How Much Can My Employer Contribute To My Hsa

Ah, the Health Savings Account, or HSA, is a bit like finding a secret stash of gold specifically for your medical needs! For many, it’s a genius way to take control of healthcare costs while also building up a little nest egg. It offers a wonderful blend of financial savvy and peace of mind, making it a surprisingly enjoyable part of managing your well-being and finances.

So, what's the big deal? Essentially, an HSA is a tax-advantaged savings account designed to help you pay for qualified medical expenses. Think of it as a personal healthcare piggy bank that grows over time, thanks to some pretty sweet tax benefits. Your contributions are tax-deductible, your earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. It’s a triple tax benefit that’s hard to beat!

In everyday life, this translates to a less stressful approach to doctor visits, prescriptions, dental work, vision care, and so much more. Instead of digging into your regular checking account and taking a hit on taxes, you can tap into your HSA funds. This can be especially helpful for managing unexpected medical bills or even planning for future healthcare needs like surgeries or long-term care.

Common ways people use their HSAs include paying for their deductible, copayments, and coinsurance. You can also use it for things like eyeglasses, contact lenses, braces, therapy, and even certain medical equipment. It’s a flexible tool that empowers you to make healthcare decisions without the immediate sting of out-of-pocket expenses.

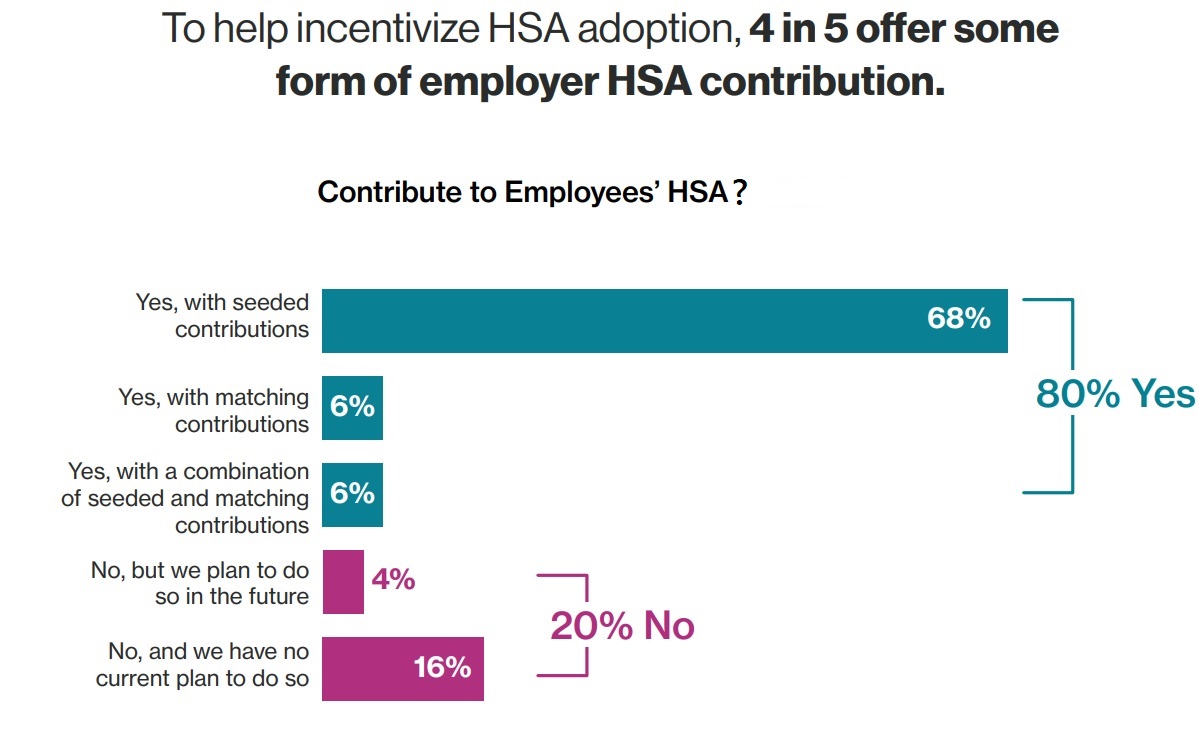

Now, for the big question on many people's minds: "How much can my employer contribute to my HSA?" This is where the magic often happens! Many employers recognize the value of HSAs and actively contribute to their employees' accounts. This is a fantastic perk, essentially free money towards your healthcare! The amount varies significantly by employer, but it’s not uncommon to see them contribute anywhere from a few hundred to several thousand dollars per year, often tied to your enrollment in a high-deductible health plan (HDHP).

To make the most of your HSA, understanding the contribution limits is key. For 2024, individuals can contribute up to $4,150, and families up to $8,300. If you’re 55 or older, you can make an additional catch-up contribution of $1,000. Remember, these limits include both your contributions and your employer's contributions.

Here are some practical tips to enjoy your HSA even more: Start early! The sooner you begin contributing, the more time your money has to grow. Max it out if you can. Those triple tax benefits are powerful. Keep good records of your medical expenses, as you can often reimburse yourself later, even years down the line. And invest your HSA funds if your plan allows. Many HSAs offer investment options, turning your savings into a long-term investment that can grow significantly over time.

Ultimately, your employer’s contribution is a wonderful bonus, but the real power lies in using your HSA strategically. It’s a tool for financial health and well-being, and with a little planning, it can be a truly rewarding part of your financial journey!