Alternatives Federal Credit Union Routing Number

Ever found yourself staring at a form, pen hovering, and a tiny, nagging question pops into your head? It’s like trying to find a specific sock in a dryer that seems to have a portal to another dimension – you know it’s in there, but where? Today, we’re tackling one of those sometimes-elusive pieces of information: the routing number. Specifically, we’re diving into the wonderful world of Alternatives Federal Credit Union routing number. Think of it as the secret handshake for your money when it travels between banks!

Now, you might be thinking, “Routing number? Isn’t that just a bunch of digits?” And you’re right, it is! But oh, what a powerful bunch of digits they are. They’re like the GPS coordinates for your financial transactions. Without them, your money could end up on a detour through the land of lost checks and misplaced direct deposits.

We’re not going to get bogged down in the nitty-gritty of banking lingo. Instead, let’s imagine your money is a very polite and well-traveled package. When you send that package, you need a specific address, right? Well, the routing number is that super-specific address for your financial institution, Alternatives Federal Credit Union.

And finding it? It’s usually about as difficult as finding your favorite comfy spot on the couch. Most of the time, it’s right there, waiting for you!

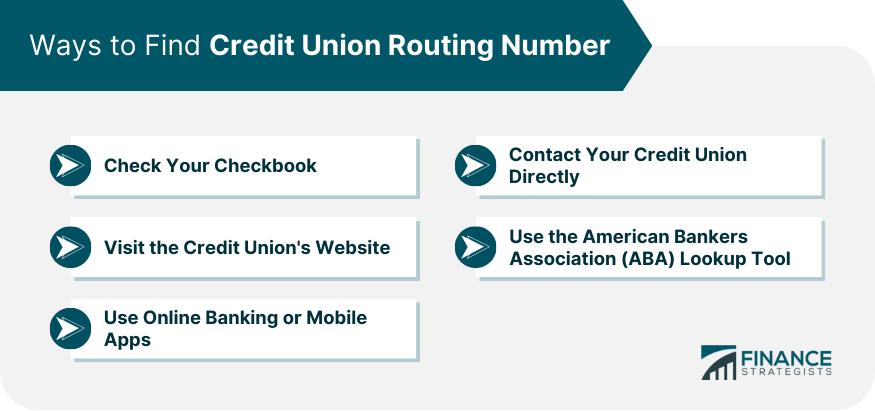

The Grand Quest for Your Routing Number!

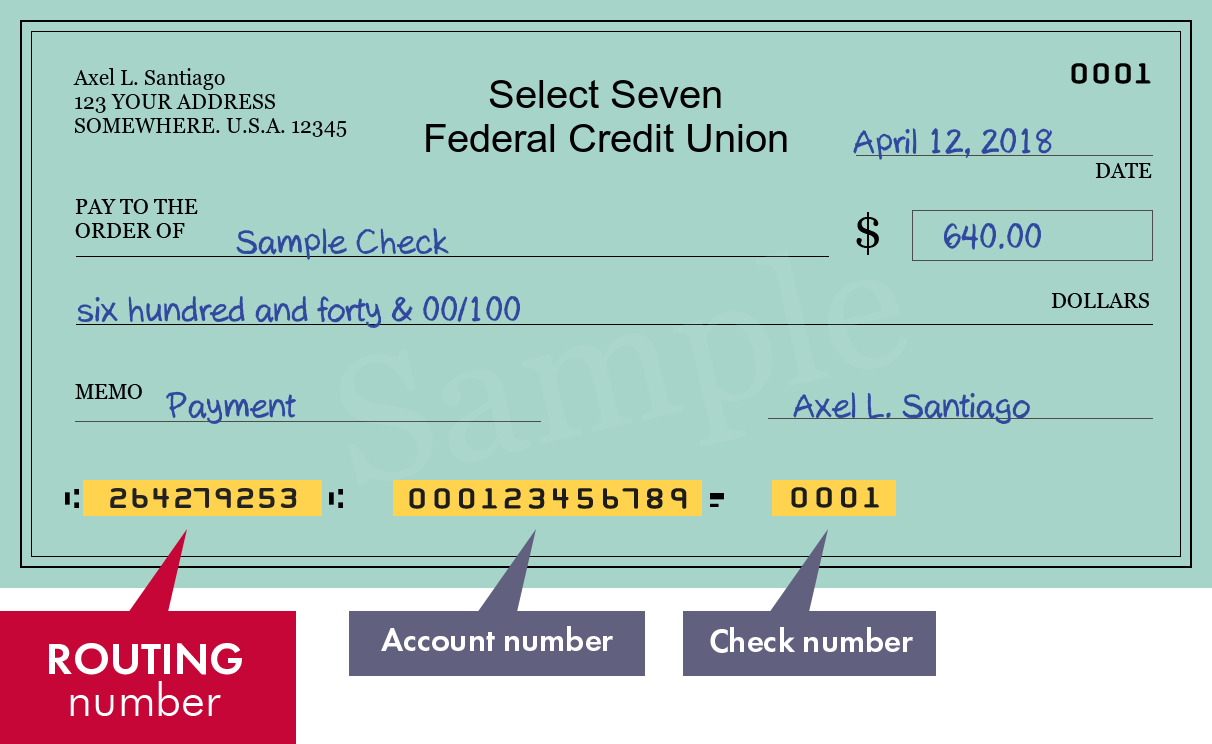

So, where does this magical number reside? Picture your Alternatives Federal Credit Union checking or savings account statement. It’s usually printed there, right alongside your account number. It’s like a little badge of honor for your money!

Think of your statement as a treasure map. And the routing number is one of the crucial X’s marking the spot. You just need to know where to look. It’s often in the top corner, sometimes near the bottom. It’s not hiding in a secret vault guarded by grumpy dragons, I promise!

If paper statements are a bit of a relic from the past (we’re all about digital, right?), don’t fret. Your online banking portal is another prime location for this information. It’s like having a digital assistant who knows all the secret codes.

Log in to your Alternatives Federal Credit Union online account. Navigate to your account details or settings. You’ll likely find the routing number displayed there. It’s usually under a section that says something like “Account Information” or “Transfer Details.” Easy peasy, lemon squeezy!

The Power of the Right Digits

Why is getting this number exactly right so important? Imagine sending a super important birthday gift to your best friend, but you accidentally swap two digits in their street address. Instead of arriving at their doorstep, your thoughtful present might end up at a stranger’s house, or worse, lost in the postal abyss! The routing number works in a similar, albeit digital, way.

When you need to set up a direct deposit for your paycheck, or if you’re sending money to a friend using an electronic transfer, that routing number tells the banking system exactly where to send your funds. It’s the difference between your hard-earned cash landing securely in your Alternatives Federal Credit Union account and it doing the cha-cha somewhere else entirely.

It ensures that your money travels with speed and precision. No detours, no unexpected layovers, just a direct, efficient flight to your intended destination. It’s the financial equivalent of a perfectly executed landing!

When You Might Need This Secret Code

So, when exactly do you need to whip out this handy routing number? Well, it pops up in a few key situations:

- Direct Deposit: This is a biggie! To get your paycheck or any other regular payments directly deposited into your Alternatives Federal Credit Union account, you’ll need to provide this number to your employer or the payer. It’s like giving them the express lane for your money.

- Electronic Funds Transfers (EFTs): Sending money between different bank accounts, whether it’s paying bills online or transferring funds from your savings to your checking, often uses EFTs. The routing number is essential for these transfers to go smoothly.

- Setting Up Bill Pay: When you use your Alternatives Federal Credit Union account to pay bills online through a company’s website, they might ask for your routing number. It helps them verify your account and ensure the payment reaches the right place.

- Applying for Loans or Other Financial Services: Sometimes, when you’re applying for certain loans or opening new financial accounts at other institutions, they may request your routing number for verification purposes.

It’s like having a universal key that unlocks many doors in the financial world. And the best part? For Alternatives Federal Credit Union members, this key is readily accessible!

A Little Extra Help if You Need It

Now, what if you’ve scoured your statements, peeked into your online banking, and you’re still feeling like you’re on a wild goose chase? Don’t panic! The friendly folks at Alternatives Federal Credit Union are there to help. Their member services team is like a team of financial superheroes, ready to swoop in and save the day.

You can always give them a call. They can guide you directly to the routing number. Or, you can visit a branch in person. Imagine walking into a friendly atmosphere, where helpful faces greet you. They’ll happily provide you with the number you need. No quest is too small for their dedicated assistance!

It’s a testament to how much they value their members. They want to make managing your money as easy and stress-free as possible. Think of them as your personal financial sherpas, guiding you up the mountain of banking.

The Magic Number Itself!

Alright, alright, the suspense is killing you, isn't it? You want the actual digits, the concrete information. Drumroll, please... For Alternatives Federal Credit Union, the routing number is:

242075753

See? Not so scary, right? It's just a simple sequence of numbers. Yet, it holds immense power in the world of finance.

This number is specific to Alternatives Federal Credit Union. It’s like their unique fingerprint in the banking universe. It differentiates them from all the other financial institutions out there. So, make sure you’re using this precise number!

It’s a small piece of information that plays a huge role in keeping your financial life running smoothly. It’s the quiet hero of your everyday transactions. It works tirelessly behind the scenes, ensuring your money goes where it's supposed to go.

Embrace the Simplicity

So, the next time you encounter a form that asks for your routing number, you can approach it with confidence. You know where to find it, and you know what it does. You're practically a financial whiz!

Remember, managing your money doesn't have to be complicated. With a little knowledge and the support of your credit union, it can be quite straightforward. Alternatives Federal Credit Union is all about making things easy for you. They want you to feel empowered and in control of your finances.

So, go forth and conquer those forms! Your routing number, 242075753, is ready to serve you. It’s your trusty sidekick for all your electronic financial adventures. And that, my friends, is a truly good feeling!