Difference Between Chapter 13 And Chapter 11

So, you've found yourself in a bit of a financial pickle. Life happens, right? Unexpected medical bills, a job loss, or maybe just a series of unfortunate (and expensive) events. It's a situation that many of us can relate to, and while it can feel overwhelming, the good news is there are established pathways to help you navigate these choppy waters. Think of it like this: when your favorite video game gets a bit too challenging, you don't just give up; you look for walkthroughs, power-ups, or maybe even a cheat code to get you back on track. Similarly, when your finances get complicated, there are legal "game plans" designed to help you win back control.

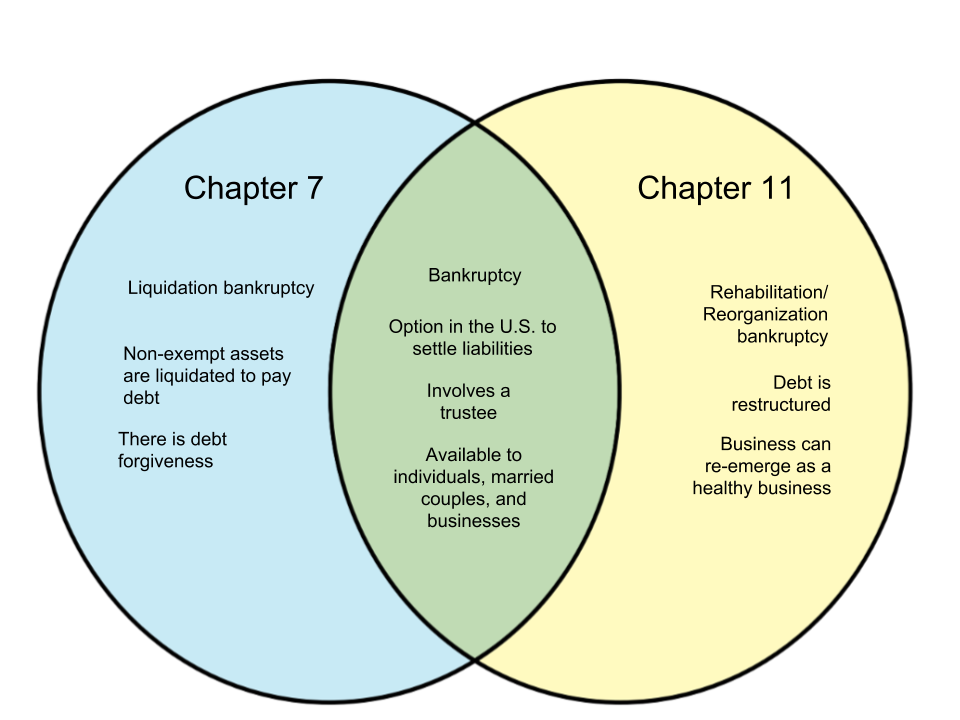

These "game plans" are often referred to as bankruptcy filings, specifically Chapter 13 and Chapter 11. While they both aim to provide relief and a fresh start, they're designed for different players on the financial battlefield. Understanding their unique strengths can be the key to choosing the right strategy for your situation.

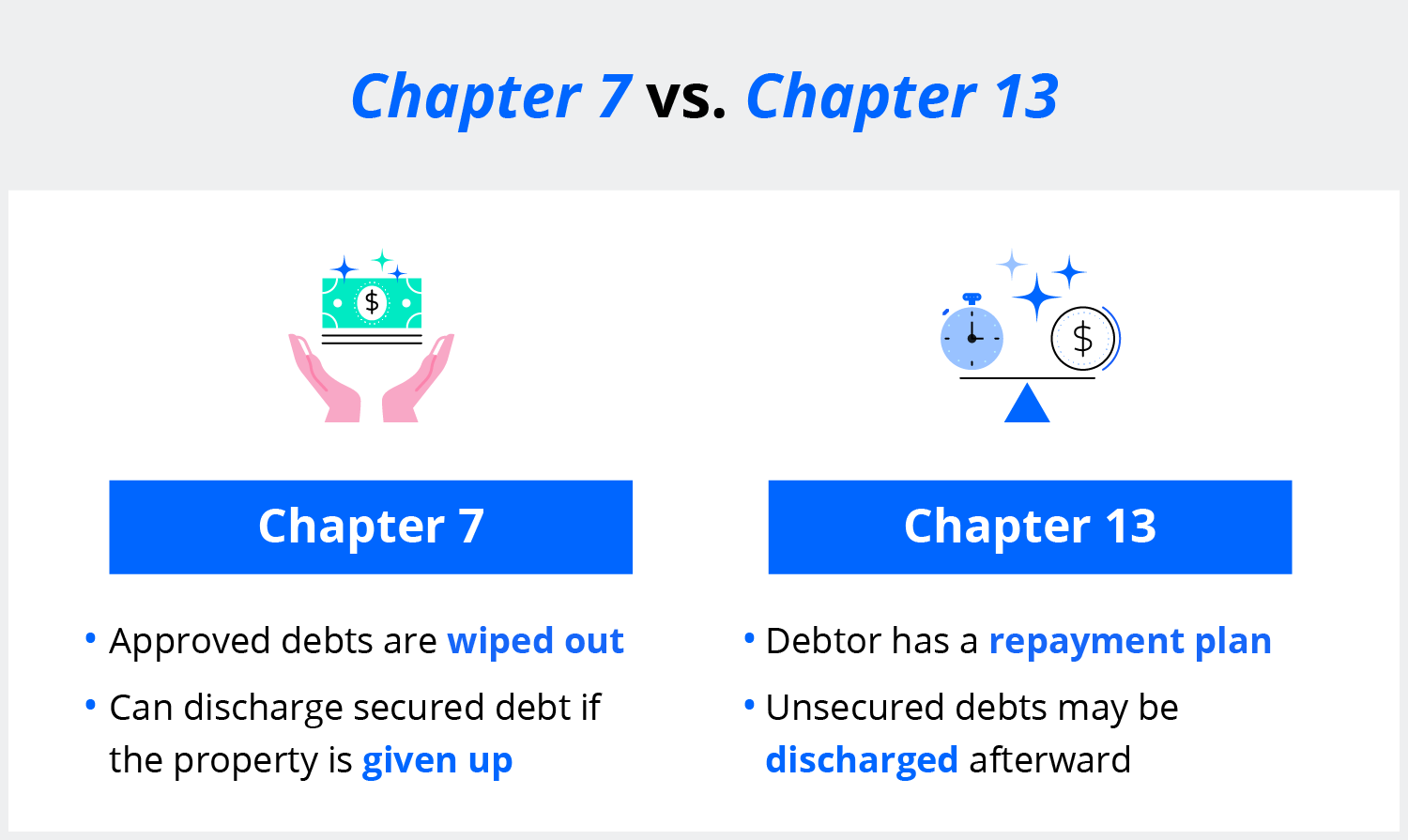

Let's start with Chapter 13, often called the "wage earner's plan." This is generally for individuals or sole proprietors with regular income. The primary purpose of Chapter 13 is to allow you to catch up on missed payments and repay a portion of your debts over a structured period, typically three to five years. Imagine it as a personalized repayment schedule negotiated with your creditors, overseen by the court. This can be incredibly beneficial if you have a steady income and want to keep valuable assets like your home or car, which you might risk losing in other scenarios.

Common examples of when Chapter 13 shines include situations where you've fallen behind on mortgage payments and want to avoid foreclosure, or if you have significant secured debt you want to restructure. It's about reorganizing your finances to make them manageable again, giving you a roadmap back to stability. You're essentially saying, "I can pay this, but I need a little more time and a structured plan."

Now, let's look at Chapter 11. This is typically the go-to for businesses, although individuals with very large debts or complex financial situations can also utilize it. Chapter 11 is more about reorganization and restructuring. It allows a business to continue operating while developing a plan to repay its creditors. Think of it as a company hitting the "pause button" to figure out how to become profitable again.

The main benefit of Chapter 11 is its flexibility. It allows for significant changes to operations, debts, and contracts, aiming to make the entity viable in the long run. It's a powerful tool for keeping businesses alive and protecting jobs, even during difficult times. For individuals, it might be used to handle extremely high levels of debt that exceed the limits of Chapter 13.

So, what are the key differences? Primarily, it's about who is using the filing and the scope of the reorganization. Chapter 13 is for individuals with regular income focused on catching up and keeping assets. Chapter 11 is broader, often for businesses, allowing for significant restructuring to ensure future viability.

To enjoy these "financial game plans" more effectively, the most crucial tip is to seek professional guidance. Navigating bankruptcy laws can be complex, and a qualified attorney can assess your unique situation and recommend the best path forward. They can help you understand the intricate rules, prepare the necessary paperwork, and represent your interests. Don't try to go it alone; think of them as your expert guide through the financial maze. Remember, these tools are there to help you get back on solid ground, so understanding them is the first step to regaining control.