Abbott Laboratories Investors 2018 Annual Report

You know, I remember back in 2018, I was at a family gathering, and my uncle, bless his heart, was going on and on about his investments. He was particularly chuffed about Abbott Laboratories. "This company," he'd say, waving his hands dramatically, "is the future of healthcare!" I, being the slightly cynical youngster I was, just nodded along, thinking, "Yeah, Uncle Bob, just like that 'revolutionary' coin collection you were peddling last year." Little did I know, Uncle Bob might have been onto something. Fast forward a few years, and here I am, diving headfirst into Abbott Laboratories' 2018 Annual Report. Who knew that a chat over lukewarm potato salad would lead to this deep dive into pharmaceuticals and medical devices? It’s funny how life (and sometimes, uncle’s financial advice) works out, isn't it?

So, what exactly were the big headlines emerging from Abbott's 2018 annual report? Let's just say it was a pretty solid year for them. They weren't exactly reinventing the wheel, but they were definitely executing. Think of it like a seasoned chef who knows exactly how to perfect a classic dish. No flashy gimmicks, just consistently good results. That's kind of the vibe I got reading through the numbers and the management's commentary. They were talking a lot about growth, particularly in their key business areas, and it seems like they delivered. I mean, nobody throws a party for a company that’s just treading water, right? You want to see some upward momentum, and Abbott seemed to be providing just that.

The Big Picture: A Year of Steady Gains

Alright, let's get down to brass tacks. The 2018 report painted a picture of a company that was strong and stable. We’re talking about a significant increase in sales and, importantly, earnings. It wasn't a meteoric rise, but a healthy, consistent climb. They highlighted their diversified portfolio, which, honestly, is a smart move. When you’re in the business of healthcare, you don't want all your eggs in one basket. A mix of diagnostics, medical devices, nutritionals, and established pharmaceuticals means that if one area hits a bump, the others can often smooth things out. It's like having a diversified investment portfolio, but for your actual health. Who wouldn't want that?

They specifically called out their diagnostics division as a real winner. This is the part of Abbott that’s all about testing – from blood glucose monitors for diabetics to tests that can detect diseases early. And in 2018, this segment was soaring. It makes sense, right? The push for early detection and personalized medicine is only getting stronger. People are more proactive about their health, and technology is enabling more sophisticated and accessible diagnostic tools. It's not the most glamorous part of healthcare, perhaps, but it's absolutely critical. Think about it – a timely diagnosis can literally change someone's life. And Abbott was clearly capitalizing on that need.

Medical Devices: Where Innovation Meets Everyday Needs

Then there’s the medical devices segment. This is where you find things like pacemakers, artificial hips, and, a big one for Abbott, their continuous glucose monitoring systems (CGMs). Remember Uncle Bob? He was probably talking about these CGMs! They’ve been a game-changer for people with diabetes, allowing them to track their glucose levels without constant finger pricks. The report showed strong sales growth here, suggesting that these innovations were resonating with both patients and healthcare providers. It’s a testament to Abbott’s commitment to developing products that directly improve quality of life. They’re not just treating illnesses; they’re helping people manage chronic conditions better. That’s pretty remarkable, if you ask me.

What I found particularly interesting is how Abbott emphasized the integration of these devices with digital platforms. It’s not just about the physical device anymore; it’s about the data it generates and how that data can be used to provide better care. This is where the future of healthcare is heading, and Abbott seemed to be right there, building the infrastructure for it in 2018. Imagine a world where your medical devices are seamlessly connected, providing real-time insights to your doctor. That’s the kind of forward-thinking that makes investors, and frankly, patients, feel optimistic. Are we there yet? Maybe not entirely, but they were certainly laying the groundwork.

Nutritionals: A Staple for All Ages

Don't forget about the nutritionals! This segment includes products like Similac for infants and Ensure for adults. These might seem like everyday consumer products, but in the context of a healthcare company, they represent a stable, recurring revenue stream. For new parents or those needing specialized nutrition, these products are essential. The report indicated solid performance in this area, demonstrating Abbott’s ability to maintain its market share in these well-established categories. It’s not the most exciting area, I'll grant you, but consistency and reliability are incredibly valuable in the business world. Think of it as the dependable workhorse of their product line. Always there, always delivering.

They also talked about innovation within nutrition, too, not just maintaining the status quo. This included developing specialized formulas and looking at emerging nutritional needs. It's a reminder that even in seemingly mature markets, there's always room for improvement and adaptation. The world’s understanding of nutrition is constantly evolving, and companies like Abbott need to keep pace to stay relevant. It’s easy to dismiss these products, but for millions of people, they are absolutely vital. And that translates to a solid, dependable business model for the company.

Pharmaceuticals: The Established Players

And then we have the traditional pharmaceuticals. This is where Abbott develops and sells prescription drugs. While they might not have had the blockbuster drug launches of some of their competitors in 2018, they still presented a healthy portfolio of established medicines. The key here was managing their existing products effectively and continuing to see demand. They also highlighted their efforts in expanding access to these medicines in various global markets. It’s about making sure that the drugs that work are available to the people who need them, which is a noble goal, and also, a smart business strategy for long-term revenue.

The report often uses phrases like "strong operational execution" and "disciplined approach" when discussing their pharma segment. This suggests a focus on efficiency and cost management, which is crucial for profitability, especially as drug patents expire and generic competition emerges. It's not always about inventing the next miracle cure; sometimes, it's about being really, really good at what you already do. And in 2018, Abbott seemed to be demonstrating just that kind of competence.

Financial Highlights: The Numbers Don't Lie

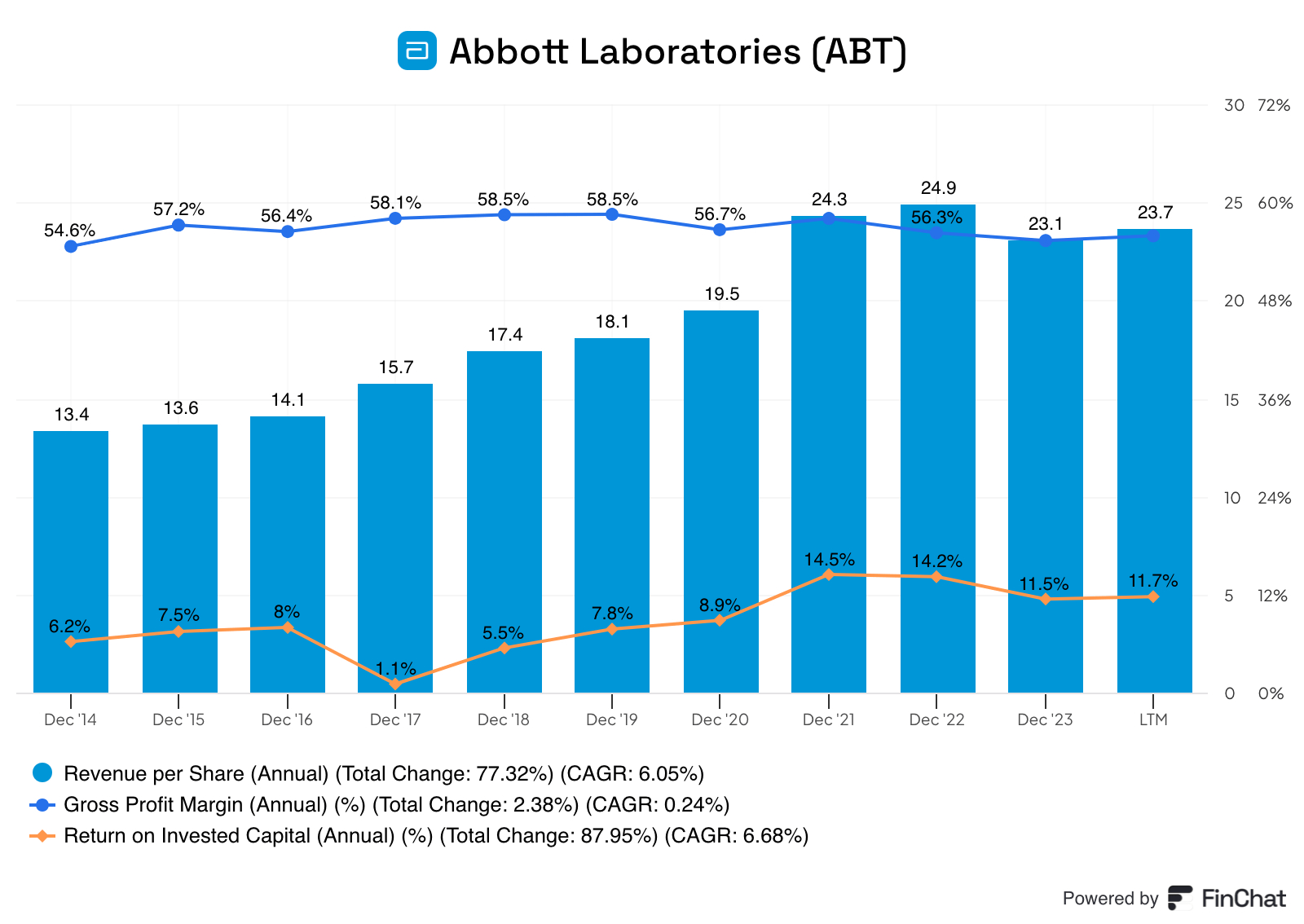

Let's glance at some of the numbers. Their revenue for 2018 saw a noticeable uptick, driven by the growth I’ve already mentioned. And importantly, their net income also showed positive movement. This is what investors are really looking for – not just more sales, but more profit. They also talked about their cash flow, which was robust. Strong cash flow means a company has the flexibility to invest in research and development, make acquisitions, pay dividends to shareholders (a big one for many investors!), and generally weather any economic storms. It’s the lifeblood of any successful business.

The management commentary often focused on what they called "organic growth," meaning growth that comes from their existing businesses, rather than through acquisitions. This is generally seen as a sign of a healthy, internally driven company. They also touched on their efforts to improve efficiency and control costs. In a competitive industry, margins matter. And Abbott seemed to be demonstrating a solid grasp on managing their expenses while still investing for the future. It's a balancing act, and they appeared to be pulling it off quite well.

Looking Ahead: What the Report Hinted At

Beyond the numbers for 2018, the annual report also offers a glimpse into the company's strategic priorities and their outlook for the future. They were clearly signaling continued investment in innovation, especially in areas like diagnostics and medical devices. The focus wasn't just on maintaining their current position but on pushing the boundaries of what's possible in healthcare technology. This is where the real excitement lies for long-term investors – the promise of future growth driven by new discoveries and market leadership.

They also emphasized their commitment to expanding their presence in emerging markets. These are areas with growing populations and increasing demand for healthcare. Tapping into these markets can provide significant long-term growth opportunities. It's a global game, after all, and Abbott seemed to be playing it strategically. It’s not just about selling more of the same; it’s about reaching new customers and adapting their offerings to different needs. This global perspective is key for any major player in the healthcare industry.

Investor Confidence: The Verdict on 2018

Overall, the 2018 Annual Report for Abbott Laboratories presents a picture of a company on a solid footing, delivering consistent growth across its diverse business segments. It wasn’t a year of revolutionary breakthroughs that would make headlines in every newspaper, but it was a year of strong, reliable performance. For investors, this kind of steady progress is often more valuable than the rollercoaster ride of high-risk, high-reward ventures. It’s the kind of performance that builds long-term wealth and confidence.

So, was Uncle Bob right all those years ago? Looking at the 2018 report, it certainly seems like he was onto something with Abbott. They were demonstrating a robust business model, a commitment to innovation, and a clear strategy for future growth. While the stock market is a complex beast and no company is immune to its whims, the 2018 report painted a very positive picture. It was a year that solidified Abbott's position as a major player in the global healthcare landscape, and for those who invested in them, it was likely a year that brought a quiet sense of satisfaction. And who knows, maybe I should start listening a bit more closely to Uncle Bob’s financial pronouncements. Just don’t tell him I said that!