Do Student Loan Payments Affect Credit Score

Let's talk about something that might sound a little serious, but honestly, it's pretty fascinating and super useful for pretty much everyone! We're diving into the world of student loans and how they interact with your credit score. Think of it like a financial detective story – figuring out the clues that make your credit report tick. It's popular because, let's face it, many of us have or will have student loans, and understanding their impact is a smart move.

Why is this important? Well, imagine you're a beginner just starting out, maybe fresh out of college. Knowing how your student loan payments affect your credit can help you build a strong financial foundation from day one. For families, it's about setting a good example and understanding how these loans can impact future big purchases, like a home. And if you're a hobbyist of financial wellness, this is just another piece of the puzzle to master!

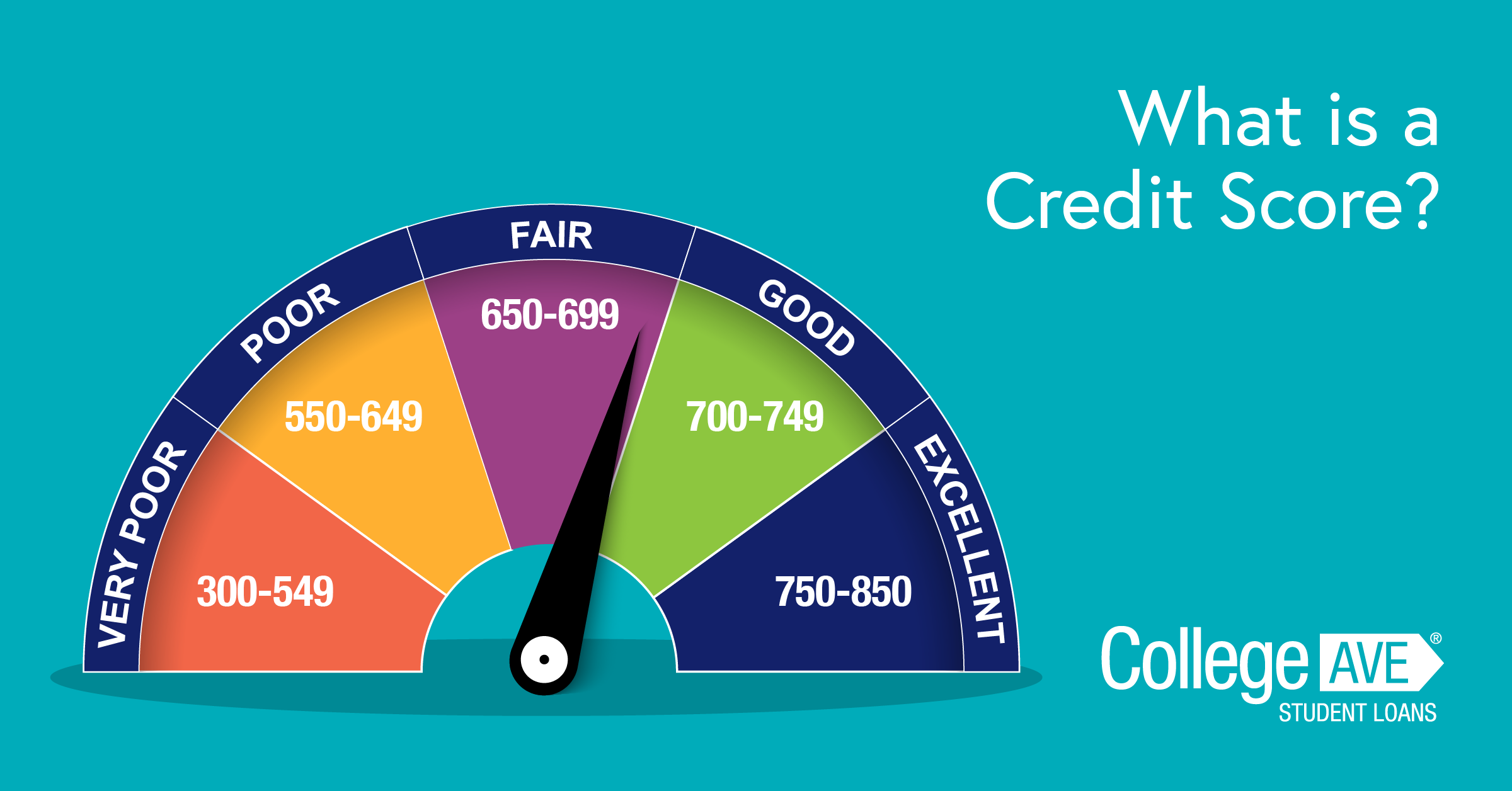

The core idea is simple: when you have a student loan, it's a form of debt. Like any other debt, like a car loan or a credit card, how you manage it is reported to the credit bureaus. This reporting directly influences your credit score.

So, how do payments affect your score? The biggest factor is payment history. Making your student loan payments on time, every time, is a huge win for your credit. It shows lenders you’re responsible. Conversely, missing payments or paying late can really ding your score. It's like a consistent "A" grade versus a "D" – the difference is significant!

There are different types of student loans, and they all play by similar rules regarding credit. Whether it's federal loans with flexible repayment plans or private loans with fixed terms, the impact on your credit is largely determined by your payment behavior. Even things like deferment or forbearance, while helpful in the short term, can sometimes affect how your loan is reported, so it’s worth understanding the nuances.

Let's think about a few scenarios. A student diligently makes their $200 monthly payment for five years. This consistent, on-time payment history will likely build a positive track record, making it easier to qualify for a mortgage later. On the flip side, someone who struggles and misses a few payments might see their credit score drop, making future borrowing more expensive or even impossible.

Getting started with understanding this is easy. First, know your loans. What's the balance? What's the interest rate? What's the due date? You can usually find this information through your loan servicer's website. Second, set up automatic payments. This is probably the easiest way to ensure you never miss a due date. It takes the guesswork out of it and is a fantastic habit to build. Finally, monitor your credit. You’re entitled to free credit reports annually from each of the major bureaus. Checking them helps you see how your student loan payments are being reflected.

In the end, understanding how student loan payments affect your credit score isn't just about avoiding problems; it's about unlocking opportunities. It's a key to financial freedom and a genuinely rewarding part of taking control of your financial journey. It’s a little bit of knowledge that pays off big!