Bollinger Bands Trend Indicator Tradingview Pdf

Ever feel like the stock market is just a giant, unpredictable game? Yeah, me too. Sometimes it’s like trying to guess what your cat is thinking. But what if I told you there are some pretty cool tools that can make it a little less… random? And one of them is hiding in plain sight on TradingView, looking all official. I’m talking about Bollinger Bands.

Now, the name itself sounds a bit fancy, right? Like something you’d order at a Michelin-star restaurant. But don't let that fool you. Bollinger Bands are actually pretty straightforward. Think of them as a little visual party happening around the price of a stock. They’re like a set of fuzzy, hugging lines that dance with the price.

These bands were cooked up by a guy named John Bollinger. He’s like the Gandalf of charting, you know? He saw the market’s wiggly-wobbly nature and thought, "There's gotta be a way to make sense of this chaos!" And voilà, Bollinger Bands were born.

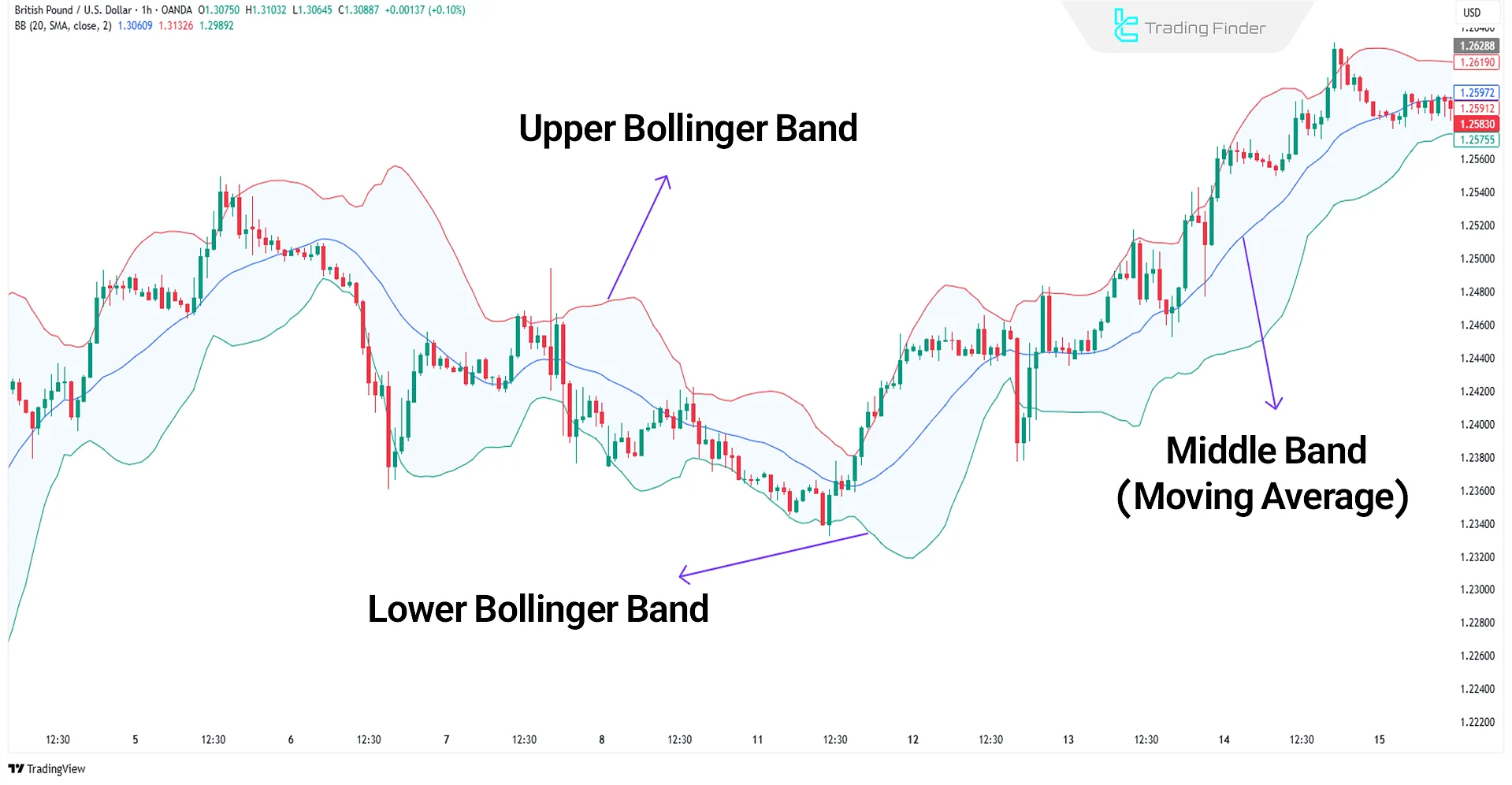

So, what are these magical bands? Basically, it's a price chart with three lines plotted on it. You've got the middle band. This one’s usually a simple moving average. Think of it as the steady friend in the group. It’s the average price over a certain period, so it moves slower than the wild price action. It gives you a general sense of the trend.

Then you have the upper band and the lower band. These are the exciting ones! They’re calculated based on the middle band, but with a bit of extra oomph – they’re a set number of standard deviations away from that middle band. Standard deviation? Sounds complicated, but just think of it as a measure of how much the price is spreading out or deviating from its average.

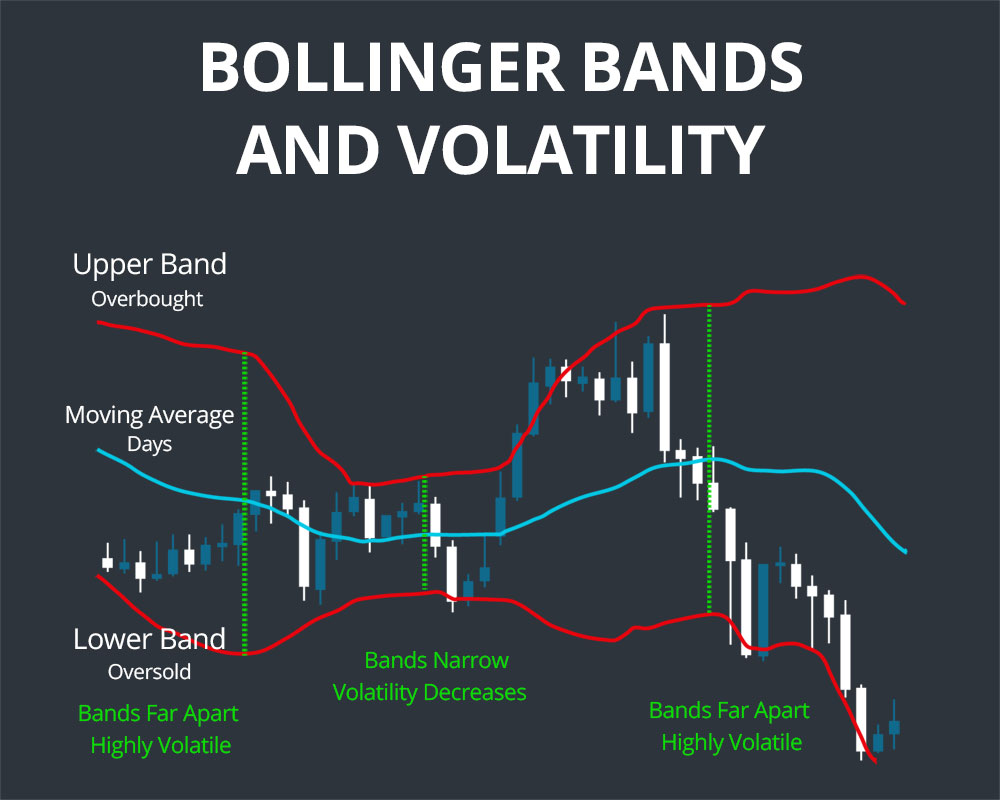

Why is this fun? Because it’s all about volatility! Bollinger Bands are brilliant at showing you when things are getting a little spicy in the market. When those bands widen out, it means the price is moving around a lot. It's like the stock is doing a frantic jig! This can signal a potential surge in momentum, or maybe just a really stressed-out stock.

On the flip side, when those bands hug each other really, really tightly, it’s called a squeeze. This is where things get really interesting. A tight squeeze often means the market is getting a bit bored, a bit too calm. But don't be fooled by the quiet. It’s like the calm before the storm, or maybe before a really good nap. A squeeze can indicate that a big price move is brewing, and it’s coming soon to a stock near you!

Think of it like this: imagine you’re stretching a rubber band. When it’s loose, not much happens. But when you stretch it really tight, you know that as soon as you let go, boing! – it’s going to snap back with some serious energy. Bollinger Bands are kind of like that rubber band for stock prices.

So, how do you actually use these things in the wild? Well, traders love to watch how the price interacts with these bands. If the price hits the upper band, some traders think it might be a little too high, a bit overextended. It could be a sign to maybe take some profits, or even consider if the price might start to pull back. It’s like a little "uh oh, maybe time to pause" signal.

And if the price kisses the lower band? You guessed it! Some traders see this as an opportunity. Maybe the stock is temporarily undervalued, a bit of a bargain. It could be a sign that the price might bounce back up. It's like a "hey, this could be a good entry point!" whisper.

But here’s the quirky bit: it’s not always that simple! Sometimes, a stock can just chug along the upper band like it owns the place. It’s like the price is saying, "I'm on fire, baby, and I'm not stopping!" This is often called a “walking the band” scenario, and it can indicate a very strong trend. So, you can't just say "hits upper band = sell" and call it a day. Gotta use your brain!

And the lower band can also be walked. A stock can just keep hugging that lower band, meaning it’s in a strong downtrend. It’s like the stock is determined to go down, down, down. So, again, context is everything.

This is where the fun really kicks in. It’s not just about following rigid rules. It’s about observing the behavior. It’s like being a detective, but instead of clues, you’re looking at charts. And instead of a mystery crime, you’re trying to understand where the money might be going.

Now, you might be wondering, "Where do I find this magical PDF I can download and become a Bollinger Band guru overnight?" Well, here's the thing. While there are tons of great articles and explanations about Bollinger Bands, the term "Bollinger Bands TradingView PDF" might not lead you to a single, official downloadable document that teaches you everything. Think of TradingView as the playground where you see these bands in action.

TradingView is this awesome website and app where you can look at stock charts. It’s got all sorts of indicators you can slap onto a chart, and Bollinger Bands are one of the classics. They’re built right in! So, you don’t need a special PDF to use them on TradingView. You just go to the chart, click the "Indicators" button, type "Bollinger Bands," and boom! They’re there, looking all snazzy.

The real "PDF" equivalent is the knowledge you gain. It’s about understanding what those bands mean, how they behave in different market conditions, and how to combine them with other indicators. It's about practicing and seeing them play out in real-time on a chart.

Think of it as learning to play a video game. You don't get a giant instruction manual. You get the game, you press buttons, you try things out, and you learn the moves. TradingView is your game console for the stock market, and Bollinger Bands are one of your coolest power-ups.

It's a fantastic way to start dipping your toes into the world of technical analysis. It's visual, it's dynamic, and it gives you something tangible to look at when you're trying to figure out what a stock might do next. It’s less about memorizing dry facts and more about observing patterns and understanding market psychology.

And the best part? It’s free to explore on TradingView! You can mess around with different stocks, different time frames, and see how the Bollinger Bands react. It’s like having a personal stock market simulator at your fingertips. You can learn without the risk, which is always a win in my book.

So, don't get too hung up on finding a specific "PDF." Instead, get excited about exploring! Jump onto TradingView, pull up a chart, add the Bollinger Bands, and just… watch. See them move. See them widen. See them squeeze. It's a lot more fun than you might think, and who knows? You might just start seeing the market in a whole new, slightly less chaotic, light. Happy charting, my friend!