An Adjusting Entry For Accrued Expenses Involves

Alright, gather 'round, fellow humans who have absolutely no clue what accounting jargon means! Let's talk about something that sounds as exciting as watching paint dry, but is actually, dare I say, a little bit fun (okay, maybe not fun, but definitely important). We’re diving into the thrilling world of an adjusting entry for accrued expenses. Don't worry, you don't need a CPA certification or a secret handshake with the ledger gods. Think of me as your friendly neighborhood accountant, minus the dusty calculator and the questionable smell of old paper.

So, picture this: It's the end of the month. You're feeling pretty smug because you've tracked all your actual money coming in and going out. You know, the stuff you can actually see. Like that giant invoice for that ridiculously over-the-top ergonomic office chair that you absolutely needed for your lumbar region, or the caffeine delivery service that’s basically keeping your business afloat. You've diligently recorded those. High five!

But here's where things get a little… sneaky. The universe, in its infinite wisdom (and sometimes mischievous nature), likes to make us incur expenses before we actually pay for them. It’s like ordering a pizza and then realizing you have to wait for the delivery guy to show up before you can actually enjoy that cheesy goodness. Annoying, right? This is the land of accrued expenses.

An accrued expense is basically a bill you owe, but haven't paid yet, and it’s for a service or good you’ve already used or received. It’s the ghost of expenses past, haunting your financial statements until you make it right. Think of it as a financial IOU that you’ve written to yourself (or, more accurately, to someone else) but haven't cashed yet.

Let’s get a little more concrete. Imagine your office has a super-duper, high-speed internet connection. You use that internet every single day, right? You're streaming cat videos during lunch breaks (don't lie!), downloading important business documents, and probably stalking your competitors online. That internet bill, however, usually comes at the end of the month, or even the beginning of the next month. But you've been using that service all month long. See the disconnect?

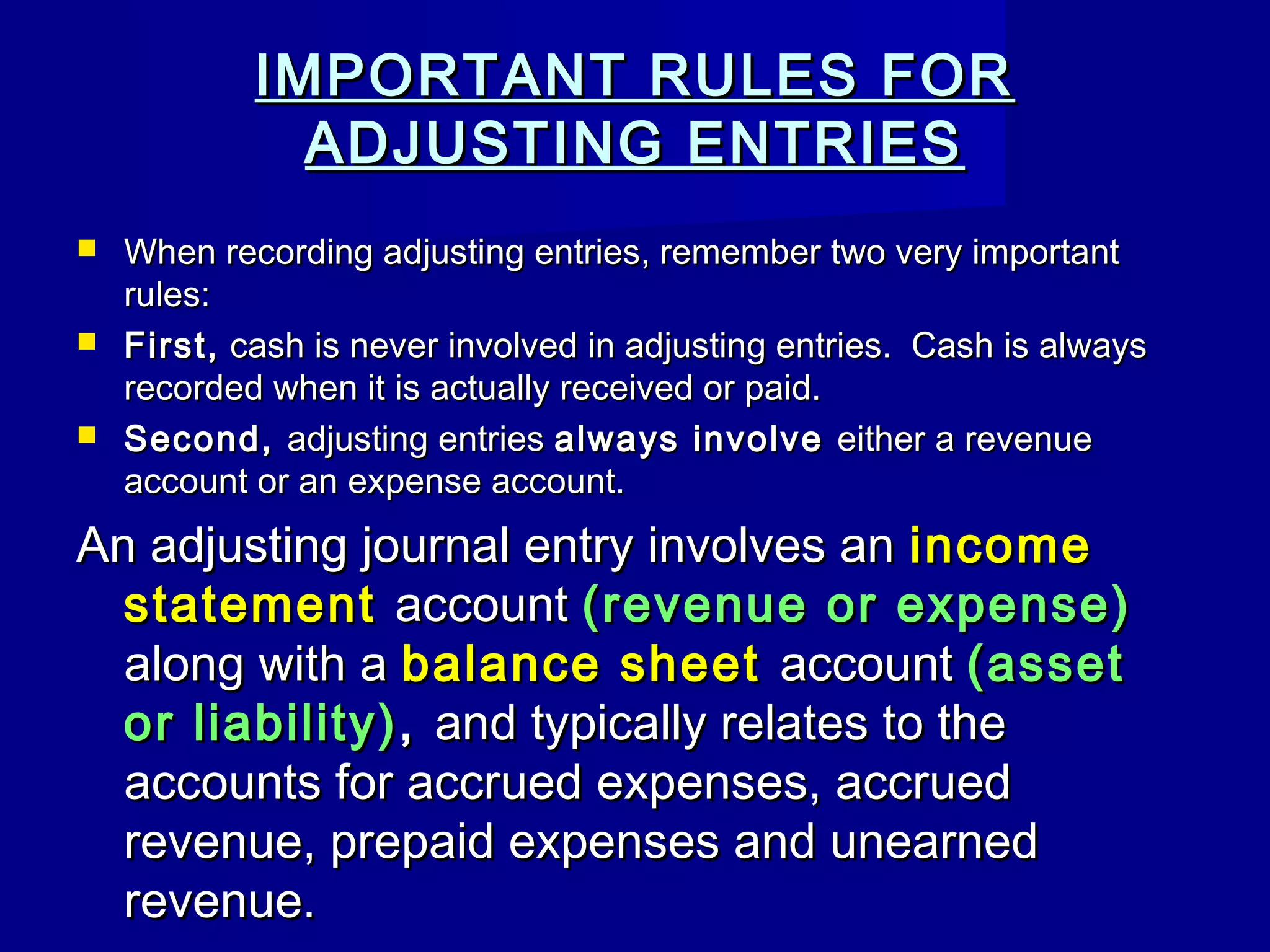

This is where the adjusting entry for accrued expenses swoops in like a superhero in a sensible suit. Its mission? To make sure your financial statements tell the real story, not just the story of the bills you’ve paid. We want to match expenses with the period they actually occurred in. It's about accrual accounting, a fancy term that basically means "let's be honest about what we owe, even if the money hasn't changed hands yet."

So, back to our internet example. Let's say your internet bill is $500, and it’s due next week, covering the entire month of July. You're preparing your financial statements on July 31st. If you don't do an adjusting entry, your July financial statements will look like you got internet for free for the entire month. Which, let's be honest, would be amazing, but also wildly inaccurate. Your profits would look artificially high, and your expenses would look suspiciously low. It’s like pretending you’re on a diet while secretly devouring a family-sized bag of potato chips.

The adjusting entry fixes this. At the end of July, you’d say, "Okay, internet company, I owe you $500 for the delicious, data-rich service you provided me this month. Even though I haven't sent you the cash yet, this expense happened in July." So, you'd record that $500 as an expense in July. This is the debit side of the entry, which you can think of as increasing your expenses (and thus, making your profits look a little less impressive, but way more honest).

Now, where does the money go, you ask? Well, it doesn't actually go anywhere at this moment. That’s where the credit side of the entry comes in. Since you haven't paid the bill yet, you've created a liability. You owe someone money. This is often called an "Accrued Expense" account or a "Accounts Payable" account. So, you'd credit this liability account for $500. This tells the world, "Hey, I have a debt of $500 that I need to settle."

So, the magic adjusting entry looks something like this (don't panic, it’s not that scary!):

Dr. Internet Expense $500

Cr. Accrued Expenses (or Accounts Payable) $500

Boom! Just like that, your July financial statements now accurately reflect the cost of that glorious internet you’ve been bathing in. Your expenses are higher, which means your profits are a bit lower, but your financial picture is a whole lot clearer. It's the accounting equivalent of finally admitting you ate the entire pizza yourself.

Let's try another example, because I know you're on the edge of your seats. Salaries! Your employees are the backbone of your business, the tireless workers who make the magic happen (and who probably deserve a raise, but that's a whole other accounting headache). Let's say payday is always on the 15th of the month. You're closing your books on the 31st. What about the salaries for, say, the last two weeks of the month?

Your employees have worked those last two weeks. They’ve sweated, they’ve strategized, they’ve probably sent a few passive-aggressive emails (we’ve all been there). They've earned that money. But you won't pay them until the 15th of next month. Again, if you ignore this, your current month's expenses will look artificially low, and your profits will look inflated. It's like saying you didn't gain weight on vacation just because you haven't stepped on the scale yet.

So, the adjusting entry for accrued salaries comes to the rescue! You’ll calculate the total salaries owed for those last two weeks and record them as an expense for the current month. This is the debit to your "Salaries Expense" account. And since you haven't paid it out yet, you'll credit a liability account, often called "Accrued Salaries Payable" or simply "Salaries Payable", for the same amount. This is the credit side.

The entry might look like this:

Dr. Salaries Expense $5,000 (let's say)

Cr. Accrued Salaries Payable $5,000

Now your financial statements accurately reflect the cost of all the hard work that went into making your business tick during that period. It’s all about matching. Matching expenses to the revenues they helped generate, and matching costs to the periods they belong in. It’s the fundamental principle of accrual accounting, and it's what separates a slightly fudged report from a truly insightful one.

Why is this so important? Well, imagine you're trying to get a loan from the bank. They want to see your financial statements. If your statements are showing artificially high profits because you've been ignoring your accrued expenses, they might think you're more financially stable than you actually are. That's a one-way ticket to a polite (or not so polite) rejection. They want the real picture, the one that shows you’re a responsible business owner who knows exactly what they owe.

It’s also crucial for internal decision-making. How can you make smart business decisions if you don't have an accurate understanding of your costs? You might think you're rolling in dough, only to find out you've got a mountain of bills waiting to be paid. It's the financial equivalent of planning a lavish vacation when you're actually living on ramen noodles.

Think of it this way: an adjusting entry for accrued expenses is like taking a real picture of your financial health, not just a filtered selfie. It’s the unsung hero of accurate financial reporting, ensuring that your balance sheet and income statement tell the honest truth. So, the next time you hear the term "accrued expense," don't run for the hills. Just remember that it's simply a bill you've incurred but haven't paid yet, and an adjusting entry is the neat and tidy way accountants make sure everything is accounted for. It's not about magic, it's just about being honest with your numbers!