How Do I Cash Or Deposit A Non Negotiable Check

Okay, so you've got a check in your hand. It's got your name on it, and it feels pretty darn good, right? Like finding an extra fry at the bottom of the bag, or a surprise ten-dollar bill in a jacket you haven't worn in ages. But then you notice it: a little phrase, maybe tucked away in a corner, or printed in the fine print. It says something like "Non-Negotiable."

Now, before you start picturing a grumpy banker with a clipboard and a stern "no," let's take a deep breath. "Non-negotiable" sounds a bit intimidating, like a secret code only for financial wizards. But honestly, it's not as scary as it sounds. Think of it less like a locked door and more like a specific set of instructions. You can still get your hands on that sweet, sweet cash (or have it safely tucked into your bank account), it just might require a slightly different approach.

So, why should you even care about this little "non-negotiable" tag? Well, imagine getting paid for a job, or receiving a gift, and then realizing you can't actually use the money. That would be a bit of a bummer, wouldn't it? It's like getting a beautifully wrapped present, only to find out it's just a really fancy rock. We want that money to work for us, to help us buy that new gadget, pay that bill, or maybe even treat ourselves to an extra scoop of ice cream. Understanding what "non-negotiable" means ensures that dream doesn't turn into a frustrating reality.

:max_bytes(150000):strip_icc()/noncash-item_final-a755ac862fea40629e736a5cedcf5ebe.png)

What's the Big Deal with "Non-Negotiable"?

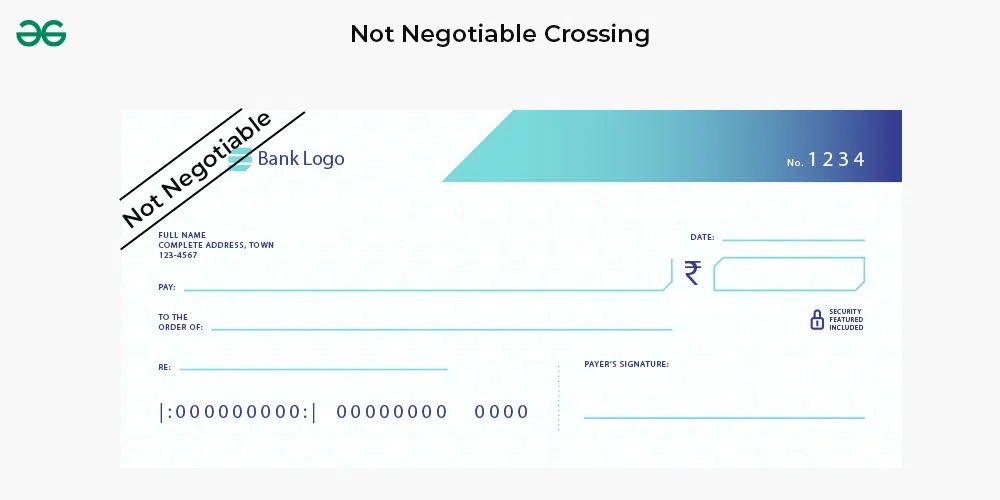

Let's break it down. When a check is labeled "non-negotiable," it generally means that it's not meant to be traded or cashed by anyone other than the person or entity it's made out to. It's like a personalized invitation to a party – only the person named on the invitation can actually go. Most checks you receive are "negotiable," meaning they can be endorsed and cashed by pretty much anyone, assuming they have the correct identification. But a non-negotiable check is a little more… exclusive.

Think about it like this: if you have a concert ticket that says "Admit One: John Smith," you can't just sell it to your friend Sarah and expect her to get in. The ticket is specific to John. A non-negotiable check works in a similar way. It's intended for you, and only you, to benefit from.

So, How Do I Get My Hands on This Non-Negotiable Goodness?

This is where the fun begins! While you can't just march into any old bank and demand cash like you're in a classic Western movie, there are usually a few straightforward ways to handle these types of checks. The key is to understand who issued the check and why.

1. The Issuing Entity is Your Best Friend (Usually):

Often, non-negotiable checks come from institutions or organizations that have a direct relationship with you. Think of a refund check from a store you returned something to, a rebate from a company, or even a disbursement from a scholarship fund or a legal settlement. In these cases, the easiest and most direct route is usually to contact the issuer directly.

Let's say you got a refund for that pair of shoes that turned out to be a bit too… enthusiastic in their squeaking. The store might have issued you a non-negotiable check. Instead of trying to cash it at your bank, which might get a confused look from the teller, you can simply take it back to the store. They’ll likely have a process for handling these, perhaps by issuing you store credit, a different form of payment, or by allowing you to deposit it directly into their system.

It's like getting a free coffee voucher. You can't just sell that voucher to the person behind you in line for a latte. You need to use it at the coffee shop that issued it. This is the same principle with many non-negotiable checks. They are designed to be used within the ecosystem of the issuer.

2. Depositing it Directly into Your Bank Account:

This is often the simplest solution, especially if the issuer is a reputable company or organization. Many banks are equipped to handle non-negotiable checks, especially if they are made out to you and you have an account with them. Think of it as the bank acting as a middleman. They'll take the check, process it, and deposit the funds directly into your account. You won't get the crisp bills in your hand immediately, but the money will be there, safe and sound.

Imagine you're expecting a government tax refund, and it comes as a non-negotiable check. You can usually deposit that directly into your checking account. The government is essentially saying, "Here's your money, and we trust our banking system to get it to you." It's like sending a very important, officially sealed letter – it goes directly to the recipient's mailbox, not to a random stranger.

What to Expect at the Bank:

When you go to deposit a non-negotiable check, the teller might ask a few questions. They might want to confirm that the check is indeed made out to you and that you have an account. They might also need to verify the issuer's information. This is all standard procedure to ensure that the funds go to the rightful owner. They're not trying to give you a hard time; they're just doing their job to protect both you and the bank.

It’s a bit like showing your ID to get into a special club. You’re proving you’re on the guest list. The bank is the bouncer, making sure only the invited get in.

3. The "Direct Deposit" Option (If Available):

Sometimes, especially with recurring payments or from larger institutions, you might have the option of setting up direct deposit. This means the funds will automatically be transferred to your bank account, bypassing the need for a physical check altogether. This is the ultimate in convenience, like having your favorite meal delivered right to your door without even having to call.

If you're receiving regular payments from an organization, it's always worth asking if they offer a direct deposit option. It’s usually a simple form to fill out, and once it’s set up, you can forget all about the check-cashing dance.

When Things Get a Little Tricky (And What to Do)

Now, there are always exceptions to the rule, and sometimes a "non-negotiable" check can be a bit more of a puzzle. Here are a few scenarios and how to navigate them:

a. The Mysterious Issuer:

What if you receive a non-negotiable check from someone or an entity you don't recognize? This is when you should proceed with caution. It's like getting a strange package in the mail – you wouldn't just open it blindly. Always verify the legitimacy of the issuer. If you're unsure, don't hesitate to contact your bank. They can often help you determine if the check is valid or if it might be part of a scam.

It’s always better to be safe than sorry. We’ve all heard stories about fraudulent checks, and a bit of diligence can save you a lot of headache.

b. Checks Marked "For Deposit Only":

Sometimes, a check might say "For Deposit Only" in addition to being non-negotiable. This is a clear instruction: the check must be deposited into a bank account. You won't be able to cash it for physical money. This is a security measure to ensure the funds are tracked and can’t be easily misused. Think of it as a highly secured digital vault for your money.

c. Government and Legal Documents:

Checks related to legal settlements, court orders, or government benefits can sometimes be non-negotiable. These often have specific instructions on how they should be handled. If you receive such a check, carefully read any accompanying documentation. If you’re still unsure, consulting with a legal professional or the issuing agency directly is your best bet. They can guide you through the specific procedures.

It's like receiving a complex instruction manual. You wouldn't try to assemble a spaceship without reading it, would you? These checks often come with their own user guides.

The Takeaway: Don't Panic, Just Ask!

So, the next time you spot that "non-negotiable" tag on a check, don't let it send you into a tailspin. It's not a roadblock; it's just a different path. Most of the time, it means the check is intended for your direct benefit and can be easily handled by depositing it into your bank account or by interacting with the issuing entity.

Remember, the world of finance can sometimes feel a bit like navigating a maze, but most of the people working in banks and businesses are there to help you. A friendly question to a bank teller or a quick call to the issuer can usually clear up any confusion. Think of it as unlocking a little puzzle, and the reward is getting your well-deserved funds!

So go forth, my friend, and confidently handle those non-negotiable checks. Your bank account (and maybe that extra scoop of ice cream) will thank you!