How Much Money Does A Person Spend In A Lifetime

I remember this one time, way back when I was a kid, maybe ten or eleven. My dad, who was always a bit of a numbers guy, sat me down with a stack of old bills and receipts. He’d been doing some, let’s call them, highly informal bookkeeping. His mission? To figure out how much he’d spent on milk in his life. Just milk! And even then, with the limited scope, the number was… I don't know, astronomical to my young brain. I probably thought we were swimming in a swimming pool of milk money. Turns out, it was less a swimming pool and more a slightly overflowing bathtub. Still, it planted a seed, you know?

That seed of curiosity about the sheer volume of money that flows through a human life. It's not just about the big stuff, the house, the car, the occasional splurge. It’s the daily grind, the little expenditures that, when you add them all up, become, well, frankly, a little terrifying. Or maybe just mind-boggling. Let’s go with mind-boggling. Because if you’re anything like me, you’ve probably had those moments, haven’t you? Staring at your bank statement, a vague sense of panic creeping in, and thinking, "Where did all that money even go?"

So, let's dive into this colossal question, shall we? How much money does a person actually spend in a lifetime? Spoiler alert: it's a lot. Like, a lot a lot. And it’s not a simple number, because, surprise! We’re all different. Our lives are different. Our choices are different. Our access to that magical green stuff is different.

The Big Picture: A Lifetime of Leaks

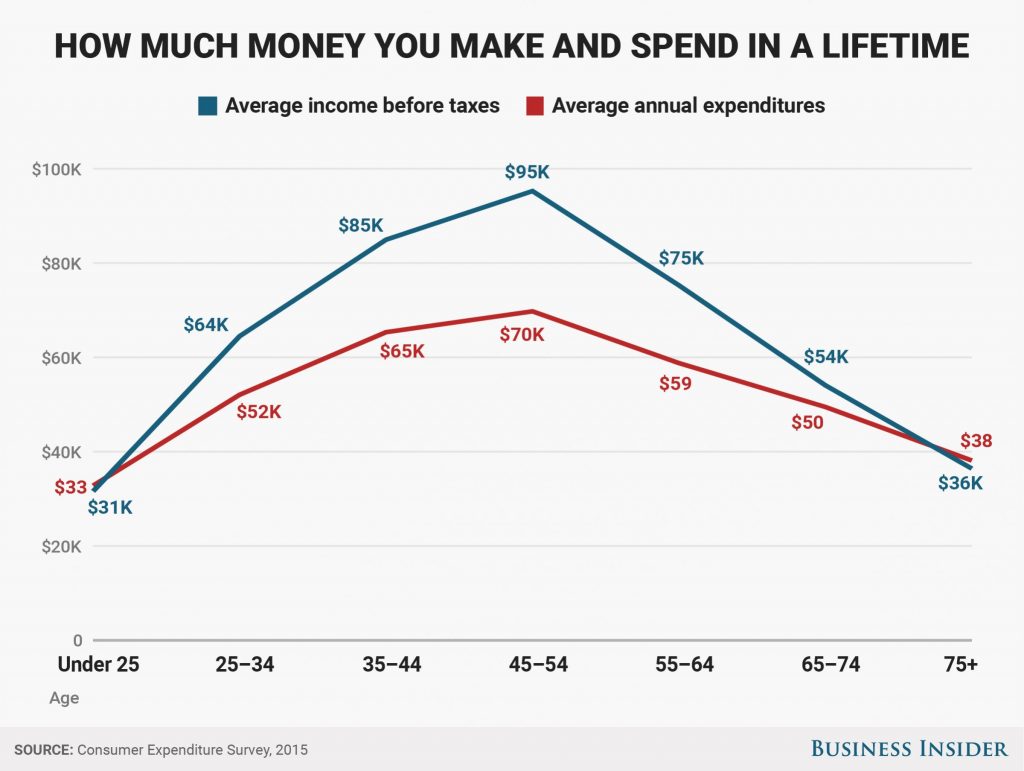

Trying to pin down an exact figure is like trying to catch smoke in your bare hands. But experts, bless their numerical hearts, have tried. They look at average incomes, average spending habits, and then they do some serious multiplying. And the numbers you'll see thrown around? They often start in the millions. We’re talking somewhere in the ballpark of $1 million to $3 million, and that’s on the conservative side for many developed countries. Let that sink in. A million bucks. Or more.

Think about that for a second. If you’re younger, that might seem like an impossibly distant figure. If you’re older, you might be nodding sagely, thinking, "Yeah, that sounds about right, maybe even a little low." It’s a journey, this spending thing. It starts with tiny purchases and, over decades, accumulates into a truly impressive sum.

And it’s not just about the essentials. Oh no. We humans are a complex bunch, aren’t we? We spend on necessities, yes, but we also spend on comforts, on experiences, on things that bring us fleeting joy, and sometimes, on things that, in hindsight, we might wonder why we bought at all. We all have those moments, don’t we? That impulse buy that sits in the back of the closet, gathering dust and silent judgment.

The Usual Suspects: Where Does All the Dough Go?

Let’s break down the major categories, the usual suspects in the Great Spending Spree of Life. These are the big hitters, the ones that consistently drain our bank accounts, sometimes without us even realizing the true cost.

Housing: The Never-Ending Mortgage (or Rent)

This is, without a doubt, the biggest chunk of most people’s spending. Whether you’re renting an apartment, buying a starter home, or upgrading to a mansion, your living space is a constant financial drain. Think about it: rent or mortgage payments, property taxes, insurance, utilities, maintenance, repairs. It’s a cycle that can last for decades. For many, their mortgage is the longest relationship they’ll ever have with a financial institution. And it’s often a love-hate relationship, isn't it?

If you own a home, that initial purchase price is just the beginning. Suddenly, you’re responsible for everything. Leaky faucets? Your problem. A tree falling on the roof? Your problem. That surprise inspection that finds something minor but requires expensive fixes? Yup, your problem. It’s a constant negotiation between wanting a comfortable home and the endless costs associated with it.

And for renters? While you might avoid some of the direct maintenance costs, the cumulative rent paid over a lifetime can easily rival the total cost of a house. Plus, you don’t build equity. It's a different kind of outflow, but an outflow nonetheless. So, whether you’re a homeowner or a renter, this is where a huge portion of your lifetime earnings will vanish.

Food: Fueling the Machine (and the occasional Indulgence)

We all gotta eat, right? This seems pretty straightforward, but the cost of food can really sneak up on you. It’s not just the groceries you buy to cook at home. It’s also the coffees on the way to work, the lunches grabbed at the office, the spontaneous dinners out with friends, the takeout on a lazy Friday night. And then there are the treats. The ice cream. The fancy pastries. The celebratory meals. We spend money on nourishing ourselves, but we also spend money on pleasure.

And consider inflation. The price of a loaf of bread today is vastly different from the price of a loaf of bread 30 years ago. When you extrapolate that over a lifetime, it’s a pretty significant number. And let’s not forget the beverages! Water, soda, juice, wine, beer – they all add up. So, next time you grab that latte, maybe give a little mental nod to its contribution to your lifetime spending tally. It’s a comfort, sure, but it’s also a quantifiable expense.

Transportation: Getting Around Town (and Beyond)

Unless you’re living a very secluded life or have a fantastic public transport system right outside your door, you’re likely spending a good chunk of change on getting from point A to point B. This includes car payments, insurance, gas, maintenance, repairs, and of course, the eventual replacement of your vehicle. Owning a car is an ongoing commitment. It’s not a one-time purchase; it’s a lifestyle expense.

Think about how many cars you might go through in a lifetime. Most people don't keep the same car for 50 years. They buy, they drive, they sell, they buy again. Each transaction, each oil change, each new set of tires – it all adds up. And what about public transport? Bus fares, train tickets, subway passes – they might seem small individually, but over a lifetime, they accumulate. Then there are the flights for vacations or business trips. Those can be some hefty expenses, can’t they?

Healthcare: The Unexpected (and Sometimes Expected) Bills

This is a tough one, isn’t it? Nobody wants to spend money on healthcare, but it's an unfortunate reality. From routine doctor’s visits and dental cleanings to unexpected illnesses, injuries, and chronic conditions, healthcare costs can be a significant burden. Even with insurance, deductibles, co-pays, and uncovered services can add up. And for those with pre-existing conditions or long-term illnesses, these costs can be truly staggering.

It’s a category that can be highly variable. Some people might sail through life with minimal healthcare expenses, while others face significant bills. It’s also a testament to how much we, as a society, value our health – even if we grumble about the price tag. It’s a necessary evil, perhaps, but a vital expense nonetheless. And let’s not forget things like prescriptions, therapy, or even just over-the-counter remedies for a common cold. All part of the grand tally!

Education: The Investment in Our Future (and Our Kids')

This one can be a double-edged sword. For many, higher education is a crucial investment in their earning potential. But that investment comes with a price tag. Student loans, tuition fees, books, living expenses while studying – it can be a massive financial undertaking. And for parents, the cost of educating their children can be equally, if not more, substantial. Think about private schools, extracurricular activities, university tuition. It’s a generational expense, often.

Even if you didn't go to college, you might have paid for vocational training, certifications, or adult education courses. It’s about acquiring skills and knowledge, and that often comes with a cost. It’s an investment in human capital, but boy, can it be an expensive investment. And sometimes, the job you get after all that education doesn't quite justify the financial outlay. That can be a tough pill to swallow, can’t it?

Entertainment & Leisure: The Fun Stuff (That Costs Money)

Let’s be honest, life wouldn’t be much fun without a bit of entertainment. Movies, concerts, sporting events, hobbies, vacations, streaming services, books, video games – the list is endless. We spend money to relax, to have fun, to explore, to connect with others. These are the things that add color and joy to our lives, but they also represent a significant portion of our spending.

And this is where personal choice plays a huge role. Some people are happy with a quiet night in and a good book, while others crave exotic travel and VIP experiences. Both are valid, but one will undoubtedly cost more. The key here is finding a balance, right? Enjoying life without completely derailing your financial future. Easier said than done, perhaps!

Personal Care & Clothing: Looking and Feeling Good

This is another area where spending can vary wildly. Haircuts, toiletries, cosmetics, gym memberships, and of course, clothing. We all need to wear clothes, but the type of clothes we buy can drastically impact our spending. Fast fashion versus designer labels, a few well-made pieces versus a closet overflowing with trendy items. It’s a constant cycle of needing to clothe ourselves, and the market is certainly designed to encourage us to buy more.

And it’s not just about covering up. It’s about presenting ourselves to the world, about feeling good about how we look. That can translate into significant spending on grooming, skincare, and fashion. Think about the cost of a good skincare routine, or the constant need to update your wardrobe to stay on-trend. It’s a never-ending fashion show of sorts, and the tickets aren't free.

Miscellaneous: The Little Things That Add Up

Then there are the miscellaneous expenses. Gifts for birthdays and holidays, pet care, charitable donations, subscriptions that you forget you have, impulse buys at the checkout. These are the smaller, often less planned expenditures that, when you tally them up, can be surprisingly substantial. It’s the death by a thousand paper cuts of your bank account, if you’re not careful.

Think about all those birthday gifts you've bought. Or the occasional impulse purchase of a gadget you barely use. Or even just the fees associated with your bank accounts. These might seem insignificant on their own, but over a lifetime, they form a considerable part of your overall spending. It’s a reminder that even the smallest financial decisions can have a long-term impact.

The Influencing Factors: Why It's Not One-Size-Fits-All

As we’ve touched upon, there’s no single answer to "how much does a person spend." Several factors come into play:

- Income Level: This is the most obvious one. Higher earners generally spend more, though not always proportionally more.

- Location: The cost of living varies dramatically. Someone living in a major city will spend far more on housing, transportation, and even groceries than someone in a rural area.

- Family Size: More mouths to feed, more bodies to clothe, more education to pay for. Families with children will naturally have higher spending.

- Lifestyle Choices: Do you travel extensively? Eat out frequently? Invest in expensive hobbies? These choices have a direct impact.

- Health: As mentioned, health issues can lead to significant, unpredictable expenses.

- Debt: Student loans, car loans, mortgages, credit card debt – interest payments are a form of spending that can add up considerably.

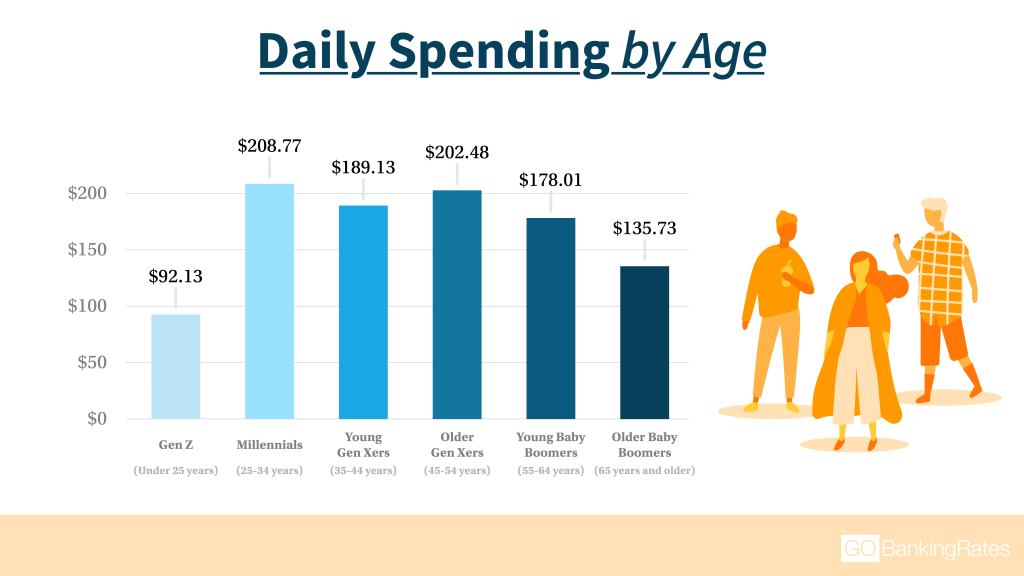

- Age and Life Stage: Spending patterns change throughout life. Young adults might spend more on education and starting out, while older adults might spend more on healthcare and leisure.

It’s a complex web, isn't it? And it’s constantly shifting. The economic climate, technological advancements, and societal trends all play a role in how we spend our money.

The Takeaway: Are We Just Spending Machines?

So, what’s the point of all this number-crunching? Is it to induce a collective sense of financial dread? Hopefully not. Instead, it’s about awareness. It’s about understanding where our hard-earned money goes. It’s about making more informed choices.

When you look at the potential for spending millions of dollars over a lifetime, it’s a powerful motivator to think about your own habits. Are you spending in alignment with your values? Are you saving enough for the future? Are you enjoying the present responsibly?

The next time you’re making a purchase, big or small, take a moment. Consider its place in the grand tapestry of your life’s expenses. It’s not about deprivation; it’s about intentionality. It’s about ensuring that the money you earn serves your goals and brings you genuine fulfillment, not just a fleeting moment of consumer satisfaction. Because ultimately, while we all spend a lot, how we choose to spend it is what truly defines our financial journey. And that, my friends, is a much more interesting story than just a number.