Fiscal Policy Involves Increases Or Decreases In

Ever wondered why sometimes it feels like the government is splashing cash on new projects, and other times it's a bit more… thrifty? It’s all thanks to something called fiscal policy. Think of it as the government’s way of using its wallet to steer the economy. And honestly, it’s not as dry as it sounds. Understanding it can give you a pretty neat peek into why certain things happen in the world around you, from the price of your morning coffee to the job market in your town.

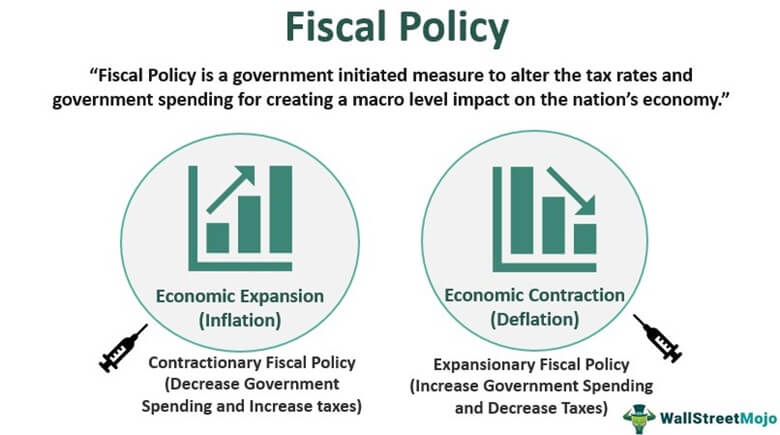

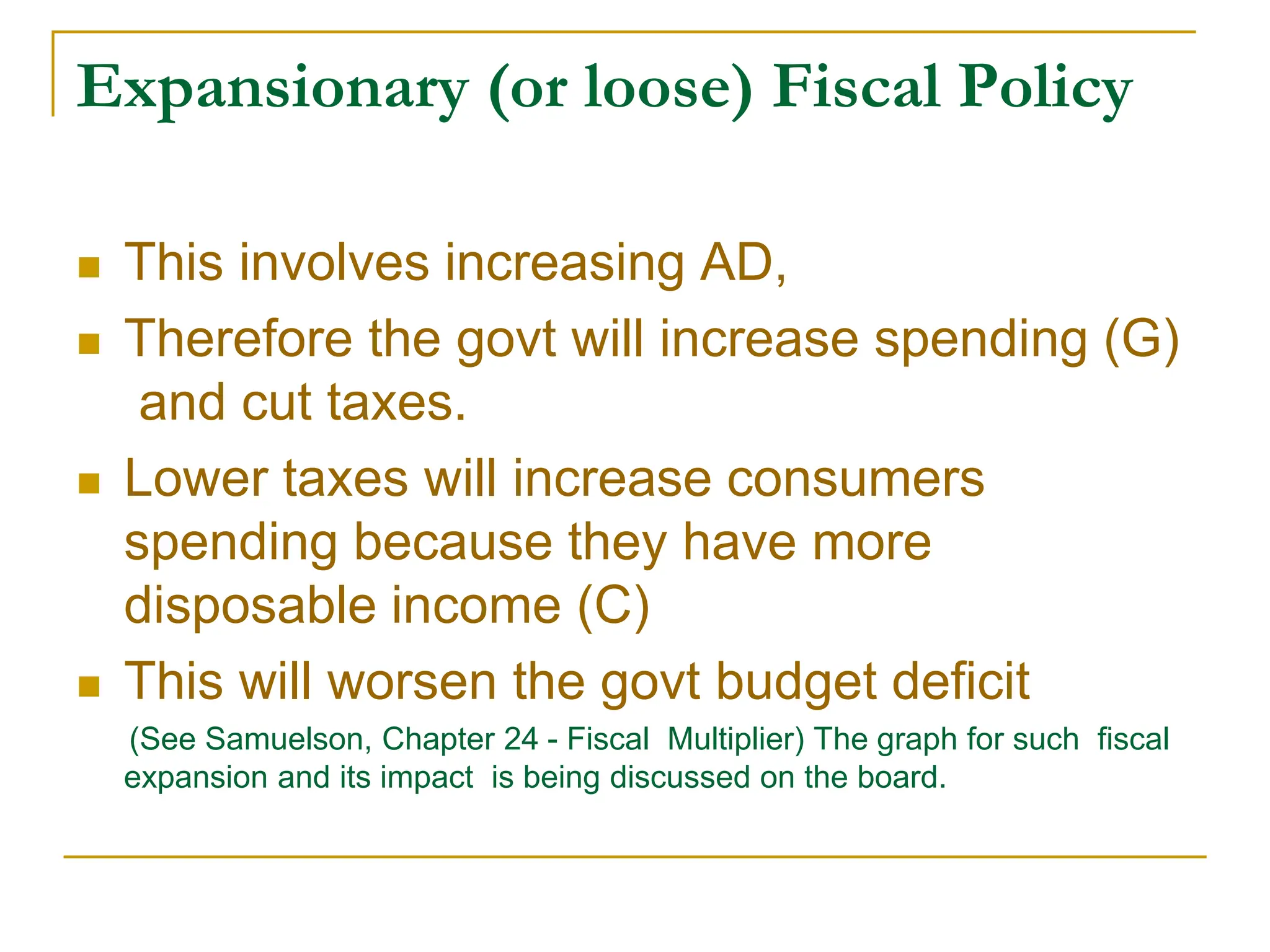

So, what exactly is this fiscal policy? In a nutshell, it involves the government making increases or decreases in two main things: government spending and taxation. When the government decides to spend more (think infrastructure projects, schools, or healthcare), that’s one side of fiscal policy. On the other hand, when they decide to raise or lower taxes for individuals and businesses, that’s the other side.

The big purpose behind all this is to keep the economy on an even keel. When things are humming along nicely, fiscal policy might aim to prevent the economy from overheating. When times get tough, like during a recession, the government might use fiscal policy to give the economy a much-needed boost. The benefits are pretty straightforward: a more stable economy generally means more jobs, lower inflation, and a better quality of life for everyone.

You might be surprised how often you encounter fiscal policy concepts, even if you don't realize it. In education, for instance, discussions about school funding, teacher salaries, or the cost of college tuition are often tied to government spending decisions. When you read about tax breaks for small businesses or stimulus checks for citizens, you’re seeing fiscal policy in action in daily life. It influences everything from the interest rates on your loans to the availability of public services you rely on.

Curious to learn more without needing a degree in economics? Start by paying attention to the news. When you hear about budget debates or new tax laws, take a moment to consider what the intended impact might be. You can also look for simpler explanations online; many reputable sources break down economic concepts in an easy-to-digest way. For example, searching for “how government spending affects jobs” or “what are the benefits of lower taxes” can open up a world of understanding.

Another simple way to explore is to think about your own household budget. Just like you decide whether to spend more on a vacation or save for a rainy day, governments make similar, albeit larger-scale, decisions. This relatable comparison can make the abstract concept of fiscal policy feel much more concrete. So, the next time you hear about government budgets or tax changes, remember that it’s all about those strategic increases or decreases designed to shape our collective economic journey.