A Net Loss Will Result During A Time Period When

:max_bytes(150000):strip_icc()/Net_loss-4192311-primary-final-a957c8d046354dab921ad0f31a4ac340.png)

Ever found yourself staring at your bank account after a particularly enthusiastic shopping spree or a series of unexpected bills? You know, that moment when you realize that despite all the comings and goings of money, the overall picture isn't quite as rosy as you'd hoped? Well, you've just experienced the fascinating, and sometimes a little bit humbling, concept of a net loss. It might sound a bit serious, but understanding it is actually super useful for everything from managing your personal finances to making sense of bigger economic trends. Think of it as a secret decoder ring for understanding why your wallet might feel lighter even if you've been earning and spending. It’s not about judging your choices, but about giving you a clear picture of where things stand. It’s a concept that pops up everywhere, from your own budget spreadsheets to the quarterly reports of giant corporations, and even in the grand narratives of national economies. So, let's dive in and demystify this idea, making it less of a mystery and more of a helpful tool in your everyday understanding of the world.

What Exactly is a Net Loss?

At its core, a net loss simply means that during a specific period, the total amount of money (or value) that has gone out is greater than the total amount of money (or value) that has come in. Imagine a bathtub. If you’re filling it up with the tap (money in) and draining it with the plug hole (money out), a net loss happens when more water is draining out than is flowing in. By the end of the period, there’s less water in the tub than there was at the start. It’s a straightforward equation: Total Outgoings > Total Incomings. This principle applies whether we're talking about a single individual, a bustling small business, a massive multinational corporation, or even an entire country's economy. It’s a fundamental measure of financial performance, indicating a decline in wealth or resources over time.

Think of it like this: if you spend $100 on groceries and entertainment, but only earn $80 during that same week, you've experienced a net loss of $20. It doesn't mean you didn't earn money, it just means you spent more than you earned.

Net loss (Definition, Formula) | Calculation Examples

This isn't just about cash in hand, either. It can encompass all sorts of financial transactions. For a business, it might include the cost of raw materials, salaries, rent, and marketing expenses (the outgoings) versus the revenue from sales and services (the incomings). For an individual, it could be your salary and any gifts received (incomings) versus your rent, utility bills, food, transport, and that impulse purchase of a fancy new gadget (outgoings). The key is to look at the entire picture for a defined period, whether that's a day, a week, a month, a quarter, or a year.

Why Should We Care About Net Losses? The Purpose and Benefits

So, why is understanding this concept so important? Well, it’s incredibly useful for a whole range of reasons. Firstly, it's a powerful tool for financial health. For individuals, recognizing a net loss can be a wake-up call. It prompts you to review your spending habits, identify areas where you might be overspending, and make adjustments to bring your incomings and outgoings back into balance, or even achieve a net gain. It encourages mindful spending and can be the first step towards building savings, paying off debt, or achieving other financial goals. Without this awareness, it's easy to drift into a situation where you're consistently spending more than you earn, leading to accumulating debt and financial stress.

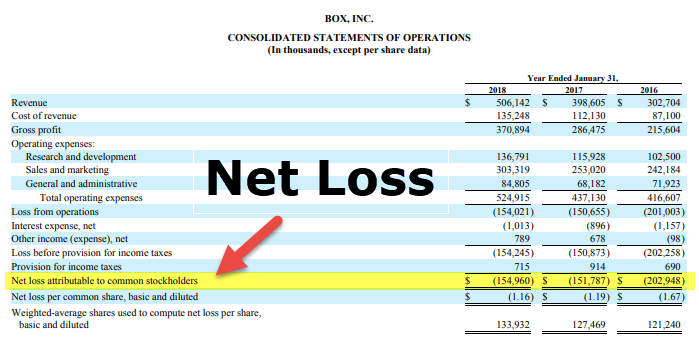

For businesses, a net loss is a critical indicator of their operational performance. If a company consistently experiences net losses, it signals that their expenses are outpacing their revenue. This can lead to serious consequences, including a depletion of cash reserves, an inability to invest in growth, and in the worst-case scenario, bankruptcy. Identifying a net loss early allows management to take corrective action, such as cutting costs, increasing prices, improving efficiency, or developing new revenue streams. It’s the business equivalent of a doctor telling you your vital signs are low – it’s a signal that something needs attention.

Beyond personal and business finances, the concept of net loss is fundamental to understanding broader economic trends. Economists use it to analyze the performance of industries, regions, and even entire countries. For instance, a country might experience a net loss in its trade balance if its imports are significantly higher than its exports. This can have implications for its currency value, employment levels, and overall economic stability. Understanding these macro-level net losses helps policymakers make informed decisions about trade agreements, fiscal policies, and economic development strategies. It’s about seeing the big picture and understanding the financial flows that shape our world.

:max_bytes(150000):strip_icc()/Netoperatingloss_4-3-v2_Final-ce7801af8cec4d8783f079c68ea7544d.png)

In essence, recognizing and understanding net losses empowers you. It provides clarity, highlights potential problems, and guides decision-making. It’s not about dwelling on the negative, but about using that information constructively to make better choices for your financial future, or to understand the dynamics of the businesses and economies around you. It’s the difference between blindly stumbling along and having a map to navigate your financial journey.