Another Common Term For Stockholders' Equity Is:

Hey there, coffee buddy! Grab your mug, let's spill some tea... or, you know, talk about something a little less scandalous but equally important. We're diving into the wonderful world of business jargon today. You know, those fancy words that sound like they belong in a secret handshake. Ever heard of "stockholders' equity"? Yeah, it’s a mouthful, right? Like trying to say "antidisestablishmentarianism" after a few too many lattes.

So, what’s the deal with this "stockholders' equity" thing? Basically, it’s the owner's slice of the pie. Imagine a company is a giant pizza, and the pizza is made up of two main things: the stuff it owes to others (like loans from the bank, or money owed to suppliers) and the stuff that the owners actually own. That latter part, the owners' bit? That’s our star player: stockholders' equity.

But here’s the fun part. Companies are a bit like chameleons. They like to change their outfits, and they’re no different with their terminology. So, while "stockholders' equity" is the official name, you’ll often hear it called something else. Something a bit snappier, maybe? Something that makes you go, "Ooh, I get it!"

And the other common term for stockholders' equity is...

Net Worth

Yep, you heard it right! Net worth. Isn't that neat? It’s like the company’s personal net worth, just on a much, much bigger scale. Think about it. When you calculate your own net worth, you look at all your assets (your house, your car, that amazing collection of vintage action figures) and you subtract all your liabilities (that student loan that feels like it’s got a permanent address in your brain, your credit card bills). What’s left? That’s your net worth. The stuff that's truly yours.

A company does the exact same thing! It looks at everything it owns (its buildings, its equipment, its cash in the bank, even its cool patents) and subtracts everything it owes. The leftover is the net worth of the company, belonging to its shareholders. It’s like the ultimate company bragging rights: "Look how much awesome stuff we have, after we pay everyone back!"

Why the two names, though? It’s kind of like how some people have a formal name and a nickname. Your parents might call you Bartholomew, but all your friends know you as "Barty." Bartholomew is the official deal, the one on your birth certificate. Barty is the more casual, friendly vibe. Similarly, "stockholders' equity" is the formal, accounting-textbook term. "Net worth" is the friendlier, more intuitive way to think about it.

It helps to visualize, right? Imagine you’re buying a little lemonade stand. You see all the lemons, the sugar, the fancy pitcher. That’s the stuff the stand has. Then you find out they owe the local grocery store for the sugar. That’s the stuff they owe. If you buy the stand, you’re basically buying what’s left over after the debts are cleared. You're buying the net worth of the lemonade stand. See? Makes perfect sense.

So, why is this "net worth" thing so darn important? Well, for starters, it’s a big indicator of a company's financial health. If a company has a high net worth, it’s generally a good sign. It means they've been successful at generating more value than they owe. It's like having a fat savings account – always a good feeling!

Think of it from an investor’s perspective. If you’re thinking about buying a piece of a company (a stock, you know?), you want to know how much is really yours. You don’t just want to know what the company has, you want to know what’s left for you after all the bills are paid. That’s where net worth comes in. It’s the real juice, the actual stake you’re buying into.

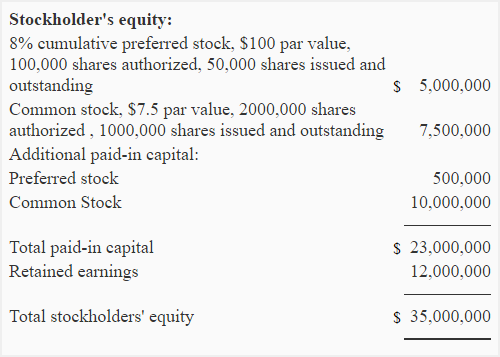

Let’s break it down a bit more, just between us. Stockholders' equity, or net worth, is typically made up of a couple of key components. There's the paid-in capital. This is the money that investors (the stockholders, obviously!) have actually handed over to the company in exchange for shares. It's like the initial investment, the seed money that got things rolling. Imagine everyone chipping in for that initial pizza dough and toppings.

And then there's the other big chunk: retained earnings. This is where the magic happens. Retained earnings are the profits that the company has made over time and chosen to keep within the business, instead of paying it out as dividends to shareholders. So, the company is profitable, it makes money, and instead of giving all that cash away, it reinvests it back into itself. It uses it to grow, to develop new products, to expand its operations. It’s like the pizza place making a profit and using that money to buy a fancier oven, or maybe even open a second location. That growing value, that accumulated profit? That's retained earnings, and it's a huge part of the company's net worth.

So, when you see "stockholders' equity" on a financial statement, just mentally substitute "net worth." It’s the same concept, just a friendlier name. It's the residual interest in the assets of an entity after deducting all its liabilities. Fancy way of saying: what’s left for the owners!

It’s a really foundational concept in accounting and finance. You can’t really understand how a company is doing without understanding its net worth. It’s like trying to understand someone’s health without knowing their weight. Not impossible, but you’re missing a crucial piece of the puzzle.

Think of a really successful startup. They start with a small amount of paid-in capital, maybe a few friends and family members pooling their cash. But as they grow, they start making profits. They reinvest those profits. Their retained earnings start to climb. And voilà! Their net worth skyrockets. Suddenly, they’re a big deal, with a substantial chunk of value that truly belongs to their owners.

Conversely, if a company is constantly losing money, its retained earnings can become negative. This means they’ve lost more than they’ve made over time. That's a red flag, folks! It's like your personal bank account going into the negatives repeatedly. Not a good look.

So, to recap our little coffee chat: "Stockholders' equity" is the formal, slightly intimidating term for the owners' stake in a company. But the more common, easy-to-grasp term is net worth. It’s the company’s assets minus its liabilities. It’s the value that’s truly left for the shareholders. It’s comprised of the money investors put in (paid-in capital) and the profits the company has kept and reinvested (retained earnings).

Why is this distinction so important for you, my friend who’s sipping on some delightful brew? Because when you’re looking at a company, whether you’re considering investing or just trying to understand the news, you want to be able to decode these terms. If you see "stockholders' equity," you can now confidently think, "Ah, that’s just their net worth!" It makes reading financial reports feel a lot less like deciphering ancient hieroglyphs and a lot more like having a casual chat about money.

It’s all about making these financial concepts accessible, right? We’re not all accountants, and that’s totally okay! But we can still understand the gist of what’s going on. And knowing that stockholders’ equity is essentially the company’s net worth is a huge step in that direction.

So, the next time you hear "stockholders' equity," give yourself a little nod. You know what it means. You know it’s the net worth. It’s the value that’s genuinely theirs. It’s the foundation upon which the owners’ claims are built. Pretty cool, huh?

And remember, this isn't just some abstract accounting principle. It has real-world implications. A strong net worth can mean a company is stable, able to weather economic storms, and has the resources to pursue growth opportunities. It's a sign of resilience and potential.

So, there you have it. Another piece of financial lingo demystified over a virtual cup of coffee. Stockholders' equity? Net worth. Easy peasy, lemon squeezy. Now you can go forth and impress your friends with your newfound financial knowledge. Or, you know, just feel a little bit more confident the next time you see those words pop up. Cheers to that!

It’s funny how the same idea can have different names, isn’t it? Like how a sandwich is a sandwich, but then you have a sub, a hoagie, a hero… all the same basic concept, just different regional flavors. This is kind of like that, but for business. Stockholders’ equity, net worth… it’s all about the ownership stake. The real value that the owners have in the company. It’s the stuff that’s left after all the IOUs are settled. And frankly, that’s the most important part for any owner, wouldn’t you agree?

So, next time you’re looking at a company’s balance sheet, don’t get intimidated by the fancy accounting terms. Just remember our little chat. Look for stockholders’ equity, and think “Net Worth.” It’s a simple substitution, but it unlocks a whole lot of understanding. And understanding is power, my friend. Especially when it comes to your money, or the money of the companies you're interested in.

It’s like having a secret decoder ring for finance. This little phrase, "net worth," is your key. It strips away the jargon and gets to the heart of what matters: what’s truly owned by the shareholders. No more confusion, just clarity. And who doesn’t love a little clarity in their life, especially when it comes to money matters? It’s the bedrock of smart decision-making, after all.

So go ahead, sip your coffee, ponder the amazing concept of net worth as it applies to businesses. It’s a powerful idea, and now, you’re officially in on the secret. High five!