Can You Put Stocks In A Trust

Ever looked at your favorite company's stock ticker and thought, "You know, this Apple pie of a company would taste even better if it was tucked away safely for my grandkids?" Well, guess what? You're not alone, and the answer to whether you can put those precious shares into a trust is a resounding, drumroll please... YES! It's like giving your investments a cozy, personal blanket, especially for the people you care about most.

Imagine your stock portfolio is a delightful collection of tiny, grown-up action figures. You’ve carefully acquired them over the years, each representing a piece of a company you believe in, from the fast-paced world of Amazon to the reliable hum of a utility company. Now, what if you wanted to make sure these little guys weren't just left to fend for themselves in the wild jungle of the stock market after you’ve… well, moved on to greener pastures? That’s where a trust swoops in, like a superhero cape for your investments!

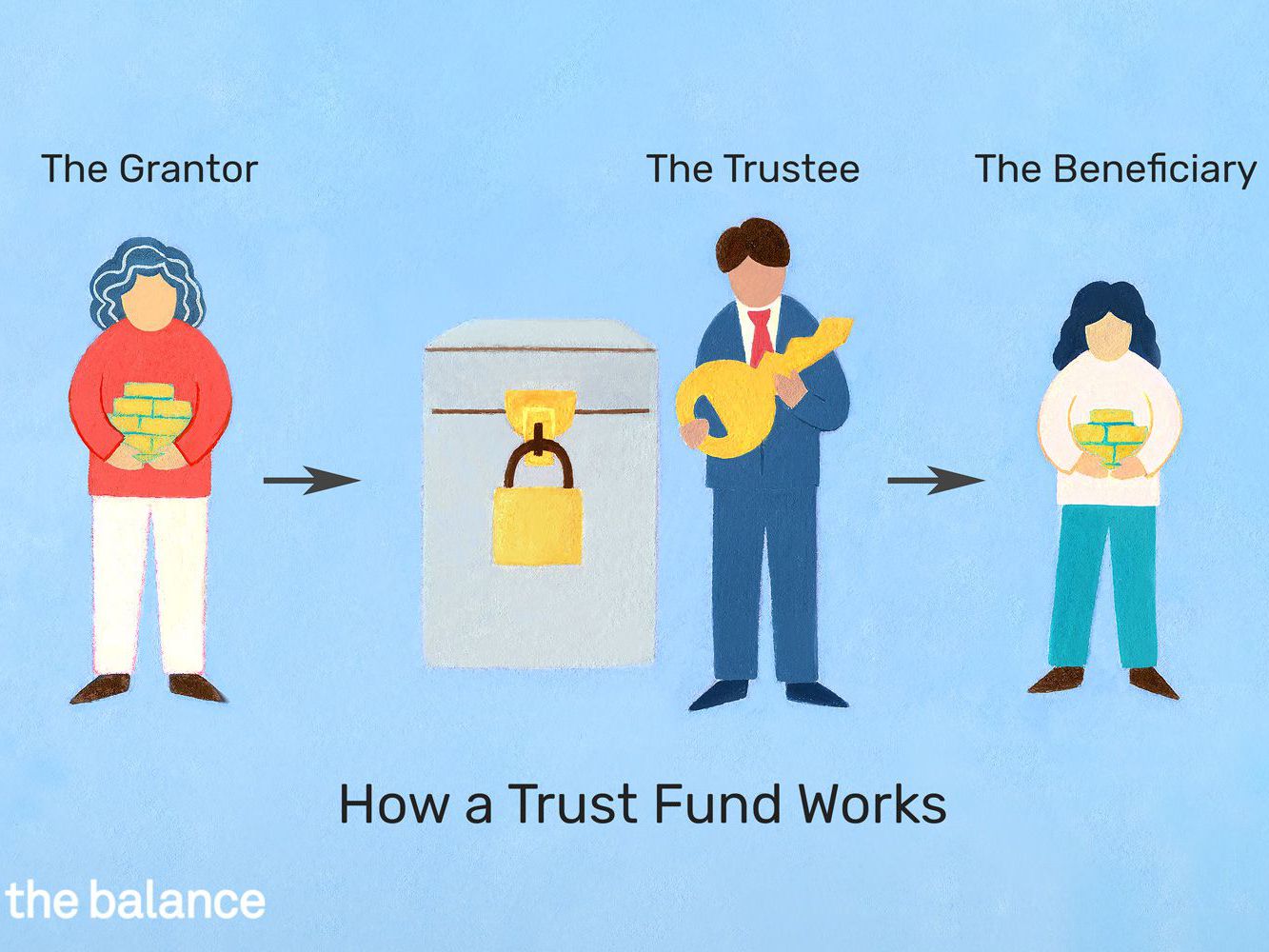

Think of a trust as a special club, with you as the founder. You invite your stocks to join this club, and you set the rules. Who gets to play with them? When can they start playing? And what kind of games are they allowed to play? It’s all in your hands. It’s not about hiding your money away in a dusty attic; it’s more like curating a private art gallery for your future art lovers.

Let’s say you have a soft spot for Disney, and your dream is for your nieces and nephews to inherit your love for animated classics and maybe even a few shares to get them started on their own financial adventures. Instead of just leaving them in your will, which can sometimes feel like a game of musical chairs with paperwork, you can put them in a trust. This trust can be set up to give them the shares when they reach a certain age, maybe when they’re old enough to understand the magic of compound interest, or perhaps even before they start their own families. It’s like sending them a surprise birthday present that keeps on giving, year after year.

And it’s not just for the younger generation! Perhaps you have a friend who’s been through thick and thin with you, and you want to ensure they receive a little something special. You can set up a trust to gift them some of your well-performing Google stocks, not as a lump sum that might disappear like a magic trick, but perhaps with instructions for them to receive dividends over time, a steady stream of appreciation for your friendship.

The really heartwarming part is the peace of mind it can bring. Knowing that your carefully chosen investments are being looked after, according to your wishes, is a huge relief. It’s like knowing your beloved pet is going to a loving home when you can no longer care for them. You’ve invested not just money, but time, research, and belief into these companies. A trust helps ensure that legacy lives on, thoughtfully and intentionally.

Now, you might be picturing a stern-faced lawyer handing over piles of dusty documents. While there's a bit of paperwork involved, it's more about setting up a thoughtful plan than navigating a labyrinth. It’s about creating a clear path for your assets, a well-trodden trail that leads to your chosen beneficiaries without unnecessary detours. Think of it like planning a beautiful road trip for your money, complete with designated stops and scenic overlooks.

One of the surprisingly fun aspects is the flexibility. You can design your trust to be as straightforward or as intricate as you like. Want your future grandchild to receive shares of Tesla only after they've proven they can parallel park perfectly? You can write that in! Okay, maybe not that specific, but you get the idea. You can tie distributions to milestones, to education, or simply to a calendar date. It’s your story, and your trust is the narrator, guiding your financial narrative for years to come.

It’s like planting a financial tree that will provide shade and fruit for generations. You get to choose the seeds, the soil, and the watering schedule!

Passive vs. active income: What's the difference, and how can you make

So, while the idea of putting stocks in a trust might sound a bit serious, it’s actually a wonderfully kind and forward-thinking way to manage your investments. It’s about extending your care and good intentions beyond your own lifetime, ensuring that the companies you’ve supported continue to benefit the people you love. It’s a way to say, "I believed in this future, and I want you to be a part of it too," in a language that transcends words – the language of enduring value and thoughtful generosity. It’s a way to make your investments not just numbers on a screen, but living legacies, ready to bring a smile, a helping hand, or even a touch of magic to those who matter most.