Flat Dollar Amount Of Net Pay

So, let's talk money. Specifically, that magical number that shows up in your bank account after all the deductions and whatnot. You know the one. The flat dollar amount of net pay. It’s like the grand finale, right? The actual cash you get to play with. No more gross pay shenanigans, just the real deal. It’s kind of a sweet relief, don't you think? Like finally getting to the good part of a movie.

Think about it. You’ve worked your tail off. You’ve battled spreadsheets, answered a million emails, probably even brewed extra coffee to survive those meetings that could have been an email. And then, BAM! There it is. Your net pay. It's the tangible reward for all that hustle. The fuel for your dreams. Or, you know, for paying rent. Which, let's be honest, is also a dream for some of us. Ha!

And what exactly is this mysterious flat dollar amount? Well, it’s what’s left after the government takes its piece, your employer takes their piece (for things like health insurance and, dare I say, retirement dreams), and any other little bits that mysteriously vanish. It’s like a magic trick, where the money disappears before your very eyes, only to reappear in your account. Except, you know, it’s not actually magic. It’s just… payroll. Still, feels a bit like a conjuring act sometimes, doesn't it?

This flat dollar amount is pretty important, though. It’s your budget’s best friend. Or worst enemy, depending on how you look at it. It dictates whether you’re living the champagne-and-caviar life (hey, a girl can dream!) or the instant-ramen-and-sad-sad-salad life. No judgment here, we’ve all been there. Ramen is a culinary masterpiece in its own right, after all. Especially when you add that perfectly cracked egg.

It's funny how we get so fixated on this one number. We see it, we spend it (or try not to!), and we repeat. It’s the scorecard of our efforts, the tangible measure of our contributions. And while it's super important for, you know, survival and fun, sometimes I wonder if we focus too much on the net. What about the journey? The skills you learned? The amazing people you met? Those are pretty valuable too, wouldn't you agree?

But back to the money. This flat dollar amount. It’s a fixed thing. Usually. Unless your hours change, or you get a raise, or… well, you get the idea. But for a given pay period, it's a solid number. Predictable. Reliable. For better or worse. It’s the anchor in the stormy seas of variable expenses. And in a world that’s constantly shifting, a little bit of predictability is a good thing. A really good thing.

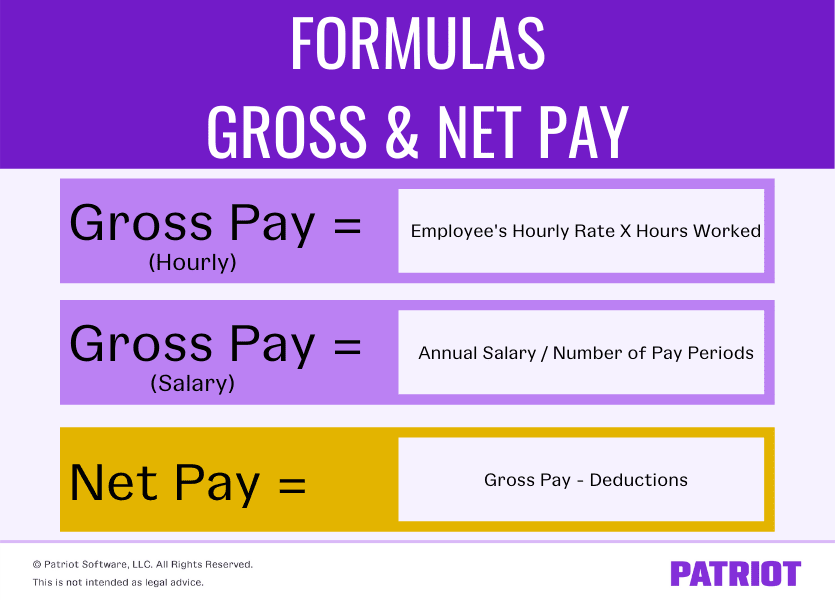

Let's break down what makes that number so… flat. We've got your gross pay, which is the big, juicy number before anything gets taken out. Think of it as the potential. The what if. It's the number you brag about to your friends when you’re feeling particularly optimistic. "Oh, yeah, I make X amount a year!" And then you don't mention the deductions. We've all done it. It's human nature, right?

Then come the deductions. Ah, the deductions. The villains in our money story. First up, taxes. Federal, state, local. It’s like a tax buffet, and you’re invited to sample all the flavors. It’s for the greater good, they say. Roads, schools, parks… and apparently, a whole lot of other things we don't always see. Still, it can feel like a significant chunk, can’t it? Makes you wonder if you should have become a professional pirate instead. Fewer taxes that way, I’m guessing.

And then there are the pre-tax deductions. These are the sneaky ones. They come out before taxes are calculated, which sounds good, right? Like a little tax break. But they’re still money coming out of your paycheck. Things like health insurance premiums. Retirement contributions (hello, 401k!). Sometimes even things like life insurance or disability. All important, all good for your future self, but they still shrink that flat dollar amount you see at the end.

So, you've got gross pay, minus pre-tax deductions, then taxes are calculated on that new lower number, and then you subtract any post-tax deductions. Post-tax deductions are less common, but they exist. Think things like union dues in some places, or garnishments (yikes!). It's a whole mathematical dance, and the final result is your precious net pay. The number that matters for your grocery list.

It’s fascinating how this system works, in a way. It’s designed to be somewhat standardized. Hence the "flat dollar amount." For most hourly workers, if your hours are consistent, your net pay will be pretty much the same each week or bi-weekly. For salaried folks, it's even more consistent, barring any overtime or bonuses. It provides a level of financial predictability that’s, frankly, essential for navigating life.

Imagine if your pay fluctuated wildly every single paycheck. How would you budget? How would you plan for anything? It would be chaos! A constant game of financial roulette. So, while we might sometimes grumble about the deductions, the resulting flat dollar amount of net pay is actually a lifeline for our financial sanity. It's the steady beat in the rhythm of our income.

And let’s talk about budgeting with that flat number. It’s a superpower, honestly. When you know exactly how much you have to work with, you can make smart decisions. You can allocate funds for bills, savings, fun money, the emergency fund (that all-important cushion!). It’s like having a clear map for your financial journey. No more wandering aimlessly through the land of "where did my money go?"

This flat dollar amount becomes the basis for so many decisions. Should I go out to dinner tonight? Can I afford that new pair of shoes? Is it time to finally start saving for that vacation I’ve been dreaming about? The answer to all of these hinges on that single, beautiful number. It’s the gatekeeper of your desires. And sometimes, it’s a stern gatekeeper.

But here's the thing: understanding your net pay is also about empowerment. When you know exactly what’s coming in, you’re in a much better position to negotiate your salary. You know what you need to earn to maintain your lifestyle, and what you'd like to earn to improve it. It gives you leverage. It’s like knowing the rules of the game before you start playing.

And for those who are self-employed or freelance? Well, the concept of a "flat dollar amount" might be a bit of a luxury. Your income can be as variable as a toddler's mood. But even then, the goal is to get to a point where your average net income provides some level of predictability. It’s about building a business that generates consistent revenue, even if the exact number shifts a bit.

So, next time you check your pay stub, take a moment to appreciate that flat dollar amount of net pay. It’s the result of a complex system, yes, but it’s also your financial reality. It’s what you’ve earned, after all the necessary bits and pieces have been accounted for. It’s your tool for building the life you want.

And if that number isn't quite what you'd hoped for? Don't despair! It’s a starting point. You can always look for ways to increase your gross pay (hello, side hustles and skill development!), or optimize your deductions (talk to a financial advisor, people!). It's not set in stone forever. It's a dynamic thing, influenced by your choices and your efforts.

Ultimately, that flat dollar amount is more than just a number on a screen. It's a symbol of your hard work, your financial responsibility, and your potential. It's the foundation upon which you build your financial future. So, go forth, understand your net pay, and use it wisely! And maybe, just maybe, treat yourself to that little something extra once in a while. You’ve earned it, right?

It's also worth noting that while the amount might be flat, the impact of that amount can be anything but. A $1000 net pay in one city can stretch much further than in another. The cost of living is a huge factor! So, while the number is flat, its purchasing power… well, that's a whole other conversation. But for the purposes of understanding your paycheck, the flat dollar amount is your key metric.

And let's not forget the psychological aspect. Seeing that consistent, predictable number can be incredibly comforting. It reduces financial anxiety, which is a real thing, and allows for better long-term planning. Knowing you’ll have roughly the same amount to work with each month is a huge relief for many people. It allows for a sense of control in a world that often feels out of our hands.

So, there you have it. The humble, yet mighty, flat dollar amount of net pay. It's the culmination of your efforts, the result of a structured system, and your primary tool for navigating the financial landscape. Embrace it, understand it, and use it to build the life you desire. And hey, if you ever find a way to make that flat dollar amount magically increase without any extra work, please, please share your secret. We’re all ears!

It’s kind of like a really good loaf of bread. You can’t just eat the flour, right? You need to bake it, slice it, and then enjoy it. Your gross pay is the flour, and your net pay? That’s the delicious, ready-to-eat bread. Makes perfect sense, doesn’t it? So, enjoy your bread! And remember, it’s all about that delicious, reliable, flat dollar amount.

Think of it as your personal financial compass. It points you in the direction of what you can realistically achieve. It’s not always going to lead you to a treasure chest of gold, but it will guide you towards responsible decisions and achievable goals. And in the grand scheme of things, that’s pretty darn valuable. More valuable than gold, sometimes. Especially when you need to buy groceries.

So, cheers to your net pay! May it always be a number you can count on, and a number that allows you to live a fulfilling and happy life. Even if it means a few more ramen nights than you’d ideally like. We've all got our journeys, and that flat dollar amount is just one part of yours. Keep hustling, keep dreaming, and keep an eye on that number!