How Long Does Probate Take After A Death

Let's dive into a topic that might sound a little serious at first, but understanding it can actually bring a surprising amount of peace and clarity during a challenging time. We're talking about probate, and specifically, "How Long Does Probate Take After A Death?" Now, why is this a topic worth exploring? Because knowing the general timeline can help manage expectations, reduce stress, and even prepare you for what's ahead. Think of it as getting the inside scoop on a process that, while necessary, can feel a bit like a mystery to many. And who doesn't love solving a good mystery, especially when it leads to a smoother path forward for everyone involved?

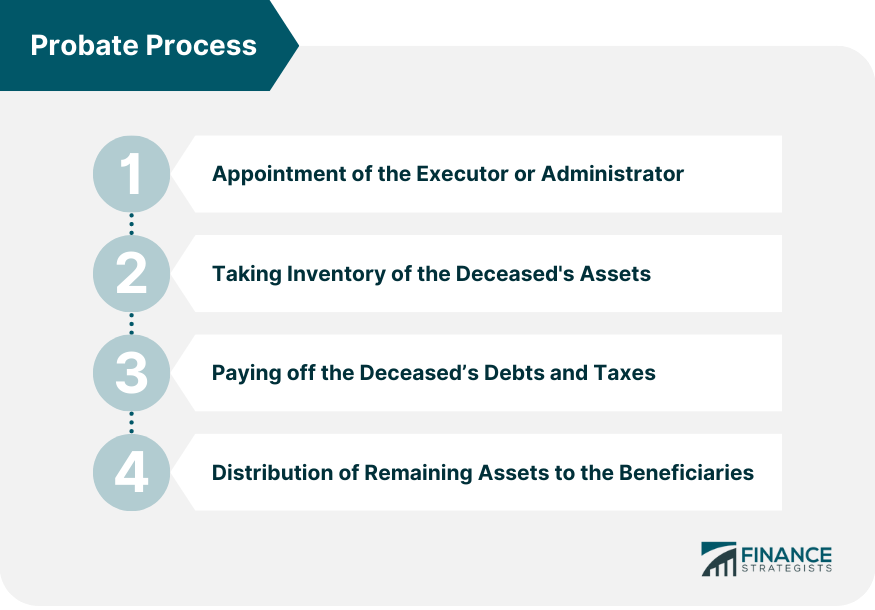

At its core, probate is the legal process of administering a deceased person's estate. This involves validating their will (if one exists), identifying and inventorying their assets, paying off any outstanding debts and taxes, and then distributing the remaining assets to the rightful beneficiaries. It's essentially the official way to wrap up someone's financial affairs after they've passed on, ensuring that everything is handled fairly and according to the law. The purpose of probate is to provide a structured and transparent method for transferring ownership of a deceased person's property and assets. It protects creditors by ensuring they have an opportunity to be paid, and it safeguards beneficiaries by ensuring they receive what they are legally entitled to.

The benefits of understanding this process, and its timeline, are plentiful. Firstly, it empowers you with knowledge. Instead of feeling lost in a maze of legal jargon and procedures, you'll have a clearer picture of what to expect. This can significantly reduce anxiety, especially for those who are tasked with managing the estate, often referred to as the executor or administrator. Knowing the general timeframe allows for better financial planning, as beneficiaries might need to know when they can expect to receive inheritances. It also helps in managing expectations – sometimes probate can be a quick and straightforward affair, while other times, it can take a considerable amount of time. Understanding the factors that influence this duration is key to avoiding unnecessary worry.

The Big Question: How Long Does It Actually Take?

This is where things get interesting, and honestly, a little bit of a generalization is necessary. There's no single, universally set date for when probate concludes. Think of it like asking "How long does it take to build a house?" – it depends on the size, complexity, and materials! However, we can break down the typical ranges and the factors that sway them. In many states, a relatively simple probate can be wrapped up within six months to a year. This is often the case when the deceased had a clear will, minimal assets, no complex debts, and no disputes among beneficiaries. Everything goes smoothly, the paperwork is filed promptly, and the court processes it efficiently.

However, it's not uncommon for probate to extend beyond a year, and in some intricate cases, it might even take two years or more. What causes these extended timelines? A few common culprits come to mind. One of the biggest is the complexity of the estate. If the deceased owned a business, had significant investments, or owned property in multiple states, this can add layers of complication. Inventories need to be thorough, valuations might require professional appraisers, and transferring ownership of various asset types can be a lengthy process. For instance, selling a house often involves market fluctuations, finding buyers, and navigating real estate transactions, all of which can take time.

Another significant factor is the presence of a will contest. If someone believes the will isn't valid, perhaps due to undue influence or lack of capacity from the testator, they can challenge it in court. These legal battles can be lengthy and costly, significantly delaying the distribution of assets. Similarly, if there are disputes among beneficiaries about how assets should be divided or who is entitled to what, this can also tie up the probate process in court hearings and negotiations.

Dealing with the legalities of an estate after a loved one has passed can feel daunting. Understanding the typical probate timeline, however, offers a valuable roadmap, helping to manage expectations and reduce the overall stress associated with this sensitive period.

The efficiency of the probate court itself plays a role. Larger, busier courts may have longer queues for scheduling hearings and processing documents. The jurisdiction where the probate is filed can have different procedural rules and timelines. Furthermore, the diligent work of the executor or administrator is crucial. If they are proactive, organized, and respond promptly to court and beneficiary requests, the process is likely to be smoother. Conversely, delays in gathering information, filing paperwork, or communicating with relevant parties can extend the timeline considerably.

Debts and taxes are another area that can impact the duration. If the deceased had significant debts, creditors have a legal right to come forward and claim what they are owed. The executor must manage these claims, which can involve negotiations or even legal proceedings if there's a dispute. Likewise, estate taxes or income taxes need to be calculated and paid before the remaining assets can be distributed. Depending on the complexity of the financial situation and the tax laws in effect, this can add several months to the probate timeline.

It's also important to consider the possibility of an out-of-state property. If the deceased owned real estate in a different state than where they resided, a separate probate process, known as an ancillary probate, might be required in that state. This adds another layer of legal procedure and can extend the overall timeline. Finally, simply locating all the assets can sometimes be a challenge. Bank accounts, investment portfolios, and even personal property can be scattered, and the executor needs time to identify and secure everything before it can be properly accounted for and distributed.

So, while there's no magic number, understanding these influencing factors – estate complexity, potential disputes, court efficiency, executor diligence, debt and tax obligations, and asset location – can give you a much better grasp of what to anticipate during the probate process. It's a journey, and like any journey, knowing the terrain helps you navigate it more confidently.