How Much Of An Umbrella Policy Do I Need

Alright, let's chat about something that might sound a little bit… well, fancy and maybe a bit intimidating: umbrella policies. When you hear "umbrella policy," you might picture someone in a three-piece suit at a big oak desk, signing a document thicker than a phone book. But honestly, it's way more down-to-earth than that, and it’s something that could actually make your life a whole lot less stressful.

Think of it like this: you’ve got your home insurance, right? And your car insurance. These are your regular raincoats, protecting you from the everyday drizzles of life. They’re essential, no doubt about it. But what happens when a hailstorm hits? You know, those unexpected, super-sized problems that can totally drench you and leave you shivering?

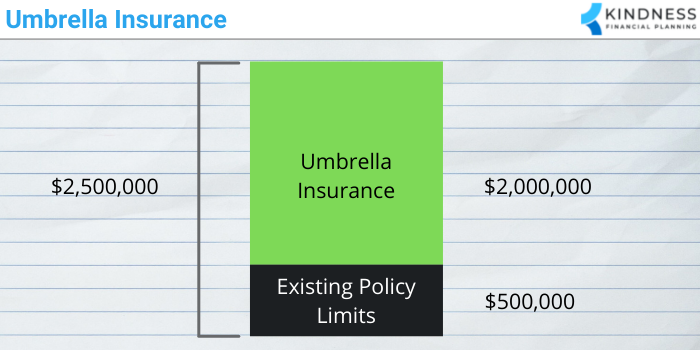

That’s where the umbrella policy swoops in, like a big, friendly, super-sized umbrella. It’s an extra layer of protection that sits on top of your existing insurance policies. It kicks in when the limits of your homeowner's or auto insurance aren't enough to cover the damage or the lawsuit.

So, How Much Umbrella Do You Actually Need?

This is the million-dollar question, isn't it? (And sometimes, unfortunately, it could be about a million dollars or more!). The truth is, there's no one-size-fits-all answer. It's like asking, "How much ice cream should I eat?" The answer depends on your life, your assets, and your tolerance for… well, financial oopsies.

Let's break it down with some relatable scenarios. Imagine you're at a friend's barbecue, and your dog, bless his furry little heart, decides to have a very enthusiastic greeting for the mail carrier. If the mail carrier gets injured and decides to sue, your homeowner's insurance might cover some of it. But what if the medical bills and lost wages are way, way higher than your policy's limit? Your personal savings, your future earnings – all of it could be on the line. Yikes.

Or, picture this: you're driving your sensible sedan, and in a split second, you're involved in a fender-bender that, through a series of unfortunate events, turns into something much more serious for the other party. Again, your auto insurance has its limits. If the damages exceed those limits, and the other party sues, your financial future could be seriously impacted.

These aren't just theoretical worries; they're real possibilities. And that’s why caring about an umbrella policy isn’t about being paranoid; it's about being prepared. It’s about having peace of mind knowing you've got a solid safety net.

Let's Talk "Assets": What Are You Protecting?

When insurers talk about how much umbrella policy you need, they're essentially asking: "What do you have to lose?" This isn't about being materialistic; it's about understanding your financial picture.

Do you own a home? That's a big asset. Do you have significant savings in the bank? That's another. Do you have investments, like stocks or retirement funds? These are all things that could be targeted in a lawsuit if your primary insurance runs out.

Think of your assets as your precious collection of vintage vinyl records or your prized collection of rare houseplants. You've invested time, money, and effort into them. An umbrella policy is like a really good, padded storage unit for those treasures, protecting them from unexpected damage.

Generally, insurance providers recommend having an umbrella policy that covers at least your net worth. Your net worth is basically what you own minus what you owe. So, if your home is worth $300,000, you have $50,000 in savings, and you owe $100,000 on your mortgage and car loan, your net worth is around $250,000. You'd probably want at least that much in umbrella coverage, and usually, much more.

The "How Much" Numbers Game: Common Recommendations

So, the practical question: what are the typical amounts? You'll often hear recommendations for:

- $1 million: This is a common starting point, especially for younger individuals or those with fewer significant assets. It’s a substantial amount of protection.

- $2 million to $5 million: As your assets grow, or if you have a higher-risk lifestyle (think owning a swimming pool, trampoline, or having teenage drivers), increasing your coverage makes a lot of sense.

- $10 million or more: For individuals with substantial wealth and a high net worth, higher levels of coverage are often necessary.

It’s also worth considering your potential for future earnings. If you're in a high-earning profession, a serious lawsuit could impact your ability to earn for years to come. The umbrella policy can protect that future income too.

A Little Story to Illustrate…

My neighbor, bless her, has a wonderful, sprawling garden. It’s her pride and joy. One day, a delivery person tripped on a slightly uneven paving stone near her gate and, unfortunately, broke their ankle quite badly. The medical bills and missed work were substantial. Her homeowner's insurance covered a good chunk, but the claim nudged the limits. If she hadn't had an umbrella policy, the remaining costs could have wiped out her savings. Thankfully, her umbrella policy stepped in, and she could focus on making sure her neighborly guest recovered, not on financial ruin.

It’s not about imagining the worst-case scenario every single day, but rather acknowledging that life has its curveballs. And when those curveballs come our way, having an umbrella policy is like having a sturdy, reliable umbrella that keeps you from getting absolutely soaked.

Why Should You Even Care? (Beyond Just Not Wanting to Be Soaked)

The biggest reason to care is financial security. It's about protecting the life you've worked hard to build. It’s about ensuring that an unexpected event doesn’t lead to a cascade of financial problems that could take years, or even a lifetime, to recover from.

Think about the peace of mind. Knowing that if the unthinkable happened, you wouldn't be personally liable for an amount that could devastate you financially. That's a pretty valuable thing, right? It’s like having a really comfortable pair of shoes – you don't think about them until you need them, and then you're incredibly grateful they're there.

Also, consider the affordability. Many people are surprised by how relatively inexpensive umbrella insurance can be, especially when compared to the massive protection it offers. It's often a small price to pay for such significant peace of mind.

Teenage drivers? Owning a swimming pool? Having a dog? Hosting frequent parties at your home? These are all factors that can increase your liability. An umbrella policy becomes even more crucial in these situations.

The Bottom Line: Chat with an Expert!

Ultimately, figuring out the exact amount of umbrella coverage you need is best done with a little help. Your insurance agent or a financial advisor can look at your specific situation – your assets, your income, your lifestyle – and give you personalized recommendations. They can help you understand the nuances and find a policy that’s just right for you.

So, don't let the "umbrella policy" sound too intimidating. Think of it as a smart, sensible way to protect your hard-earned security and enjoy life with a little less worry. It’s the extra layer that lets you truly relax, knowing you’re covered, come rain or shine… or even a full-blown financial hurricane.