Am I Suppose To Send Cpa Debit And Credit Statements

Alright, pull up a chair, grab that lukewarm latte you’ve been nursing, and let’s talk about something that sounds as thrilling as watching paint dry but is actually, dare I say, kinda important. We’re diving headfirst into the mystical world of CPA debit and credit statements. Now, I know what you’re thinking: "Is this another one of those 'adulting' things I’m supposed to magically understand after turning 25?" And to that, I say, "Probably! But fear not, brave warrior of financial responsibility, for I shall be your slightly-caffeinated guide."

Let’s be honest, the terms "debit" and "credit" can feel like secret codes whispered by accountants in hushed tones. Debit, credit, cash flow, accrual – it's enough to make your brain do a tiny interpretive dance of confusion. And when someone throws in "CPA debit and credit statements," your eyes might glaze over faster than a donut at a police academy graduation. But here’s the thing: understanding these statements is like having a superpower. A superpower that helps you avoid accidentally buying a private island when you’re only trying to track your grocery spending. So, buckle up, buttercup!

So, Am I Supposed to Send These Things?

The million-dollar question, right? And the answer, as with most things in life that involve rules and paperwork, is: "It depends." Think of it like asking if you're supposed to bring a dish to a potluck. Are you hosting? Are you a valued guest? Is the host a notorious food snob who will judge your artisanal cheese board? The context matters!

Generally speaking, if you’ve hired a Certified Public Accountant (CPA) to manage your business finances, or even your personal taxes, they will likely be providing you with statements. These aren’t typically things you generate and send to them out of the blue, like a surprise birthday party. Instead, they are the ones sending them to you. They're like the report cards of your financial life, detailing all the comings and goings of your money.

What Exactly Are These Statements?

Imagine your finances are a bustling marketplace. There are vendors (your income), customers (your expenses), and a very meticulous town crier (your CPA) keeping track of every transaction. Debit and credit statements are essentially the detailed ledgers from this marketplace.

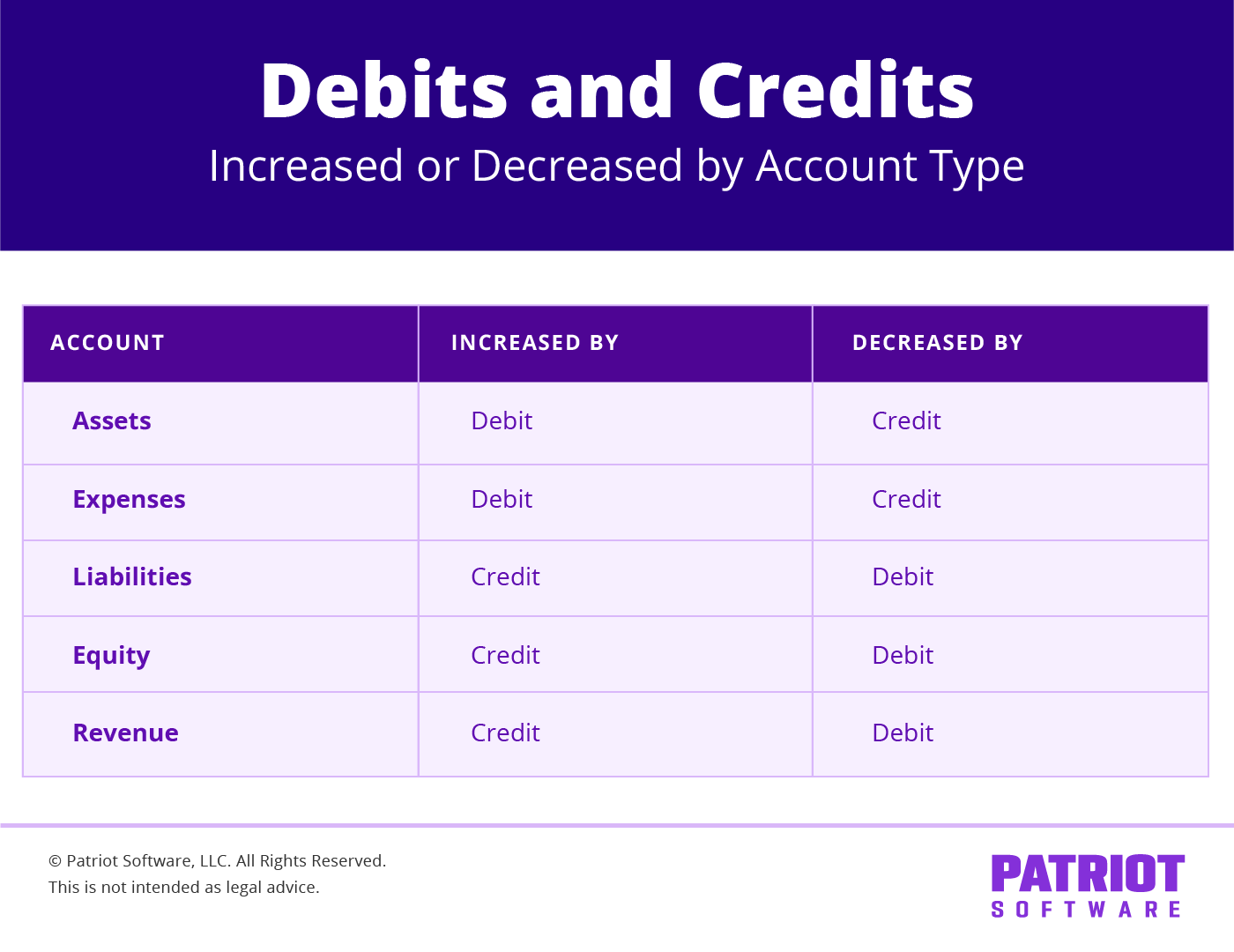

A debit, in its simplest form, is money leaving your account. Think of it as the cash you hand over for that ridiculously expensive avocado toast. Or the bill you pay for your streaming service that you swear you only use to watch nature documentaries (but secretly binge-watch reality TV). It’s a reduction in your cash balance.

A credit, on the other hand, is money coming into your account. It’s the sweet, sweet sound of a refund hitting your bank. It’s the paycheck you’ve been eagerly anticipating. It’s the money your client finally paid you for that amazing project you slaved over. It’s an increase in your cash balance.

So, CPA debit and credit statements are just formal documents from your accountant that break down all these ins and outs. They show you where your money went (debits) and where it came from (credits) over a specific period, like a month or a quarter.

Why Should I Care About This Financial Jargon?

Because, my friends, ignorance is not bliss when it comes to your money. Ignoring these statements is like pretending that mysterious ticking noise in your car will just go away. Spoiler alert: it won't, and it'll probably cost you more in the long run. Here's why these statements are your financial besties:

- They Keep You Honest: Ever looked at your bank statement and gone, "Wait, how did I spend that much on impulse buys last month?" These statements do that, but with the authority of a seasoned professional. They highlight your spending habits, which can be both humbling and incredibly motivating to make changes. It’s like having a financial drill sergeant, but with better spreadsheets.

- They Catch Mistakes (and Shenanigans): CPAs are human, and even humans can sometimes make… let’s call them "creative entries." These statements are your chance to review and ensure everything is accurate. Did they accidentally categorize your fancy coffee habit as "essential business supplies"? You'll catch it! Did a rogue transaction appear that looks suspiciously like someone else’s questionable online purchase? You’ll be the first to know. Think of yourself as the ultimate financial detective.

- Tax Time Freedom: This is the big kahuna. When tax season rolls around, and you’re scrambling for receipts like a squirrel hoarding nuts for winter, having these organized statements from your CPA will be like finding a hidden treasure chest. It makes tax preparation a breeze, and nobody wants a stressed-out accountant, trust me. They have enough stress with all the numbers already!

- Business Health Check: For business owners, these statements are vital. They show you profitability, cash flow, and areas where you might be bleeding money. It’s the financial equivalent of a doctor’s check-up, helping you diagnose any financial ailments before they become serious. You wouldn't ignore a fever, so don't ignore a dipping profit margin!

When Do I Actually Send Something?

Okay, so we've established that your CPA is usually the one sending you stuff. But are there any scenarios where you might need to send them something related to debit and credit statements? Yes, and it's usually in the form of supporting documentation.

Think of it like this: your CPA is the chef, and the statements are the beautifully plated meal. But to create that masterpiece, the chef needs ingredients. Those ingredients are your financial records. So, if your CPA asks for:

- Receipts for large expenses: Did you buy a new industrial-sized espresso machine for your home office? Your CPA will likely want a receipt to back that up.

- Bank and credit card statements: They might ask for these to cross-reference and ensure everything is accounted for. It’s like them saying, "Show me the money!" (but in a professional, less intimidating way).

- Invoices and payment confirmations: For income and outgoing payments, these are crucial.

So, while you're not typically sending them the debit and credit statements themselves (unless they specifically ask for a copy of something you generated, which is rare), you are sending them the raw materials that go into creating those statements. It’s a collaborative effort, a financial tango, if you will.

The "Oops, I Forgot" Scenario

What if you’ve been blissfully unaware of this whole debit/credit statement thing and suddenly your CPA is asking for information? Don't panic! It's not the end of the world. Think of it as your financial wake-up call. Most CPAs are understanding, especially if you're new to business or finances.

The best course of action is to be honest and communicate. Explain your situation, and ask them what you need to do to get back on track. They can usually help you sort through past transactions and get your financial records in order. It might be a bit of work, but it's better than a surprise tax bill or a business crisis.

So, the next time you hear "CPA debit and credit statements," don't run for the hills. Embrace it! It’s a sign that you're on top of your financial game, or at least, you're getting there. And who knows, you might even find a strange sort of satisfaction in understanding where all your hard-earned cash is disappearing to. Now, if you’ll excuse me, I think I hear my bank account calling… probably to tell me about another impulse purchase. Cheers!