Guaranteed Installment Loans Direct Lenders Only

Hey there, friend! So, life throws us curveballs, right? Sometimes those curveballs are a little bigger than we expect, and suddenly we need a bit of extra cash. Maybe your trusty old car decided it was time for a well-deserved nap (right in the middle of your commute, naturally!), or perhaps that dream vacation you've been saving for suddenly became a lot more urgent. Whatever the reason, we've all been there, staring at our bank account and doing that slightly panicked mental math dance.

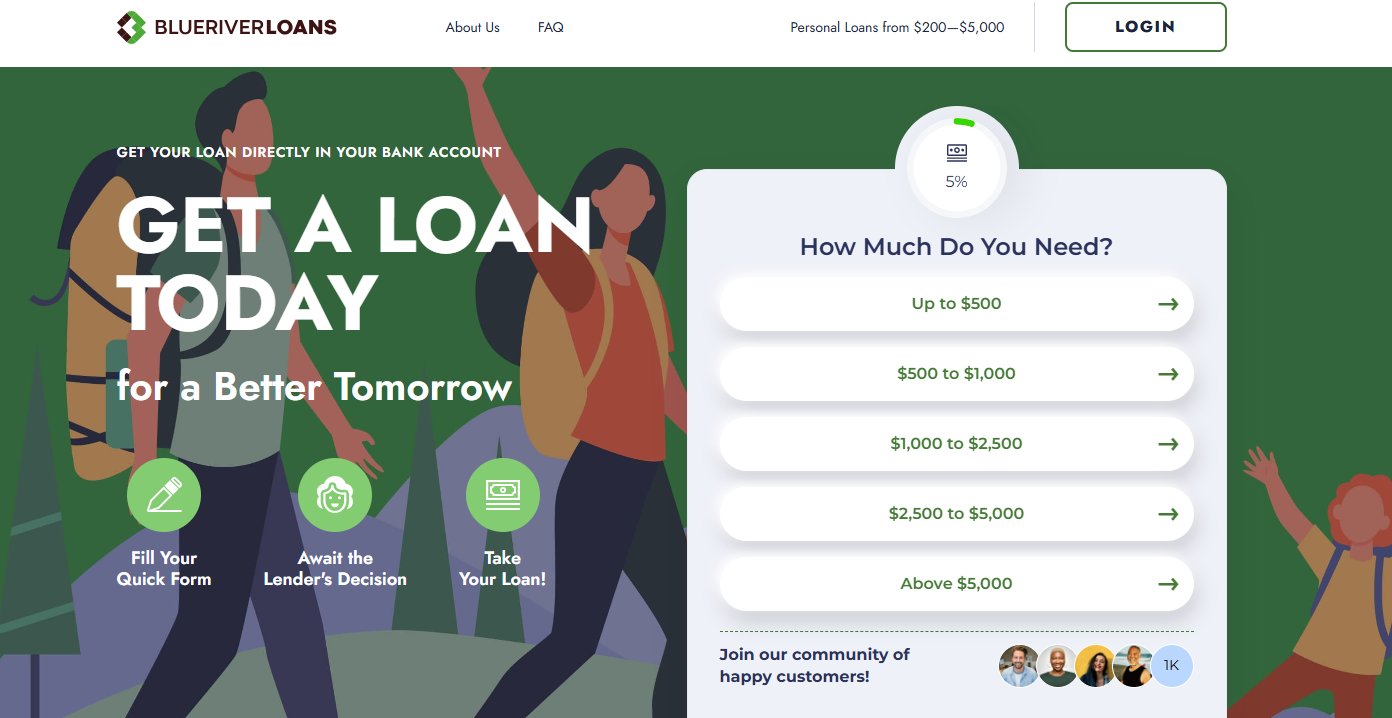

Now, when you're in a pinch, the last thing you need is a headache. And let's be honest, navigating the world of loans can feel a bit like trying to assemble IKEA furniture without the instructions – confusing and potentially frustrating. That's where the magic of guaranteed installment loans direct lenders only comes into play. Sounds a bit formal, doesn't it? Let's break it down, like we're sharing a coffee and dissecting the latest episode of our favorite show.

So, What Exactly is a "Guaranteed Installment Loan"?

Think of an installment loan as a loan you pay back in regular, predictable chunks. You know, like your phone bill or your Netflix subscription, but for a bigger purchase. These are the loans where you borrow a specific amount of money, and then you agree to pay it back over a set period, with each payment including a bit of the original loan amount (the principal) and some interest. It's like a friendly financial roadmap, showing you exactly where you're going and when you'll get there.

Now, about that "guaranteed" part. This is where things get really interesting, and honestly, a bit of a sigh of relief for your wallet. While no lender can truly guarantee a loan without any sort of application or credit check (that would be like a magic wand, and unfortunately, those are in short supply!), it generally means that if you meet the lender's basic criteria, your approval is highly probable. We're talking about a much higher chance of getting that "yes" than with some other types of loans. It’s like showing up to a party with an invitation versus just hoping they let you in!

"Direct Lenders Only" - Why Does That Matter?

This is another super important piece of the puzzle, and it's a biggie. When you see "direct lenders only," it means you're dealing directly with the company that's actually providing the money. No middleman, no brokers, no extra layers of bureaucracy that can often lead to more fees and confusion. Think of it as ordering pizza directly from the pizza place versus going through a third-party app. You usually get a more straightforward experience, and often, better pricing.

Imagine you need to ask your boss for a raise. You'd go to your boss, right? You wouldn't go to their assistant, then to their colleague, hoping they'd pass the message along. Dealing with a direct lender is similar – you're talking to the decision-maker, the one with the funds. This can often translate to a faster approval process and a more transparent journey.

The Perks of Going Direct

So, why is this "direct lender" thing so appealing? For starters, it usually means fewer fees. When you go through a broker, they need to get paid, and that cost often gets passed on to you. Direct lenders cut out that middleman, saving you money. Plus, they are the ones setting the terms and conditions, so you're getting the information straight from the horse's mouth, so to speak.

It also often means quicker processing times. Since there are fewer hands involved, the application and approval process can be significantly streamlined. You submit your application, they review it, and boom – you get your answer. This is especially clutch when you need funds sooner rather than later. Who wants to wait around for a loan when you've got a leaky faucet that's threatening to turn your bathroom into a mini-swimming pool?

What Kind of Situations Are These Loans For?

Okay, so you're probably wondering, "When would I even need one of these?" Well, the possibilities are pretty darn broad! These loans are fantastic for unexpected emergencies. That's the obvious one. Your furnace decides to take a permanent vacation in July? Ka-ching! You need a new appliance yesterday? Ka-ching again! They can be a real lifesaver when life decides to surprise you with a bill you weren't anticipating.

But it's not just about emergencies. These loans can also be incredibly helpful for planned expenses too. Thinking about a home renovation project that will finally get rid of that avocado-green kitchen you inherited from the 70s? Need to consolidate some higher-interest debts into a more manageable payment plan? Want to finally take that family trip to see the giant ball of twine you've always heard so much about? Installment loans from direct lenders can make those dreams a reality.

They offer a structured way to manage larger expenses, breaking them down into bite-sized pieces. It's like eating an elephant – you don't do it all at once, you do it one bite at a time. And these loans provide the perfect eating utensils!

What to Look For in a Direct Lender

Now, even though we're talking about "guaranteed" (with that important asterisk), you still want to be smart about who you choose. Not all direct lenders are created equal, just like not all pizza toppings are created equal (pineapple, anyone? shudder). Here's what to keep an eye out for:

Transparency is Key!

A good direct lender will be upfront and honest about everything. This means clear interest rates (APR – Annual Percentage Rate), reasonable fees (if any!), and a straightforward repayment schedule. There should be no hidden clauses or confusing jargon. If you feel like you need a decoder ring to understand their loan agreement, run for the hills!

They should also be clear about their eligibility requirements. What kind of credit score do they typically look for? What are the income requirements? Knowing this upfront saves you the disappointment of applying and getting denied. It's like checking the dress code before a fancy party – you don't want to show up in pajamas!

Reputation Matters

Do your homework! Look for lenders with a solid reputation. Read online reviews, check with consumer protection agencies, and see what other people are saying. A lender that consistently gets positive feedback is usually a safe bet. You want a lender who's known for treating their customers with respect, not for sending out a search party every time you miss a payment by a day.

A good lender will also have excellent customer service. If you have questions, you want to be able to reach them easily and get helpful answers. They should be there to guide you, not to make you feel like you're bothering them. Think of them as your friendly financial sherpas, guiding you up the mountain of debt repayment.

Fast and Efficient

Remember how we talked about speed? A good direct lender will have a streamlined application process. You should be able to apply online, often with minimal documentation. And the approval and funding process should be as quick as possible. If they're asking for your firstborn child and a lock of hair from your pet hamster, it's probably not the fastest option!

They'll also have clear communication about the timeline for funding. You shouldn't be left in the dark wondering when the money will actually land in your account. A little bit of certainty goes a long way when you're waiting for funds!

Understanding the "Guaranteed" Part (The Fine Print, Sort Of!)

So, let's circle back to that "guaranteed" word. As I mentioned, it's not a magic spell. Most direct lenders offering installment loans will have some form of credit assessment. This doesn't always mean a perfect credit score is required. Many lenders specialize in helping people who might have had a few financial bumps in the road. They understand that life happens!

What they're usually looking for is evidence that you can afford the repayments. This typically involves looking at your income, your existing debts, and your employment stability. They want to see that you have a reliable way to pay them back. It's like asking a friend to borrow their favorite sweater – they want to know you'll take care of it and give it back!

Some lenders might even offer loans for bad credit, but these often come with higher interest rates to compensate for the increased risk. It's a trade-off, but sometimes it's the only option available. The key is to find a lender whose terms you understand and can comfortably manage. Don't sign anything you're not 100% sure about!

What to Expect in the Application Process

The application itself is usually pretty straightforward. You'll likely need to provide:

- Personal Information: Your name, address, date of birth, etc. The basics, like filling out a birthday card.

- Employment Details: Where you work, how long you've been there, and your income. They want to know you have a steady income stream, like a reliable Wi-Fi connection.

- Bank Account Information: This is for depositing the loan funds and setting up your repayment schedule.

- Identification: Proof of who you are, like a driver's license or passport. Gotta make sure you're you!

Some lenders might ask for more detailed financial information, but it's usually all done online and securely. They're not trying to dig up dirt on your questionable reality TV viewing habits (unless, of course, that's impacting your finances significantly!).

The Payoff: A Brighter Financial Future

So, there you have it! Guaranteed installment loans from direct lenders – a straightforward way to get the funds you need when you need them. It’s about cutting out the middleman, getting clear terms, and moving forward with your financial goals, whether they're big or small, planned or unexpected.

Life is full of moments that require a little extra help, and sometimes, a financial boost is just what the doctor ordered. By understanding how these loans work and choosing a reputable direct lender, you can tackle those financial challenges with confidence. So go forth, explore your options, and remember that with a little planning and the right support, you can definitely turn those financial curveballs into home runs! You've got this!