Can You Get Both Ssdi And Ssi

So, picture this: my neighbor, bless her heart, Mrs. Gable. Sweetest lady, always has a smile and a plate of her legendary lemon bars. She’s been dealing with some pretty significant health issues lately, and it’s been a struggle, you know? She’s not working, and things are tight. Anyway, one afternoon, while I was helping her haul in some groceries, she sighed and said, “I’m just so confused about all this government stuff. They keep talking about SSDI and SSI. Can you even get both? It feels like I’m drowning in paperwork and acronyms.”

And honestly? I felt that. That feeling of being completely overwhelmed by a system that’s supposed to help you. It’s enough to make anyone’s head spin, right? So, Mrs. Gable’s question got me thinking, and honestly, it’s a question a lot of people probably have but are too embarrassed or too tired to ask. Can you, in fact, get both SSDI and SSI? Let’s dive in and see if we can untangle this bureaucratic knot. (Spoiler alert: It’s not as simple as a yes or no, but it’s definitely possible!)

First off, let’s break down these two big, scary acronyms. Think of them as two different pathways to financial assistance from the Social Security Administration (SSA) if you can no longer work due to a medical condition. They sound similar, and they both come from the same government agency, but they have some pretty key differences. It’s like having two different doors to the same house, but one door has a fancy doorknob and the other is a bit more… basic.

SSDI: The Disability Insurance Story

SSDI stands for Supplemental Security Income. Wait, no, that’s not right! See what I mean? Even I get them mixed up! SSDI actually stands for Social Security Disability Insurance. There, got it. This is a program for people who have a qualifying disability and have a work history with enough work credits. Think of work credits like little points you earn by paying Social Security taxes while you’re employed. The more you’ve worked and paid into the system, the more credits you accumulate.

So, if you’ve worked for a significant period of your life and then become disabled, SSDI might be your ticket. It’s funded by Social Security taxes paid by workers and employers. The amount you receive through SSDI is generally based on your average lifetime earnings before you became disabled. It’s designed to replace a portion of the income you lost due to your disability. Pretty straightforward, right? Well, as straightforward as government programs ever are.

Here’s the kicker: To qualify for SSDI, you need to meet the SSA’s strict definition of disability. They look at whether your medical condition is expected to last for at least 12 months or result in death, and if it prevents you from doing substantial gainful activity (SGA). SGA is basically a fancy term for working and earning a certain amount of money per month. That amount changes annually, so it’s always a moving target. You’ll likely have to go through a rigorous application process, providing extensive medical records and possibly undergoing medical examinations. It can be a long and often frustrating journey.

SSI: The Needs-Based Safety Net

Now, let’s talk about SSI. This one stands for Supplemental Security Income. Ah, there’s the other one! Unlike SSDI, SSI is a needs-based program. This means it’s for individuals who have little to no income and resources, and who are disabled, blind, or aged (65 or older). It doesn't require a work history at all. So, if you’ve never worked, or haven’t worked enough to earn the necessary work credits for SSDI, SSI might be an option for you.

SSI is funded by general tax revenues, not Social Security taxes. The benefit amounts are set by federal law and are generally lower than SSDI payments. However, SSI recipients may also be eligible for state supplements, which can increase the total monthly payment. This program is designed to provide a basic safety net for those who are most vulnerable and have limited financial means.

The eligibility criteria for SSI also involve meeting the SSA’s definition of disability (or blindness, or being age 65+). But, in addition to the disability requirement, you must also meet strict income and resource limits. This means the SSA will look at your savings, bank accounts, property (other than your primary home), and any income you receive from other sources. If your assets or income are above a certain threshold, you won’t qualify for SSI, even if you’re disabled.

So, Can You Really Get Both?

Okay, drumroll please… The answer is a resounding yes, you can sometimes receive both SSDI and SSI. This is often referred to as being a "concurrent” recipient. But, and this is a pretty big “but,” it’s not automatic and it’s not for everyone.

How does this work, you ask? Well, imagine you qualify for SSDI, but your monthly SSDI benefit is quite low. Perhaps you only worked part-time for a few years, or you had periods of unemployment. Your SSDI payment might be less than the maximum federal benefit rate for SSI. In these situations, you might be eligible to receive SSI benefits to supplement your SSDI income, bringing your total monthly income up to a certain level.

The SSA will calculate your SSDI benefit. If that amount is below the SSI federal benefit rate, and you meet all the other SSI eligibility requirements (like the income and resource limits), you could get both. Think of it like this: SSI acts as a booster to your SSDI if your SSDI alone isn't enough to cover your basic needs.

However, there are some important caveats to understand. The SSA has specific rules about how these benefits interact. When you receive both, your SSDI benefit will reduce the amount of SSI you receive. The SSI payment is calculated by taking the maximum federal benefit rate and subtracting your countable income, which includes your SSDI benefit. So, you won’t end up with a windfall; the SSI is purely to bridge the gap.

It’s also crucial to remember that the income and resource limits for SSI are very strict. Even if your SSDI benefit is low, if you have any savings or other income that puts you over the SSI limits, you won’t qualify for the supplemental portion. This is where things can get a bit tricky and why understanding the details is so important.

Who is Likely to Qualify for Both?

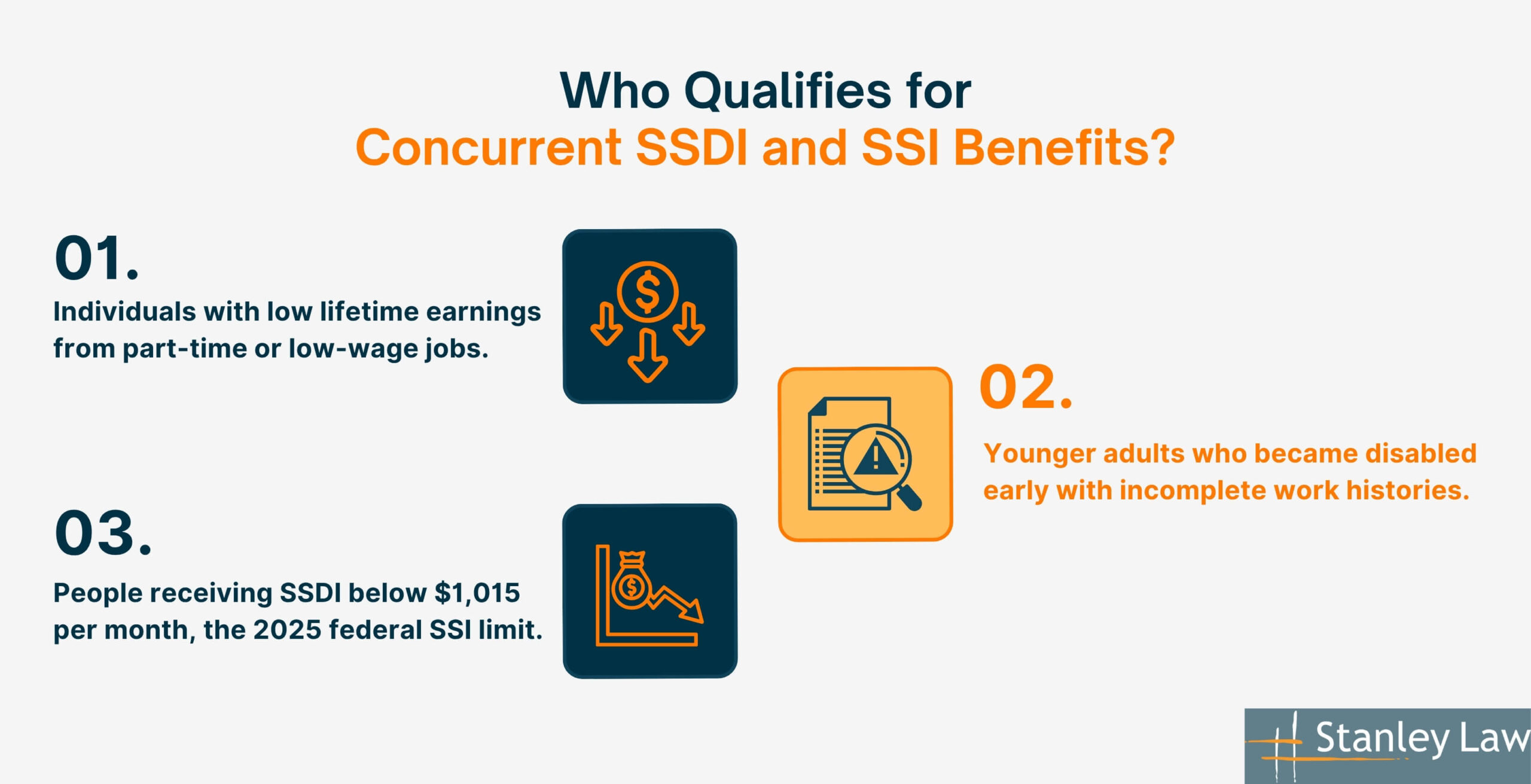

Generally, individuals who are most likely to receive both SSDI and SSI are those who:

- Have a qualifying disability. (This is the non-negotiable for both programs!)

- Have a limited work history, resulting in a low SSDI benefit amount.

- Have very low income and resources that meet SSI’s strict limits.

- Are unable to engage in substantial gainful activity.

Think about someone who might have had a chronic illness or disability from a young age, worked sporadically for a few years, and then had their condition worsen to the point where they can no longer work. They might have earned enough work credits for a small SSDI benefit but still struggle financially. In this scenario, SSI could provide that much-needed supplement.

Another example could be someone who worked for many years but experienced a period of long-term unemployment or a significant layoff before becoming disabled. Their work credits might be sufficient for SSDI, but if their average earnings were not extremely high, their SSDI benefit might be modest.

The Application Process: A Marathon, Not a Sprint

Applying for SSDI and SSI, especially for both simultaneously, is a process that requires patience, persistence, and a good dose of organization. You can apply for both at the same time by filling out the relevant applications. The SSA often uses the same application forms for disability claims, and they will determine your eligibility for both programs based on the information you provide.

Key steps and considerations include:

- Gathering Medical Evidence: This is paramount. You’ll need detailed medical records from all your doctors, hospitals, therapists, and any other healthcare providers you’ve seen. This documentation needs to clearly show your diagnosis, treatment history, and how your condition limits your daily activities and ability to work.

- Completing the Forms Accurately: Be thorough and honest on all application forms. Missing information or inconsistencies can lead to delays or denials.

- Understanding Work History: For SSDI, you’ll need to provide details about your past employment, including dates of employment, job titles, and descriptions of your duties.

- Disclosing Income and Resources: For SSI, be prepared to provide a complete and accurate picture of all your income and resources, no matter how small. This includes cash, bank accounts, stocks, bonds, and any property you own.

- Being Prepared for Medical Exams: The SSA may require you to undergo Consultative Examinations (CEs) with doctors they choose. These are to evaluate your condition from their perspective.

- Appealing if Necessary: It’s a sad reality that many initial disability claims are denied. If this happens to you, don’t give up! The appeals process is your right, and many people are approved on appeal.

It’s also a good idea to keep detailed records of everything: who you speak to at the SSA, what they say, dates of appointments, and copies of all documents you submit. A binder or a digital folder can be your best friend.

Why It Matters: The Financial Reality

For someone living with a disability, the ability to receive both SSDI and SSI can be a lifeline. The amounts from either program alone might not be enough to cover essential living expenses like rent, food, utilities, and medical care. Combining them, even with the reduction in SSI due to the SSDI payment, can provide a more stable financial footing.

Imagine living on just a few hundred dollars a month. It’s a nearly impossible scenario in most parts of the country. The dual benefits, while still modest, can make the difference between homelessness and having a roof over your head, between starving and being able to afford basic necessities. It’s about dignity and the ability to manage your condition without the constant, crushing weight of financial insecurity.

Furthermore, receiving SSI often comes with eligibility for Medicaid, which provides essential healthcare coverage. If you qualify for SSDI but your state’s Medicaid program has different eligibility rules, or you don’t automatically qualify, getting SSI can open the door to vital medical treatment. This is a huge benefit, as managing a disability often requires ongoing and sometimes expensive medical care.

SSDI recipients also eventually become eligible for Medicare, but there’s typically a 24-month waiting period after you’ve been approved for SSDI. So, if you need health insurance sooner, SSI’s Medicaid eligibility can be a critical bridge.

Common Pitfalls and What to Watch Out For

Navigating the Social Security system is notoriously complex. Here are a few common pitfalls:

- Not Disclosing All Income/Resources: Even small amounts from odd jobs, gifts, or family members can affect SSI eligibility. Be completely transparent.

- Missing Deadlines: The SSA has strict deadlines for appeals and submitting information. Missing them can mean your claim is closed.

- Not Providing Enough Medical Evidence: The SSA relies heavily on medical documentation. If your records don’t clearly show the severity and impact of your condition, your claim may be denied.

- Giving Up Too Soon: As mentioned, denial is common. Persistence is key.

- Not Understanding the Interaction: Believing you’ll get the full SSDI amount plus the full SSI amount is a misunderstanding. The SSI is reduced.

It’s also worth noting that the SSA has specific rules about who is considered disabled. They use a five-step sequential evaluation process to assess disability claims. This involves looking at whether you are currently working, the severity of your medical condition, whether your condition meets or medically equals a listing in their “blue book” (a catalog of disabling conditions), whether you can do the work you did in the past, and whether you can do any other type of work. It’s a tough standard.

Seeking Help: You Don’t Have to Go It Alone

Given the complexity, it’s often highly recommended to seek professional help. Disability advocates or attorneys who specialize in Social Security claims can be invaluable. They understand the system, know what evidence is needed, and can guide you through the application and appeals process.

Many disability advocates work on contingency, meaning they don’t get paid unless you win your case. This makes their services accessible to those with limited financial resources. They can be the voice you need when you’re too overwhelmed to speak for yourself.

So, to circle back to Mrs. Gable. Her question, “Can you get both SSDI and SSI?” is a valid and important one. The answer is yes, under specific circumstances, and it’s a crucial lifeline for many who are struggling with disability and financial hardship. It’s a complex system, no doubt, but understanding the basics is the first step to navigating it successfully.

If you find yourself in a similar situation, remember that you’re not alone. Take a deep breath, gather your information, and don’t be afraid to ask for help. The goal is to secure the support you need to live with dignity and as much comfort as possible when facing the challenges of a disability.