If that’s a factor, and ketamine shows promise in reducing those thoughts, that’s a major selling point for insurance. It’s about saving lives, folks. And insurance companies, at their core, are supposed to help with that. Supposed to.

Step 3: The "Off-Label" Obstacle (and How to Dodge It)

Here's another quirky detail. Ketamine is approved by the FDA for anesthesia. For anesthesia. Using it for depression is considered "off-label." This sounds scary, right? Like you’re doing something you’re not supposed to. But "off-label" use is super common in medicine. Think about it. Doctors prescribe drugs all the time for things they weren't originally designed for, if the evidence is there.

The trick with insurance is to frame it correctly. Your doctor needs to emphasize the established medical literature supporting ketamine for depression. They need to show that this isn't some wild guess. It's a treatment backed by science. It's a calculated, evidence-based decision.

It’s like saying, "Yes, this chef is famous for their amazing steak. But they also make a surprisingly fantastic lasagna. And here’s why." The lasagna might not be on the main menu, but it’s still delicious and effective.

Step 4: The Appeals Arena

So, what if they say no? Don't despair! This is where the real fun begins. The appeals process. It’s like a legal battle, but with more feelings and less shouting. Probably.

You and your doctor will likely have to appeal the decision. This involves more paperwork, more letters, and more evidence. You might have to point out errors in their initial decision. You might have to present even more compelling arguments. It’s a marathon, not a sprint. But the prize? Feeling better. That’s a pretty sweet prize.

Sometimes, insurance companies have specific pathways for experimental treatments or treatments that are gaining traction. You just have to find them. It's like finding a hidden treasure chest. It takes effort, but the reward can be immense.

Alternative Routes and Future Fun

What if insurance is just a no-go? Don’t give up on the treatment itself. There are other options. Payment plans. Financing options from clinics. Sometimes, your doctor might know of clinical trials that are looking for participants. That’s like getting paid to try a revolutionary new thing. Double win!

The landscape is changing. More research is coming out. More clinics are offering ketamine. As it becomes more mainstream, insurance coverage will likely improve. It's a snowball effect. The more people it helps, the more undeniable it becomes. And then, insurance companies will have to take notice. They’ll have to adapt.

So, while getting ketamine treatment covered by insurance can feel like navigating a maze blindfolded, it's not impossible. It requires persistence, a good doctor in your corner, and a willingness to embrace the slightly quirky, slightly bureaucratic process. And hey, at least it’s a more interesting conversation than explaining your latest Netflix binge, right? Keep the faith, and keep fighting the good fight!